8916 a Form 2012

What is the 8916 A Form

The 8916 A Form is a tax document used by businesses and individuals in the United States to report certain information to the Internal Revenue Service (IRS). This form is primarily associated with tax compliance and is often required for specific tax-related filings. It is essential for ensuring that all relevant financial data is accurately reported, which can help avoid potential penalties or issues with the IRS.

How to use the 8916 A Form

To effectively use the 8916 A Form, individuals and businesses should first determine if they are required to file it based on their specific tax situation. Once it is established that the form is necessary, users should carefully read the instructions provided by the IRS. This will guide them through the process of filling out the form accurately. It is crucial to ensure that all required fields are completed and that any necessary attachments are included before submission.

Steps to complete the 8916 A Form

Completing the 8916 A Form involves several key steps:

- Gather necessary financial documents and information related to the tax year.

- Review the form's instructions to understand what information is required.

- Fill out the form, ensuring all fields are completed accurately.

- Attach any required documents or schedules as specified in the instructions.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the 8916 A Form. Typically, forms must be submitted by the tax filing deadline for the year in question. This date is usually April 15 for individual taxpayers, but it may vary for businesses or if extensions are filed. Keeping track of these deadlines is essential to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The 8916 A Form can be submitted through various methods, depending on the preferences of the filer and the requirements set by the IRS. Options include:

- Online submission through approved e-filing services.

- Mailing a paper version of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Key elements of the 8916 A Form

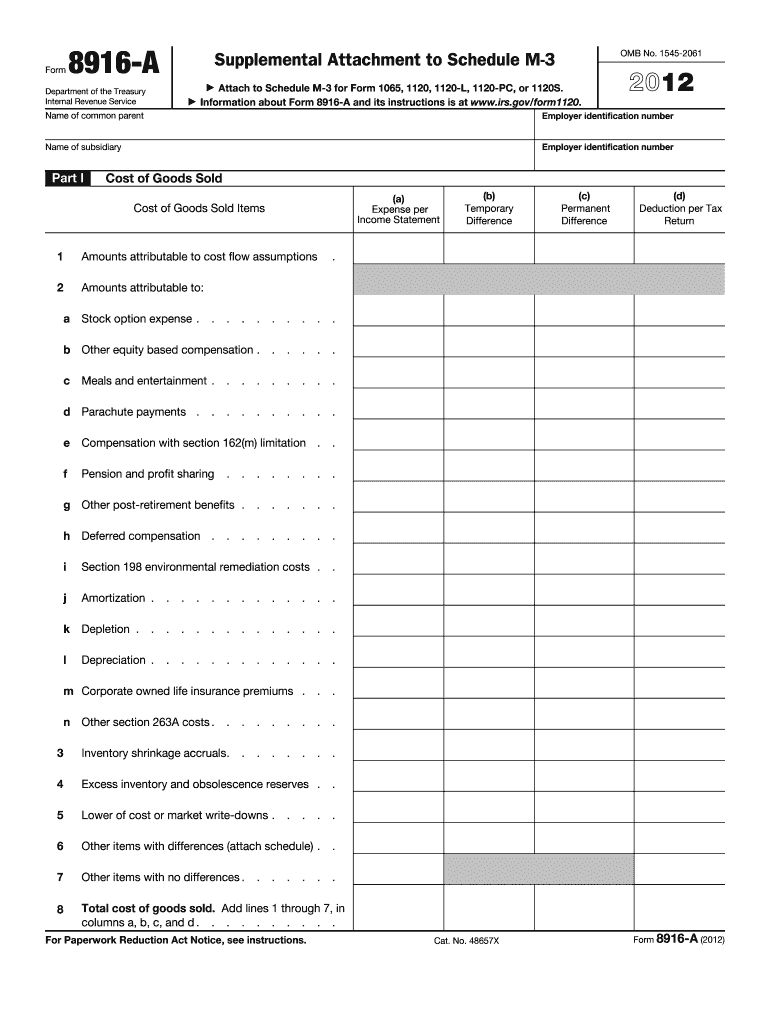

Key elements of the 8916 A Form include various fields that require specific information. Common sections may include taxpayer identification details, income reporting, deductions, and credits. Each section must be completed accurately to ensure compliance with IRS regulations. Missing or incorrect information can lead to processing delays or penalties.

Quick guide on how to complete 2012 8916 a form

Discover the most efficient method to complete and endorse your 8916 A Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior way to complete and endorse your 8916 A Form alongside other forms for public services. Our advanced electronic signature platform equips you with everything necessary to handle paperwork swiftly and in accordance with official standards - comprehensive PDF editing, management, protection, signing, and sharing tools all conveniently available within an intuitive interface.

Only a few steps are needed to finalize the completion and endorsement of your 8916 A Form:

- Insert the fillable template into the editor using the Get Form key.

- Review what details you must supply in your 8916 A Form.

- Move between the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Obscure fields that are no longer relevant.

- Press Sign to create a legally enforceable electronic signature using your chosen method.

- Include the Date alongside your signature and finish your task with the Done button.

Store your completed 8916 A Form in the Documents folder of your profile, download it, or share it with your preferred cloud storage. Our service also facilitates flexible form sharing. There’s no requirement to print your templates when sending them to the appropriate public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

Find and fill out the correct 2012 8916 a form

Create this form in 5 minutes!

How to create an eSignature for the 2012 8916 a form

How to generate an electronic signature for your 2012 8916 A Form in the online mode

How to create an eSignature for your 2012 8916 A Form in Google Chrome

How to create an eSignature for signing the 2012 8916 A Form in Gmail

How to create an electronic signature for the 2012 8916 A Form right from your smart phone

How to generate an eSignature for the 2012 8916 A Form on iOS

How to make an electronic signature for the 2012 8916 A Form on Android devices

People also ask

-

What is the 8916 A Form and why is it important?

The 8916 A Form is a tax form used by businesses to report specific information regarding their tax liabilities. Understanding how to properly fill out and submit the 8916 A Form is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

-

How can airSlate SignNow help with the 8916 A Form?

airSlate SignNow simplifies the process of completing and eSigning the 8916 A Form by providing an intuitive platform for document management. With our solution, businesses can easily create, edit, and securely send their 8916 A Form for electronic signatures, streamlining their workflow.

-

Is there a cost associated with using airSlate SignNow for the 8916 A Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the ability to manage the 8916 A Form. Our cost-effective solutions ensure that businesses can efficiently handle their document needs without overspending.

-

Can I integrate airSlate SignNow with other software for the 8916 A Form?

Absolutely! airSlate SignNow supports integrations with numerous third-party applications, allowing you to seamlessly incorporate the 8916 A Form into your existing workflows. This ensures that you can manage your documents alongside your favorite tools, enhancing productivity.

-

What features does airSlate SignNow offer for handling the 8916 A Form?

airSlate SignNow provides a variety of features specifically designed to assist in managing the 8916 A Form, including customizable templates, secure eSigning, and real-time tracking. These features help ensure that your documents are completed accurately and efficiently.

-

How does airSlate SignNow ensure the security of the 8916 A Form?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption and secure cloud storage to protect your sensitive information, including the 8916 A Form, ensuring that your documents are safe from unauthorized access.

-

Can I access the 8916 A Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage the 8916 A Form on the go. This flexibility ensures that you can eSign and send documents anytime, anywhere, enhancing your efficiency.

Get more for 8916 A Form

Find out other 8916 A Form

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template