To Return Your Completed Application Secretary of State Sos Ri Form

Understanding the To Return Your Completed Application Secretary Of State Sos Ri

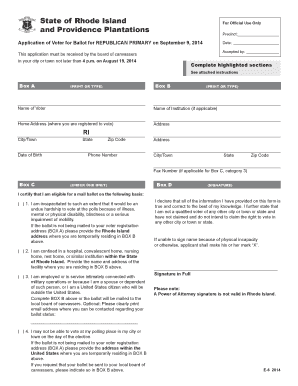

The "To Return Your Completed Application Secretary Of State Sos Ri" refers to the formal process required for applicants to submit their completed applications to the Secretary of State in Rhode Island. This application is typically used for various purposes, including business registrations, licensing, and other official state matters. Understanding the specific requirements and procedures associated with this application is essential for ensuring compliance and timely processing.

Steps to Complete the To Return Your Completed Application Secretary Of State Sos Ri

Completing the application involves several key steps:

- Gather necessary information, including personal identification and any relevant business details.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Prepare any supporting documents that may be required, such as proof of identity or business documentation.

- Choose a submission method: online, by mail, or in-person.

Form Submission Methods for the To Return Your Completed Application Secretary Of State Sos Ri

Applicants have several options for submitting their completed applications to the Secretary of State:

- Online: Many applications can be submitted electronically through the official Secretary of State website. This method is often the fastest and most efficient.

- By Mail: Completed applications can be printed and mailed to the appropriate office. Ensure that sufficient postage is applied and allow for delivery time.

- In-Person: Applicants may also submit their applications directly at the Secretary of State's office. This option allows for immediate confirmation of receipt.

Required Documents for the To Return Your Completed Application Secretary Of State Sos Ri

To ensure a smooth application process, it is crucial to gather all required documents beforehand. Commonly required documents may include:

- Identification proof, such as a driver's license or passport.

- Business formation documents if applicable, such as Articles of Incorporation or LLC formation papers.

- Any additional documentation specified in the application instructions.

Legal Use of the To Return Your Completed Application Secretary Of State Sos Ri

The completed application serves a legal purpose by formally notifying the Secretary of State of the applicant's intent to register or apply for a specific service. Submitting this application is often a prerequisite for obtaining licenses, permits, or other official recognitions. Failure to submit the application correctly may result in delays or denials.

Eligibility Criteria for the To Return Your Completed Application Secretary Of State Sos Ri

Eligibility to submit the application varies depending on the type of application being filed. Generally, applicants must:

- Be a resident of Rhode Island or have a business presence in the state.

- Meet any specific requirements outlined in the application instructions.

- Provide accurate and truthful information throughout the application process.

Quick guide on how to complete to return your completed application secretary of state sos ri

Easily prepare [SKS] on any device

Managing online documents has become increasingly common among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or disorganized documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to To Return Your Completed Application Secretary Of State Sos Ri

Create this form in 5 minutes!

How to create an eSignature for the to return your completed application secretary of state sos ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to address a tax return envelope?

Format the address correctly: Write the full name of the IRS center to which you're sending your documents. For example, you might write "Internal Revenue Service." On the next line, write the specific address for the IRS center. This could include a P.O. Box, street address, or other details.

-

What is beneficial ownership in Rhode Island?

Beneficial Ownership Information (BOI) refers to the information that certain businesses must report to regulatory authorities, outlining details about the individuals who ultimately own or control the company.

-

Do I have to file a state tax return in Rhode Island?

If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return. Even if you are not required to file a federal return, you may still have to file a Rhode Island return if your income exceeds the amount of your personal exemption.

-

How do I maintain my LLC in Rhode Island?

Maintain Your Business in Rhode Island File an Annual Report. Business Corporations and Limited Liability Companies must file an annual report with the RI Department of State. ... Maintain a Registered Agent/Office. Maintain a valid registered agent and registered office on file with the RI Department of State. ... Pay Taxes.

-

Where do I mail my MI tax return?

Completed forms for individuals, corporations and partnerships should be sent to the following address: East Lansing Income Tax Processing Center, PO Box 526, Eaton Rapids, MI 48827.

-

How do I send my tax return by mail?

Mailing Tips Write both the destination and return addresses clearly or print your mailing label and postage. If your tax return is postmarked by the filing date deadline, the IRS considers it on time. Mail your return in a USPS® blue collection box or at a Postal location that has a pickup time before the deadline.

-

What address should I put on my tax return?

Even if you are filing a prior year tax return, and your address was different during the tax year which that return concerns, you must include your current address, so that the IRS can contact you regarding that tax return in the future. The IRS recommends contacting them every time you have a change of address.

-

Where do I mail my Rhode Island state tax return?

DO NOT staple or otherwise attach your payment or Form RI-1040V to your return or to each other. Instead, just put them loose in the envelope. Mail your tax return, payment and RI-1040V to the Rhode Island Division of Taxation, One Capitol Hill, Providence, RI 02908- 5807.

Get more for To Return Your Completed Application Secretary Of State Sos Ri

- Franklin county area tax bureau fill online printable form

- Pa schedule fg multiple owner or lessor prorationsincome annualization pa 1000 fg formspublications

- Form 1040 nr schedule a sp

- 8300 sp informe de pagos en efectivo en exceso de 10000

- Sample appraisal report not intended to be used for insurance coverage form

- S a x o b a n k c l i e n t f u n d s t r a n s f e r request form

- Form 8952 instructions fill out ampamp sign online

- Form 540 es estimated tax for individuals form 540 es estimated tax for individuals 772010645

Find out other To Return Your Completed Application Secretary Of State Sos Ri

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now