Homeowner's Tax Relief Assessor Ada County 2023-2026

Understanding the Ada County Homestead Exemption

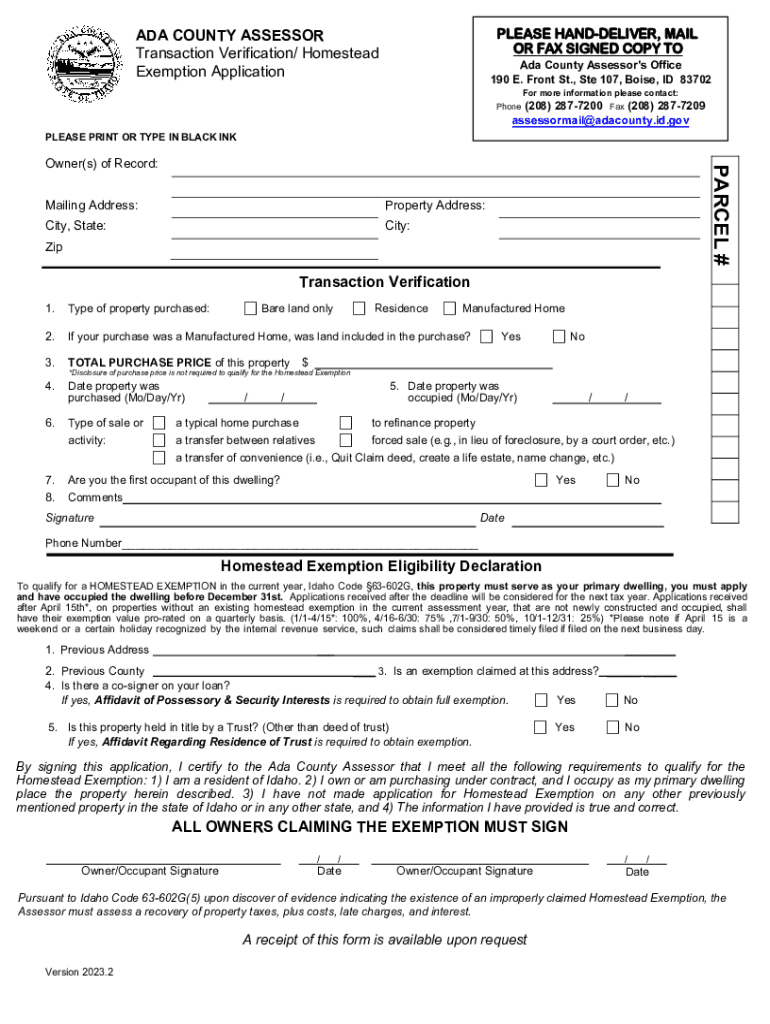

The Ada County homestead exemption is a program designed to provide property tax relief to homeowners. This exemption allows eligible homeowners to reduce the taxable value of their primary residence, resulting in lower property taxes. The exemption is particularly beneficial for individuals who may be facing financial challenges or those who want to ensure their home remains affordable. Understanding the specifics of this exemption can help homeowners take advantage of available benefits.

Eligibility Criteria for the Ada County Homestead Exemption

To qualify for the Ada County homestead exemption, homeowners must meet certain criteria. Generally, applicants must own and occupy the property as their primary residence. Additionally, the property must be located within Ada County. There are age and income considerations as well, particularly for seniors and individuals with disabilities. It's important for applicants to review these criteria carefully to ensure they meet all requirements before applying.

Steps to Apply for the Ada County Homestead Exemption

Applying for the Ada County homestead exemption involves several straightforward steps. First, homeowners need to complete the application form, which can typically be obtained from the Ada County Assessor's office or their official website. Next, applicants should gather necessary documentation, such as proof of residency and ownership. Once the application is completed and documents are ready, homeowners can submit their application either online or by mail. It is advisable to check for any specific deadlines to ensure timely processing.

Required Documents for the Ada County Homestead Exemption

When applying for the Ada County homestead exemption, certain documents are essential for a successful application. Homeowners should provide proof of ownership, such as a deed or title, along with identification that verifies residency, like a driver's license or utility bill. If applicable, documentation supporting any age or disability claims may also be required. Ensuring that all necessary documents are included can help streamline the application process.

