STATUTE of LIMITATIONS ASSESSMENTS Form

Understanding the Statute of Limitations Assessments

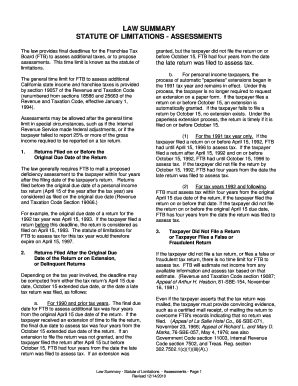

The statute of limitations assessments refer to the legal time limits within which a taxpayer can be audited or assessed additional taxes by the IRS. These limits vary depending on the type of tax and the specific circumstances surrounding the taxpayer's situation. Generally, the IRS has three years from the date a tax return is filed to initiate an audit or assess additional taxes. However, this period can extend to six years if the taxpayer underreports their income by more than twenty-five percent. In cases of fraud or if no return is filed, there is no statute of limitations, allowing the IRS to assess taxes indefinitely.

Steps to Complete the Statute of Limitations Assessments

Completing the statute of limitations assessments involves several key steps to ensure compliance and accuracy. First, gather all relevant tax documents, including filed returns and any correspondence from the IRS. Next, determine the applicable statute of limitations based on the type of tax and the circumstances of your case. It is crucial to review your tax history and identify any discrepancies or issues that may affect the assessment period. Finally, consult with a tax professional if necessary to understand your rights and obligations under the law. Proper documentation and timely responses to IRS inquiries are essential throughout this process.

Key Elements of the Statute of Limitations Assessments

Several key elements define the statute of limitations assessments. These include the type of tax being assessed, the filing date of the tax return, and any actions taken by the taxpayer that may extend the assessment period. For instance, if a taxpayer files an amended return, the statute of limitations may reset, providing the IRS with additional time to assess taxes. Furthermore, understanding the specific rules and exceptions that apply to different types of taxes—such as income tax, estate tax, or employment tax—is vital for accurate assessments.

State-Specific Rules for the Statute of Limitations Assessments

Each state in the U.S. has its own rules regarding the statute of limitations for tax assessments. While federal guidelines provide a framework, state laws can vary significantly. Some states may have shorter or longer assessment periods, and certain conditions may apply that differ from federal standards. It is important for taxpayers to familiarize themselves with the specific statutes in their state to ensure compliance and avoid potential penalties. Consulting a local tax professional can provide valuable insights into these state-specific regulations.

Filing Deadlines and Important Dates

Filing deadlines are crucial when dealing with statute of limitations assessments. The general deadline for filing federal tax returns is April fifteenth of each year, unless an extension is granted. Taxpayers should be aware of any state-specific deadlines that may differ. Additionally, important dates related to audits or assessments, such as the date the IRS sends a notice, can significantly impact the statute of limitations. Keeping track of these dates helps ensure that taxpayers respond promptly and maintain their rights.

Penalties for Non-Compliance

Failure to comply with the statute of limitations assessments can result in severe penalties. If the IRS determines that a taxpayer has not filed a return or has underreported income, they may impose fines or additional taxes. In cases of fraud, the penalties can be even more substantial, potentially leading to criminal charges. It is essential for taxpayers to understand these risks and take proactive steps to address any potential issues with their tax filings to avoid non-compliance penalties.

Quick guide on how to complete statute of limitations assessments

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to quickly create, modify, and eSign your documents without any disruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related operations today.

The easiest way to modify and eSign [SKS] seamlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to STATUTE OF LIMITATIONS ASSESSMENTS

Create this form in 5 minutes!

How to create an eSignature for the statute of limitations assessments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are STATUTE OF LIMITATIONS ASSESSMENTS?

STATUTE OF LIMITATIONS ASSESSMENTS refer to the legal time limits within which a party can initiate a lawsuit or claim. Understanding these assessments is crucial for businesses to ensure they act within the legal timeframe to protect their rights and interests.

-

How can airSlate SignNow help with STATUTE OF LIMITATIONS ASSESSMENTS?

airSlate SignNow provides a streamlined platform for managing documents related to STATUTE OF LIMITATIONS ASSESSMENTS. With our eSigning capabilities, businesses can quickly execute necessary documents, ensuring compliance and timely action within the legal limits.

-

What features does airSlate SignNow offer for managing legal documents?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all essential for handling STATUTE OF LIMITATIONS ASSESSMENTS. These tools help businesses maintain organization and efficiency in their legal processes.

-

Is airSlate SignNow cost-effective for small businesses dealing with STATUTE OF LIMITATIONS ASSESSMENTS?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are flexible, allowing small businesses to access essential features for managing STATUTE OF LIMITATIONS ASSESSMENTS without breaking the bank.

-

Can I integrate airSlate SignNow with other software for STATUTE OF LIMITATIONS ASSESSMENTS?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for STATUTE OF LIMITATIONS ASSESSMENTS. This allows you to connect with tools you already use, streamlining your document management process.

-

What are the benefits of using airSlate SignNow for legal assessments?

Using airSlate SignNow for legal assessments, including STATUTE OF LIMITATIONS ASSESSMENTS, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled professionally and securely.

-

How secure is airSlate SignNow for handling sensitive legal documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your documents, including those related to STATUTE OF LIMITATIONS ASSESSMENTS, ensuring that your sensitive information remains confidential.

Get more for STATUTE OF LIMITATIONS ASSESSMENTS

- Real estate and rental and leasing new hampshire u s census form

- Retail trade hawaii u s census bureau census form

- Transportation commodity flow survey alabama economic census census form

- Transportation commodity flow survey arkansas economic census census form

- Transportation commodity flow survey california economic census census form

- Transportation commodity flow survey florida economic census census form

- Form mo 1040es estimated tax declaration for individuals

- Mo ms corporation allocation and apportionment of income schedule 772045260 form

Find out other STATUTE OF LIMITATIONS ASSESSMENTS

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure