Ada County Homeowner Exemption Form 2009

What is the Ada County Homeowner Exemption Form

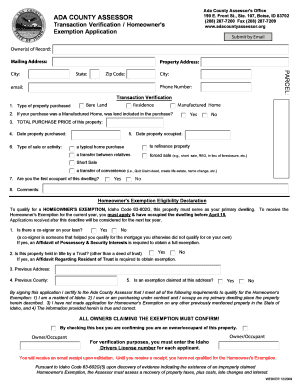

The Ada County Homeowner Exemption Form is a crucial document for homeowners in Ada County, Idaho, aiming to reduce their property tax burden. This form allows eligible homeowners to claim an exemption on a portion of their home's assessed value, thereby lowering the amount of property tax owed. The exemption is available to those who occupy their home as their primary residence and meet specific eligibility criteria set by local regulations.

Eligibility Criteria

To qualify for the Ada County Homeowner Exemption, applicants must meet several criteria:

- The property must be the applicant's primary residence.

- The applicant must be the owner of the property.

- Applicants must have lived in the home for at least one year prior to applying.

- There may be income limits or other conditions based on local laws.

It is essential for applicants to review the specific eligibility requirements outlined by the Ada County Assessor's Office to ensure compliance.

Steps to Complete the Ada County Homeowner Exemption Form

Filling out the Ada County Homeowner Exemption Form involves several straightforward steps:

- Obtain the form from the Ada County Assessor's Office or download it from their official website.

- Fill in the required personal information, including your name, address, and property details.

- Provide documentation proving your ownership and residency, such as a utility bill or mortgage statement.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either online, by mail, or in person.

How to Obtain the Ada County Homeowner Exemption Form

The Ada County Homeowner Exemption Form can be obtained through several convenient methods:

- Visit the Ada County Assessor's Office in person to request a physical copy.

- Download the form directly from the official Ada County website.

- Request a copy via mail by contacting the Assessor's Office.

It is advisable to ensure that you have the most current version of the form to avoid any issues during submission.

Form Submission Methods

Homeowners have multiple options for submitting the Ada County Homeowner Exemption Form:

- Online: If available, complete and submit the form electronically through the Ada County Assessor's website.

- By Mail: Send the completed form to the designated address provided on the form.

- In Person: Deliver the form directly to the Ada County Assessor's Office.

Each submission method may have different processing times, so it is important to choose the option that best fits your timeline.

Legal Use of the Ada County Homeowner Exemption Form

The Ada County Homeowner Exemption Form is legally binding once completed and submitted according to local laws. To ensure its validity, it is essential to provide accurate information and necessary documentation. The form must be submitted by the deadline to qualify for the exemption in the current tax year. Failure to comply with the legal requirements may result in the denial of the exemption.

Quick guide on how to complete ada county homeowner exemption form

Prepare Ada County Homeowner Exemption Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents promptly without delays. Manage Ada County Homeowner Exemption Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign Ada County Homeowner Exemption Form effortlessly

- Obtain Ada County Homeowner Exemption Form and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Ada County Homeowner Exemption Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ada county homeowner exemption form

Create this form in 5 minutes!

How to create an eSignature for the ada county homeowner exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ada County Homeowner Exemption Form?

The Ada County Homeowner Exemption Form is a document that allows qualifying homeowners to receive a property tax reduction on their primary residence. By filing this form, you can potentially save a signNow amount on your annual property taxes, making homeownership more affordable in Ada County.

-

How can I obtain the Ada County Homeowner Exemption Form?

You can obtain the Ada County Homeowner Exemption Form directly from the Ada County Assessor's website or by visiting their office. It is available for download in a PDF format, making it easy to access and complete from the comfort of your home.

-

What are the eligibility requirements for the Ada County Homeowner Exemption Form?

To qualify for the Ada County Homeowner Exemption Form, you must be the owner of a residential property that is your primary dwelling. Additionally, you should meet specific residency and income criteria as outlined by the Ada County Assessor, ensuring fair access to property tax reductions.

-

When is the deadline to submit the Ada County Homeowner Exemption Form?

The deadline to submit the Ada County Homeowner Exemption Form is typically April 15th of each year. It is crucial to submit your application on time to ensure that you receive the home exemption for the upcoming tax year.

-

How does the Ada County Homeowner Exemption Form affect my property taxes?

Filing the Ada County Homeowner Exemption Form can signNowly reduce your property tax liability by lowering the assessed value of your home. This reduction means you will pay less in taxes, providing essential savings that can be used for other expenses related to homeownership.

-

Can I file the Ada County Homeowner Exemption Form online?

Yes, you can file the Ada County Homeowner Exemption Form online through the Ada County Assessor's portal. This convenient option allows you to complete and submit your application quickly without having to visit the office in person.

-

What documents do I need to submit with the Ada County Homeowner Exemption Form?

When filing the Ada County Homeowner Exemption Form, you may need to provide supporting documents such as proof of ownership, identification, and any relevant financial information. Make sure to review the instructions carefully to ensure you include all necessary documentation for a smooth application process.

Get more for Ada County Homeowner Exemption Form

Find out other Ada County Homeowner Exemption Form

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation