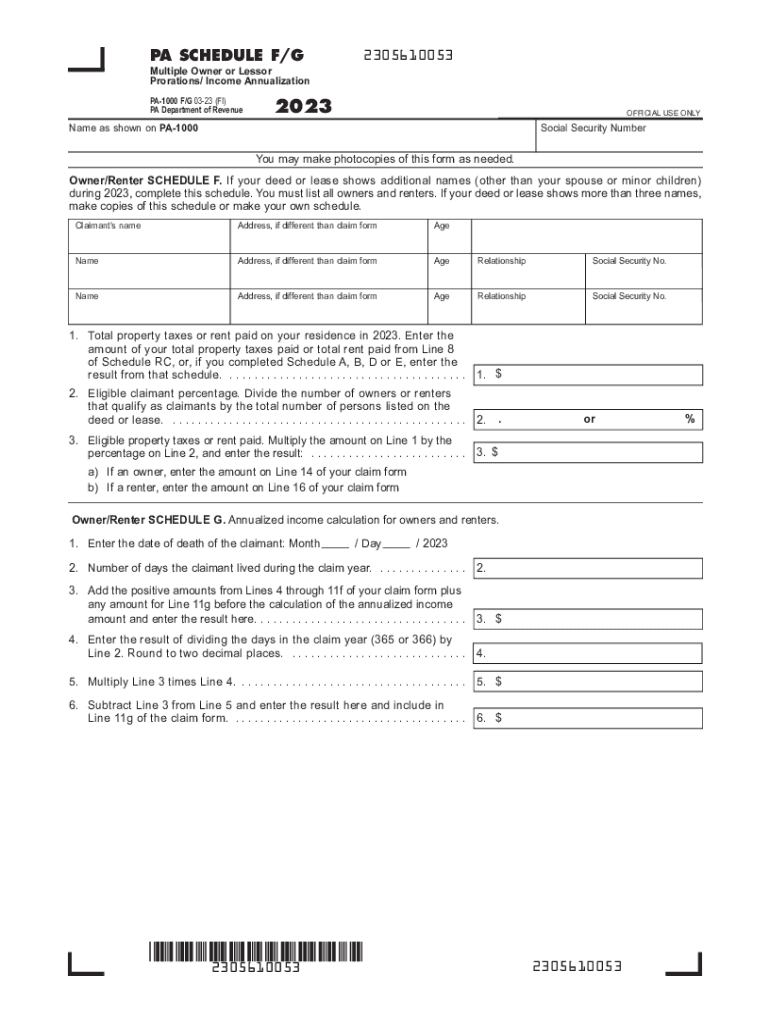

PA Schedule FG Multiple Owner or Lessor ProrationsIncome Annualization PA 1000 FG FormsPublications 2023-2026

Understanding the Schedule F Tax Form

The Schedule F tax form is specifically designed for farmers and ranchers to report income and expenses related to farming activities. This form allows taxpayers to detail their agricultural income, including sales of livestock, produce, and other farm products. It also provides a space to deduct expenses such as feed, fertilizer, and labor costs, which are essential for accurately calculating taxable income. Understanding the nuances of this form is crucial for ensuring compliance with IRS regulations and maximizing potential deductions.

Steps to Complete the Schedule F Tax Form

Filling out the Schedule F tax form requires careful attention to detail. Here are the key steps to complete the form:

- Gather Financial Records: Collect all relevant documents, including receipts for income and expenses related to your farming activities.

- Report Income: In Part I of the form, list all sources of income from farming, including sales of crops and livestock.

- Detail Expenses: In Part II, categorize and enter all farming expenses. This includes costs for supplies, equipment, and labor.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss from farming.

- Review and Submit: Double-check all entries for accuracy before submitting the form with your tax return.

Filing Deadlines for the Schedule F Tax Form

The Schedule F tax form must be filed alongside your annual federal income tax return, which is typically due on April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents for Schedule F Tax Form

To accurately complete the Schedule F tax form, certain documents are necessary:

- Income Records: Sales receipts, invoices, and bank statements showing income from farming.

- Expense Documentation: Receipts and invoices for all farming-related expenses, including equipment purchases and operational costs.

- Previous Year’s Tax Return: This can provide a useful reference for reporting income and expenses.

Legal Use of the Schedule F Tax Form

The Schedule F tax form is legally required for individuals engaged in farming who wish to report their income and expenses accurately. Failure to file this form can result in penalties from the IRS. It is essential for taxpayers to ensure that all information reported is truthful and complete, as discrepancies can lead to audits and additional scrutiny.

IRS Guidelines for Schedule F Tax Form

The IRS provides specific guidelines for completing the Schedule F tax form. Taxpayers should familiarize themselves with these guidelines to ensure compliance. This includes understanding what qualifies as deductible expenses and how to report various types of income. The IRS also offers resources and publications that can assist in accurately completing the form.

Quick guide on how to complete pa schedule fg multiple owner or lessor prorationsincome annualization pa 1000 fg formspublications

Effortlessly Prepare PA Schedule FG Multiple Owner Or Lessor ProrationsIncome Annualization PA 1000 FG FormsPublications on Any Device

Digital document management has gained immense popularity among businesses and individuals. It offers a superior eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle PA Schedule FG Multiple Owner Or Lessor ProrationsIncome Annualization PA 1000 FG FormsPublications on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Modify and eSign PA Schedule FG Multiple Owner Or Lessor ProrationsIncome Annualization PA 1000 FG FormsPublications with Ease

- Obtain PA Schedule FG Multiple Owner Or Lessor ProrationsIncome Annualization PA 1000 FG FormsPublications and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign PA Schedule FG Multiple Owner Or Lessor ProrationsIncome Annualization PA 1000 FG FormsPublications and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa schedule fg multiple owner or lessor prorationsincome annualization pa 1000 fg formspublications

Create this form in 5 minutes!

How to create an eSignature for the pa schedule fg multiple owner or lessor prorationsincome annualization pa 1000 fg formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa form pa 1000?

The pa form pa 1000 is a legal document required for businesses in Pennsylvania to register for various tax-related purposes. Understanding this form is crucial for ensuring compliance and avoiding penalties. With airSlate SignNow, you can easily eSign and manage your pa form pa 1000 online.

-

How can airSlate SignNow help with the pa form pa 1000?

airSlate SignNow simplifies the process of completing and submitting the pa form pa 1000 by offering a secure, user-friendly platform for eSigning. You can customize your workflows to include specific fields that need to be filled out, ensuring accuracy and efficiency. Plus, you can track the status of your document in real-time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes, making it affordable to manage the pa form pa 1000. Our plans include features such as unlimited document signing and customizable workflows. Check our website for the latest pricing details and choose the plan that fits your needs.

-

What features are included in airSlate SignNow for handling the pa form pa 1000?

With airSlate SignNow, you get multiple features designed to support the handling of the pa form pa 1000. These include a user-friendly interface for filling out forms, advanced security measures, and support for various file types. Our platform also allows for easy collaboration among team members for efficient form management.

-

How secure is my information when using airSlate SignNow for the pa form pa 1000?

Your security is our priority at airSlate SignNow. We employ advanced encryption and security protocols to safeguard your information while you work on the pa form pa 1000. Rest assured that your data is protected, allowing you to focus on completing your documents without worry.

-

Can I integrate airSlate SignNow with other software while using the pa form pa 1000?

Yes, airSlate SignNow offers seamless integrations with various applications to streamline your workflow while managing the pa form pa 1000. This compatibility enables you to enhance your document management processes by incorporating your preferred tools. Explore our integration options to learn more.

-

What benefits does airSlate SignNow offer for eSigning the pa form pa 1000?

Using airSlate SignNow for eSigning the pa form pa 1000 offers numerous benefits, such as faster turnaround times and increased efficiency. You can sign documents from anywhere, eliminating the need for physical signatures and printing. This convenience makes the signing process smoother and reduces paper waste.

Get more for PA Schedule FG Multiple Owner Or Lessor ProrationsIncome Annualization PA 1000 FG FormsPublications

- Small business partnership agreement doc form

- Sales assistant application form

- Athlete information sheet

- Nelnet release of authorization form

- Replacement diploma order form iowa state university

- Percopo scholarship application rose hulman top ranked rose hulman form

- Medication administration permission form

- Maroon guard application planoettes planoettes form

Find out other PA Schedule FG Multiple Owner Or Lessor ProrationsIncome Annualization PA 1000 FG FormsPublications

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease