Instructions for Schedule M 3 Form 1120 L IRS Gov 2014

What is the Instructions For Schedule M 3 Form 1120 L IRS gov

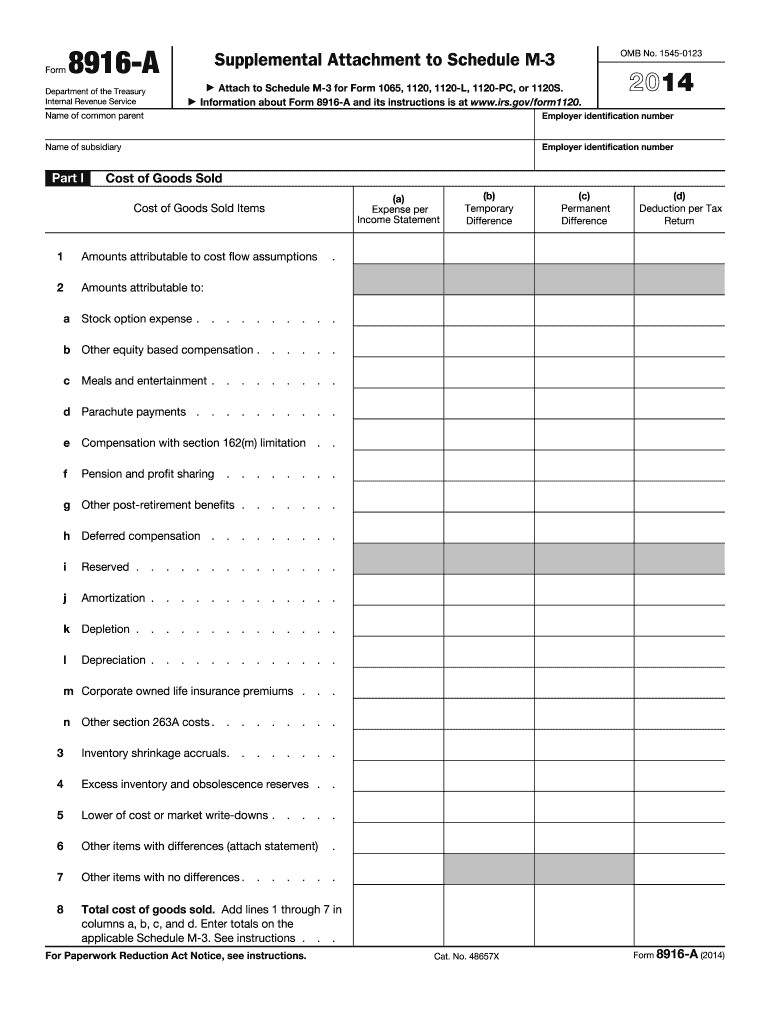

The Instructions For Schedule M 3 Form 1120 L is a crucial document provided by the IRS for certain corporations to report their financial information. This form is specifically designed for life insurance companies, allowing them to disclose their operations and financial status accurately. The instructions guide users through the necessary steps to complete the schedule, ensuring compliance with federal tax regulations. Understanding this form is vital for life insurance entities to maintain transparency and fulfill their tax obligations.

Steps to complete the Instructions For Schedule M 3 Form 1120 L IRS gov

Completing the Instructions For Schedule M 3 Form 1120 L involves several key steps. First, gather all financial records, including income statements and balance sheets, for the tax year. Next, carefully read through the instructions to understand the required information and specific sections of the form. Fill out the form systematically, ensuring that all numbers are accurate and correspond to the financial data. It is essential to review the completed form for any errors before submission. Finally, submit the form according to the IRS guidelines, either electronically or via mail.

Legal use of the Instructions For Schedule M 3 Form 1120 L IRS gov

The legal use of the Instructions For Schedule M 3 Form 1120 L is paramount for life insurance companies in the United States. This form must be completed accurately to comply with IRS regulations. Failure to adhere to these guidelines can result in penalties or legal issues. It is important for corporations to ensure that the information disclosed on the form is truthful and complete, as any discrepancies may lead to audits or further scrutiny from tax authorities.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Instructions For Schedule M 3 Form 1120 L can be done through various methods. Corporations may choose to file electronically, which is often the preferred method due to its efficiency and speed. Alternatively, the form can be submitted via mail, ensuring it is sent to the correct IRS address based on the entity's location. In-person submissions are generally not common for this form, but it is advisable to check with local IRS offices for any specific requirements or options available.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Schedule M 3 Form 1120 L are critical to ensure compliance with tax laws. Typically, the form must be filed on or before the due date of the corporation's income tax return. For most corporations, this is the fifteenth day of the fourth month after the end of their tax year. It is essential to stay informed about any changes in deadlines or additional requirements from the IRS to avoid late filing penalties.