Form Submission Methods for the Ada County Homestead Exemption

Homeowners in Ada County have multiple options for submitting their homestead exemption application. The application can be submitted online through the Ada County Assessor's website, which provides a convenient and efficient method. Alternatively, homeowners may choose to mail their completed application to the Assessor's office. In-person submissions are also an option for those who prefer direct interaction. Each method has its own benefits, and homeowners should select the one that best fits their needs.

Important Filing Deadlines for the Ada County Homestead Exemption

Filing deadlines for the Ada County homestead exemption are crucial for homeowners to keep in mind. Typically, applications must be submitted by a specific date each year to qualify for the exemption for that tax year. Missing this deadline may result in the loss of potential tax savings. Homeowners should verify the exact dates with the Ada County Assessor’s office to ensure compliance and maximize their benefits.

Quick guide on how to complete homeowners tax relief assessor ada county

Prepare Homeowner's Tax Relief Assessor Ada County effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any holdups. Manage Homeowner's Tax Relief Assessor Ada County on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Homeowner's Tax Relief Assessor Ada County seamlessly

- Locate Homeowner's Tax Relief Assessor Ada County and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark essential portions of your documents or hide sensitive information using specialized tools from airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring new printouts. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign Homeowner's Tax Relief Assessor Ada County while ensuring seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homeowners tax relief assessor ada county

Create this form in 5 minutes!

How to create an eSignature for the homeowners tax relief assessor ada county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ada county homestead exemption?

The ada county homestead exemption is a property tax benefit that allows homeowners to reduce their taxable property value. This exemption can signNowly lower your property taxes, making homeownership more affordable. To qualify, you must meet specific criteria set by the county.

-

How do I apply for the ada county homestead exemption?

To apply for the ada county homestead exemption, you need to complete an application form available on the county's website. Ensure you provide all necessary documentation, such as proof of residency and ownership. The application must be submitted by the deadline to receive the exemption for the current tax year.

-

What are the benefits of the ada county homestead exemption?

The primary benefit of the ada county homestead exemption is the reduction in property taxes, which can lead to signNow savings. Additionally, this exemption can provide financial relief for low-income homeowners and those on fixed incomes. It also helps to stabilize the housing market by encouraging homeownership.

-

Are there any income restrictions for the ada county homestead exemption?

Yes, there are income restrictions for the ada county homestead exemption, particularly for certain programs aimed at assisting low-income homeowners. It's essential to check the specific eligibility criteria on the county's website to determine if your income qualifies you for the exemption. Meeting these requirements can enhance your chances of receiving the benefit.

-

How does the ada county homestead exemption affect my property value?

The ada county homestead exemption reduces the assessed value of your property for tax purposes, which can lower your overall property tax bill. This exemption does not affect the market value of your home but provides financial relief by decreasing the taxable amount. Homeowners should take advantage of this exemption to maximize their savings.

-

Can I combine the ada county homestead exemption with other tax benefits?

Yes, homeowners can often combine the ada county homestead exemption with other tax benefits, such as senior citizen exemptions or disability exemptions. However, it's crucial to review the specific regulations and eligibility requirements for each exemption. Consulting with a tax professional can help you understand how to maximize your benefits.

-

What documents do I need to provide for the ada county homestead exemption application?

When applying for the ada county homestead exemption, you typically need to provide proof of ownership, such as a deed, and proof of residency, like a utility bill or driver's license. Additional documentation may be required depending on your specific situation. Always check the county's guidelines for the most accurate and up-to-date requirements.

Get more for Homeowner's Tax Relief Assessor Ada County

- Dlsu reconsideration form

- Geometry assignment find the measure of each angle indicated worksheet answers 42316009 form

- Citizens arrest minnesota form

- Uniform residential appraisal report fillable 100066901

- Choctaw casino self ban form choctaw nation gaming

- Restitution agreement template 787747025 form

- Restorative practice treatment agreement template form

- Grass cutt contract template form

Find out other Homeowner's Tax Relief Assessor Ada County

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement