SCHEDULE a 2 Investments, Income, and Assets of Business EntitiesTrusts CALIFORNIA FORM AMENDMENT Ownership Interest is 10% or G

Understanding the SCHEDULE A 2 Investments, Income, And Assets Of Business Entities Trusts CALIFORNIA FORM AMENDMENT Ownership Interest Is 10% Or Greater

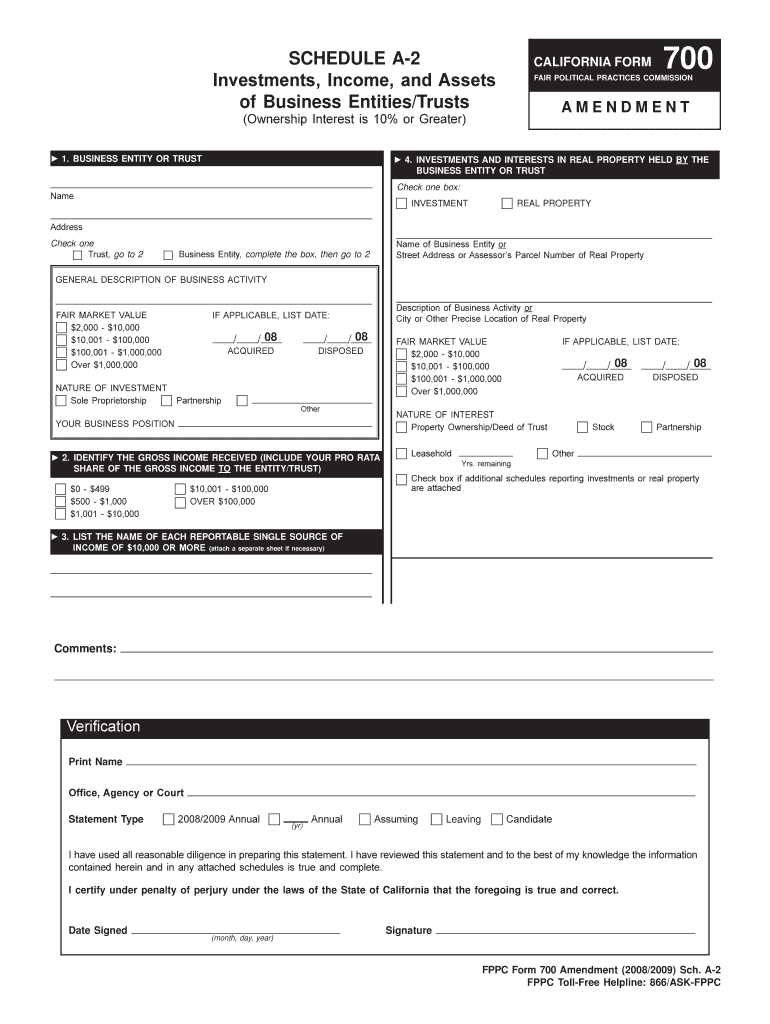

The SCHEDULE A 2 form is a crucial document for reporting investments, income, and assets held by business entities and trusts in California. It specifically addresses ownership interests that are ten percent or greater. This form is typically required for compliance with state regulations, ensuring transparency in financial disclosures. It captures essential information regarding the financial interests of business entities and trusts, which may impact taxation and regulatory obligations.

Steps to Complete the SCHEDULE A 2 Investments, Income, And Assets Of Business Entities Trusts CALIFORNIA FORM AMENDMENT Ownership Interest Is 10% Or Greater

Completing the SCHEDULE A 2 form involves several key steps:

- Gather all necessary financial documents, including records of investments, income statements, and asset valuations.

- Identify all business entities and trusts in which you hold a ten percent or greater ownership interest.

- Accurately fill out each section of the form, ensuring that all figures reflect the most current and accurate information.

- Review the completed form for accuracy and completeness before submission.

- Submit the form according to the specified filing methods, which may include online submission, mailing, or in-person delivery.

Key Elements of the SCHEDULE A 2 Investments, Income, And Assets Of Business Entities Trusts CALIFORNIA FORM AMENDMENT Ownership Interest Is 10% Or Greater

The key elements of the SCHEDULE A 2 form include:

- Ownership Interest: Detailed reporting of ownership stakes of ten percent or greater in various business entities or trusts.

- Income Reporting: Disclosure of income generated from these investments, which is essential for tax assessment.

- Asset Valuation: Accurate valuation of assets held by the entities or trusts, providing a clear picture of financial health.

- Entity Identification: Clear identification of the business entities or trusts involved, including their legal names and structures.

Legal Use of the SCHEDULE A 2 Investments, Income, And Assets Of Business Entities Trusts CALIFORNIA FORM AMENDMENT Ownership Interest Is 10% Or Greater

The legal use of the SCHEDULE A 2 form is primarily for compliance with California state regulations. It serves to ensure that individuals and entities disclose significant ownership interests, which can affect taxation and regulatory oversight. Failure to accurately complete and submit this form may result in penalties or legal repercussions, emphasizing the importance of adherence to state laws.

Filing Deadlines for the SCHEDULE A 2 Investments, Income, And Assets Of Business Entities Trusts CALIFORNIA FORM AMENDMENT Ownership Interest Is 10% Or Greater

Filing deadlines for the SCHEDULE A 2 form can vary based on the specific circumstances of the business entity or trust involved. Generally, it is advisable to submit the form by the designated annual reporting deadline to avoid potential penalties. Keeping track of these deadlines is crucial for maintaining compliance with state regulations.

Examples of Using the SCHEDULE A 2 Investments, Income, And Assets Of Business Entities Trusts CALIFORNIA FORM AMENDMENT Ownership Interest Is 10% Or Greater

Examples of scenarios where the SCHEDULE A 2 form is applicable include:

- A partner in a limited liability company (LLC) who holds a fifteen percent ownership interest must report this on the form.

- A trustee managing a trust with significant investments must disclose the income and assets held, particularly if the ownership interest exceeds ten percent.

- Corporations with multiple shareholders may need to report individual ownership stakes that meet the threshold set by the form.

Quick guide on how to complete schedule a 2 investments income and assets of business entitiestrusts california form amendment ownership interest is 10 or

Complete [SKS] seamlessly on any device

Digital document management has become increasingly prominent among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the features needed to create, alter, and eSign your documents promptly without delays. Manage [SKS] across any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to alter and eSign [SKS] effortlessly

- Retrieve [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule a 2 investments income and assets of business entitiestrusts california form amendment ownership interest is 10 or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule 2 classification?

Schedule II drugs, substances, or chemicals are defined as drugs with a high potential for abuse, with use potentially leading to severe psychological or physical dependence. These drugs are also considered dangerous.

-

What is the California Prudent Investor Rule?

The Uniform Prudent Investor Act requires trustees to: Consider the purposes, terms, distribution requirements, and any other circumstances of the trust when making such investment decisions. Exercise reasonable care, skill, and caution when managing and investing trust assets.

-

What is a Schedule 2 example?

Schedule II/IIN Controlled Substances (2/2N) Examples of Schedule II narcotics include: hydromorphone (Dilaudid®), methadone (Dolophine®), meperidine (Demerol®), oxycodone (OxyContin®, Percocet®), and fentanyl (Sublimaze®, Duragesic®). Other Schedule II narcotics include: morphine, opium, codeine, and hydrocodone.

-

Why would you file a Schedule 2?

Schedule 2: Supporting documentation for tax form 1040 if box 11b is checked. This Schedule is used to report additional taxes owed such as the alternative minimum tax, self-employment tax, or household employment taxes.

-

What if you don't have a schedule 2 for FAFSA?

If you don't have Schedule 2 for FAFSA (Free Application for Federal Student Aid), you may not need to report additional taxes. However, it's essential to consult with a tax professional or the IRS for specific guidance.

-

What is schedule a 2?

Use Schedule A-2 to report investments in a business entity (including a consulting business or other independent contracting business) or trust (including a living trust) in which you, your spouse or registered domestic partner, and your dependent children, together or separately, had a 10% or greater interest, ...

Get more for SCHEDULE A 2 Investments, Income, And Assets Of Business EntitiesTrusts CALIFORNIA FORM AMENDMENT Ownership Interest Is 10% Or G

- Sp 4 131 form

- Purpose of this worksheet use the caregivers statement along with the pit childcare child day care credit worksheet when form

- Ranger college transcript september form

- Dhs 4106c eng health plan enrollment form for people 65 or older form pdf

- 951 reddy farm road grayson ga 30017 mls 6738718 form

- Pa schedule c profit or loss from business or profession form and instructions pa 40 c

- Louisiana tax power of attorney form r 7006 pdf

- Mineral revenues in louisiana form

Find out other SCHEDULE A 2 Investments, Income, And Assets Of Business EntitiesTrusts CALIFORNIA FORM AMENDMENT Ownership Interest Is 10% Or G

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free