CT 1040 2024-2026

What is the CT 1040

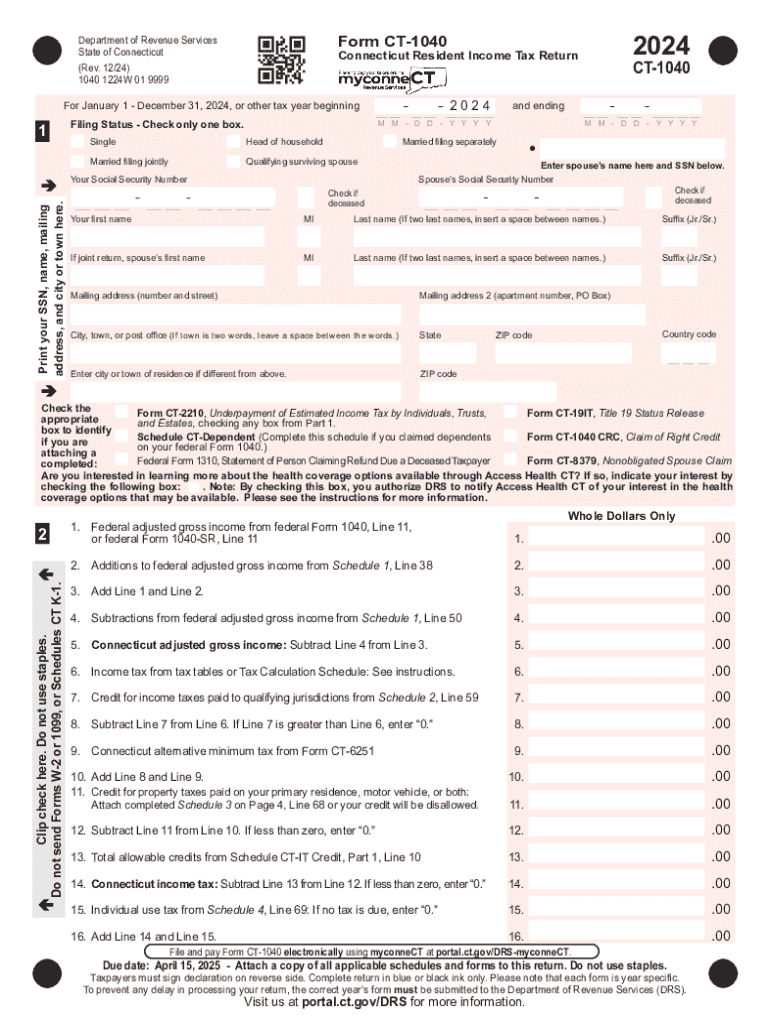

The CT 1040 is the state income tax form used by residents of Connecticut to report their income and calculate their state tax obligations. This form is essential for individuals who earn income within the state, as it helps determine the amount of tax owed or any potential refund due. The CT 1040 is part of the Connecticut Department of Revenue Services (DRS) tax forms and is specifically designed for individual taxpayers, including those who are self-employed, retirees, and students.

Steps to complete the CT 1040

Completing the CT 1040 involves several key steps to ensure accuracy and compliance with state tax regulations. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your total income by adding all sources of income together. After calculating your total income, you will need to determine your deductions and credits, which can reduce your taxable income. Finally, calculate the amount of tax owed or the refund due and sign the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the CT 1040 to avoid penalties. For the tax year 2024, the deadline to file your CT 1040 is typically April 15, unless it falls on a weekend or holiday, in which case the deadline may be extended. Additionally, if you are unable to file by this date, you may apply for an extension, which allows for an additional six months to submit your return. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

When preparing to file the CT 1040, it is important to have all required documents on hand. Essential documents include W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documentation for deductions, such as mortgage interest statements, property tax receipts, and charitable contributions, should be gathered. Keeping organized records will streamline the filing process and help ensure that all necessary information is accurately reported.

Form Submission Methods

The CT 1040 can be submitted through various methods, providing flexibility for taxpayers. You may file the form electronically using approved e-filing software, which is often the fastest method for processing returns and receiving refunds. Alternatively, you can print the completed form and mail it to the Connecticut Department of Revenue Services. In-person submissions are also accepted at designated DRS offices, allowing for direct assistance if needed. Each method has its own processing times and requirements, so choose the one that best fits your needs.

Key elements of the CT 1040

The CT 1040 includes several key elements that taxpayers must complete accurately. These elements consist of personal information, income reporting, deductions and credits, and tax calculations. The form also features sections for specific adjustments, such as contributions to retirement accounts or health savings accounts. Understanding these components is vital for ensuring that the form is filled out correctly and that taxpayers receive any eligible credits or deductions, ultimately affecting their overall tax liability.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040

Create this form in 5 minutes!

How to create an eSignature for the ct 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the ct 1040 instructions 2024?

The ct 1040 instructions 2024 provide detailed guidelines on how to complete your Connecticut income tax return. These instructions cover eligibility, necessary forms, and important deadlines to ensure compliance. Understanding these instructions is crucial for accurate filing and to avoid penalties.

-

How can airSlate SignNow help with ct 1040 instructions 2024?

airSlate SignNow simplifies the process of signing and sending documents related to your ct 1040 instructions 2024. With our platform, you can easily manage your tax documents, ensuring they are signed and submitted on time. This streamlines your tax filing process and enhances your productivity.

-

Are there any costs associated with using airSlate SignNow for ct 1040 instructions 2024?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions provide access to essential features for managing your ct 1040 instructions 2024 documents. You can choose a plan that fits your budget while ensuring you have the tools necessary for efficient document management.

-

What features does airSlate SignNow offer for managing ct 1040 instructions 2024?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage. These tools are designed to help you efficiently handle your ct 1040 instructions 2024 documents. Additionally, our user-friendly interface makes it easy for anyone to navigate and utilize these features.

-

Can I integrate airSlate SignNow with other software for ct 1040 instructions 2024?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing ct 1040 instructions 2024. Whether you use accounting software or document management systems, our platform can seamlessly connect to improve efficiency.

-

What are the benefits of using airSlate SignNow for ct 1040 instructions 2024?

Using airSlate SignNow for your ct 1040 instructions 2024 provides numerous benefits, including time savings and improved accuracy. Our platform ensures that your documents are securely signed and stored, reducing the risk of errors. This allows you to focus on other important aspects of your business.

-

Is airSlate SignNow secure for handling ct 1040 instructions 2024 documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling your ct 1040 instructions 2024 documents. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are secure while using our platform.

Get more for CT 1040

- Incenter vs circumceter ws piedra vista high school form

- Participation information sheet template

- Foods amp nutrition recipe card gcffy org form

- Report form manufacturer s field safety corrective action

- Pob jfk transcript request form

- Section v pole vault certification form

- Skmc25818082013132 form

- Dorney park youth group permission slip release and waiver of liability i parentguardian of stjamesjc form

Find out other CT 1040

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document