Key elements of the Instructions For Schedule M 3 Form 1120 L IRS gov

The Instructions For Schedule M 3 Form 1120 L includes several key elements that must be addressed. These elements typically encompass financial disclosures, reconciliation of income, and detailed reporting of assets and liabilities. Each section of the form is designed to capture specific information about the corporation's operations, ensuring a comprehensive overview of its financial health. Understanding these elements is crucial for accurate reporting and compliance with IRS standards.

Quick guide on how to complete instructions for schedule m 3 form 1120 l 2017 irsgov

Discover the simplest method to complete and sign your Instructions For Schedule M 3 Form 1120 L IRS gov

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior way to complete and sign your Instructions For Schedule M 3 Form 1120 L IRS gov and associated forms for public services. Our advanced eSignature solution provides you with everything necessary to manage documents swiftly and comply with legal standards - powerful PDF editing, handling, securing, signing, and sharing tools are all accessible within an intuitive interface.

Only a few steps are required to complete and sign your Instructions For Schedule M 3 Form 1120 L IRS gov:

- Insert the fillable template to the editor using the Get Form button.

- Review the information you need to include in your Instructions For Schedule M 3 Form 1120 L IRS gov.

- Move between the fields with the Next button to avoid missing any details.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is crucial or Redact sections that are no longer relevant.

- Tap on Sign to generate a legally enforceable eSignature using your preferred method.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finalized Instructions For Schedule M 3 Form 1120 L IRS gov in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile form sharing options. There’s no need to print your templates when you need to submit them to the relevant public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule m 3 form 1120 l 2017 irsgov

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule m 3 form 1120 l 2017 irsgov

How to make an electronic signature for your Instructions For Schedule M 3 Form 1120 L 2017 Irsgov online

How to make an eSignature for the Instructions For Schedule M 3 Form 1120 L 2017 Irsgov in Google Chrome

How to make an eSignature for putting it on the Instructions For Schedule M 3 Form 1120 L 2017 Irsgov in Gmail

How to make an eSignature for the Instructions For Schedule M 3 Form 1120 L 2017 Irsgov from your smartphone

How to create an eSignature for the Instructions For Schedule M 3 Form 1120 L 2017 Irsgov on iOS

How to generate an electronic signature for the Instructions For Schedule M 3 Form 1120 L 2017 Irsgov on Android devices

People also ask

-

What are the Instructions For Schedule M 3 Form 1120 L IRS gov.?

The Instructions For Schedule M 3 Form 1120 L IRS gov. provide detailed guidelines on how to fill out this schedule for tax reporting purposes. They ensure compliance with IRS regulations for life insurance companies. Referencing these instructions is crucial for accurate reporting to avoid potential penalties.

-

How does airSlate SignNow facilitate the signing of documents related to Instructions For Schedule M 3 Form 1120 L IRS gov.?

airSlate SignNow allows users to easily send and electronically sign documents required for the Instructions For Schedule M 3 Form 1120 L IRS gov. With an intuitive interface, you can streamline the signing process, ensuring timely submissions to the IRS. This feature enhances productivity and compliance.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to meet the needs of different businesses, including those needing assistance with the Instructions For Schedule M 3 Form 1120 L IRS gov. Each plan provides access to essential features, ensuring a cost-effective solution for document management and e-signature needs.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Yes, airSlate SignNow offers seamless integrations with popular tax preparation software and platforms, making it easier to manage your documents related to the Instructions For Schedule M 3 Form 1120 L IRS gov. This interoperability enhances your workflow and reduces the time spent on manual data entry.

-

What benefits does airSlate SignNow provide for filing tax documents?

By using airSlate SignNow, businesses benefit from a secure and efficient way to prepare and file their tax documents, including those related to the Instructions For Schedule M 3 Form 1120 L IRS gov. The platform’s legally binding e-signature feature helps ensure that all necessary documents are signed promptly, minimizing delays.

-

Is airSlate SignNow user-friendly for those unfamiliar with online document signing?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone, even those unfamiliar with online document signing, to navigate. Clear instructions and support resources are available, ensuring that getting started with e-signatures, including for Instructions For Schedule M 3 Form 1120 L IRS gov., is a breeze.

-

What security measures are in place for documents signed via airSlate SignNow?

airSlate SignNow prioritizes security by employing advanced encryption and authentication methods for documents signed through its platform. This ensures that all your documents, including those concerning the Instructions For Schedule M 3 Form 1120 L IRS gov., are safe and protected from unauthorized access.

Get more for Instructions For Schedule M 3 Form 1120 L IRS gov

Find out other Instructions For Schedule M 3 Form 1120 L IRS gov

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement