OKLAHOMA MORTGAGE BROKER LICENSE Company New Form

What is the Oklahoma Mortgage Broker License Company New

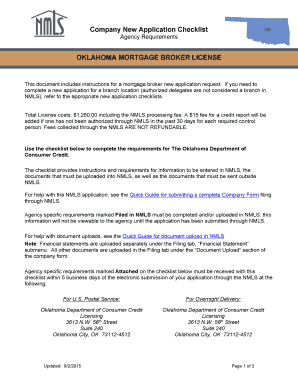

The Oklahoma Mortgage Broker License is a regulatory requirement for individuals and companies that wish to operate as mortgage brokers in the state of Oklahoma. This license ensures that brokers adhere to state laws and regulations governing the mortgage industry. It is essential for maintaining ethical standards and protecting consumers during the mortgage process. The license is issued by the Oklahoma Department of Consumer Credit and is mandatory for anyone facilitating mortgage transactions on behalf of lenders or borrowers.

How to Obtain the Oklahoma Mortgage Broker License Company New

To obtain the Oklahoma Mortgage Broker License, applicants must complete several steps. First, individuals must meet specific eligibility criteria, which typically include being at least eighteen years old, having a high school diploma or equivalent, and completing pre-licensing education requirements. Next, applicants must submit a comprehensive application to the Oklahoma Department of Consumer Credit, along with the required fees. Background checks and fingerprinting are also part of the process to ensure the integrity of the applicants. Once the application is approved, the applicant can begin operating as a licensed mortgage broker.

Key Elements of the Oklahoma Mortgage Broker License Company New

Key elements of the Oklahoma Mortgage Broker License include the following:

- Pre-licensing education: Applicants must complete a state-approved education program covering mortgage laws and practices.

- Background checks: A thorough review of the applicant's criminal history is conducted to ensure compliance with state regulations.

- Continuing education: Licensed brokers must complete ongoing education to stay updated on industry changes and maintain their license.

- Fees: There are application and renewal fees associated with obtaining and maintaining the license.

Steps to Complete the Oklahoma Mortgage Broker License Company New

Completing the Oklahoma Mortgage Broker License involves several steps:

- Complete a pre-licensing education course from an approved provider.

- Gather necessary documentation, including proof of education and identification.

- Submit the application to the Oklahoma Department of Consumer Credit.

- Undergo a background check and fingerprinting.

- Pay the required application and licensing fees.

- Wait for approval from the Department before starting operations.

State-Specific Rules for the Oklahoma Mortgage Broker License Company New

Oklahoma has specific rules governing the mortgage broker licensing process. These rules include mandated pre-licensing education hours, which must cover state and federal mortgage laws. Additionally, brokers must adhere to ethical guidelines established by the Oklahoma Department of Consumer Credit. It is crucial for applicants to familiarize themselves with these regulations to ensure compliance and avoid penalties.

Required Documents for the Oklahoma Mortgage Broker License Company New

When applying for the Oklahoma Mortgage Broker License, applicants must prepare and submit several documents, including:

- Proof of completion of a pre-licensing education course.

- A completed application form provided by the Oklahoma Department of Consumer Credit.

- Identification documents, such as a driver's license or passport.

- Background check authorization and fingerprinting results.

- Payment receipts for application and licensing fees.

Quick guide on how to complete oklahoma mortgage broker license company new

Complete [SKS] effortlessly on any device

Online documentation management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paper documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign [SKS] without any hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your documentation management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to OKLAHOMA MORTGAGE BROKER LICENSE Company New

Create this form in 5 minutes!

How to create an eSignature for the oklahoma mortgage broker license company new

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who regulates mortgage companies in Oklahoma?

The Oklahoma Department of Consumer Credit regulates: Mortgage Brokers. Mortgage Companies. Supervised Loan Companies (Pay Day Loans)

-

What does the Oklahoma Department of Consumer Credit do?

The Department of Consumer Credit serves as the primary regulator for non-depository consumer credit transactions in the State of Oklahoma. Founded in 1969, this agency now encompasses the following primary divisions: Examinations. Licensing.

-

What is the difference between a broker and a mortgage company?

A mortgage broker acts as an intermediary by helping consumers identify the best lender for their situation, while a direct lender is a bank or other financial institution that decides whether you qualify for the loan and, if you do, hands over the check.

-

How to get an NMLS license in Oklahoma?

How to Become a Loan Officer in Oklahoma Request an NMLS Account. ... Complete NMLS-Approved Pre-Licensure Education. ... Pass the SAFE Mortgage Loan Officer Test. ... Complete State and FBI Criminal Background Checks. ... Complete the NMLS Application. ... Secure Your Employer Sponsorship.

-

What regulatory agency oversees mortgage companies?

The California Department of Financial Protection and Innovation (DFPI) supports a healthy and trusted financial marketplace in California through regulation and enforcement that protects consumers and enables responsible innovation.

-

Who holds mortgage companies accountable?

Consumer Financial Protection Bureau (CFPB) The bureau relies on laws passed by Congress to enforce regulatory measures in the mortgage sector. Some of these laws include: Real Estate Settlement Procedures Act – This is one of the major acts in the mortgage lending sector.

-

Who regulates banks in Oklahoma?

Though the Oklahoma Banking Department regulates Banks, Credit Unions, Trust Companies, Savings & Loans, Money Order Companies and Money Transmission Companies, we do not regulate each and every one you might find in Oklahoma. Some have federal regulators, while others are regulated by agencies in other states.

-

How profitable is a mortgage broker?

How mortgage brokers profit from transactions. Mortgage brokers can work independently or belong to a brokerage. They typically earn a commission of around 1%-2% of the loan value, which the borrower or the lender can pay. When you take out a larger loan, your mortgage broker makes more money.

Get more for OKLAHOMA MORTGAGE BROKER LICENSE Company New

- License transfer form oregon oregon

- Official transcript request cos form

- Managing information leakage stanford university ilpubs stanford

- Candidate must be available to work 15 hours per week which may form

- Authorization to release test scores cos form

- Ps form 2591 usps com

- Iowa real estate commission39s irec39s group real estate form

- Hez eligibility criteria form

Find out other OKLAHOMA MORTGAGE BROKER LICENSE Company New

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now