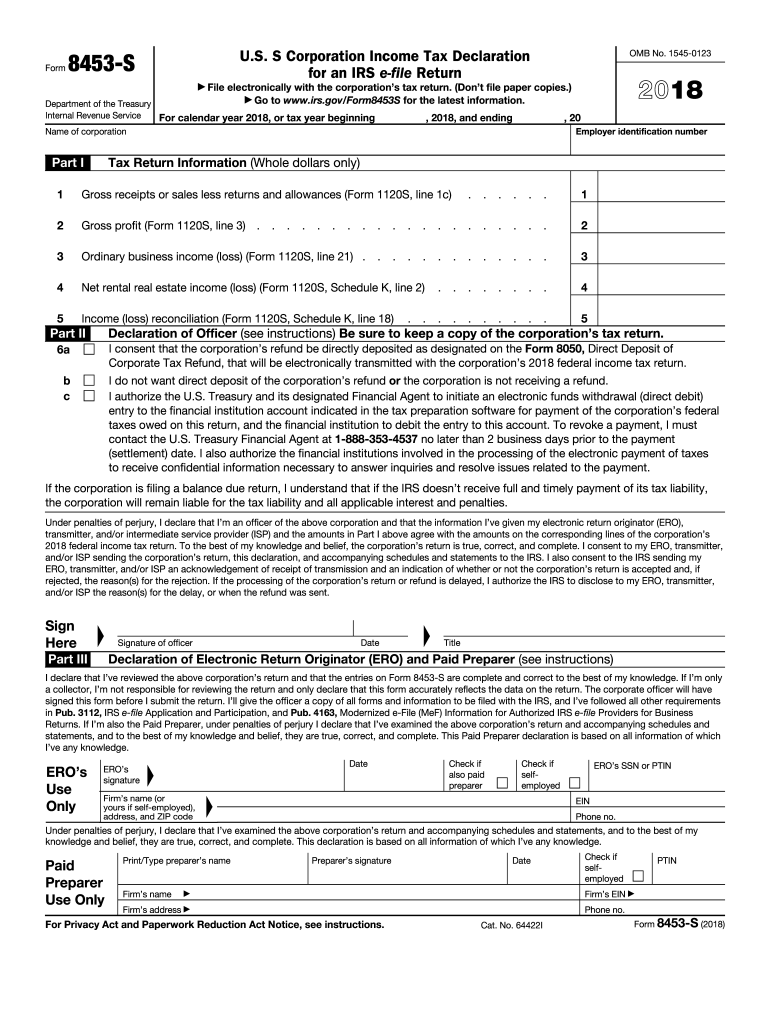

Form 8453 for 2018

What is the Form 8453 for?

The Form 8453 is a crucial document used in the U.S. tax filing process. Specifically, it serves as a declaration for taxpayers who e-file their federal tax returns. This form allows taxpayers to authorize the electronic submission of their tax returns while ensuring that they maintain a paper trail for their records. It is particularly relevant for individuals who are filing Form 1040, 1040A, or 1040EZ and wish to e-file their returns securely.

How to use the Form 8453

To utilize the Form 8453 effectively, taxpayers must complete it in conjunction with their e-filed tax return. The form requires specific information, including the taxpayer's name, Social Security number, and details about the tax return being filed. Once completed, the taxpayer must sign the form, which can be done electronically or by hand, depending on the filing method. After signing, the form should be submitted alongside the e-filed return to the IRS to validate the submission.

Steps to complete the Form 8453

Completing the Form 8453 involves several straightforward steps:

- Gather necessary information, including your tax return details and personal identification.

- Fill out the required fields on the form, ensuring accuracy in your name and Social Security number.

- Review the form for any errors or omissions.

- Sign the form, either electronically or by hand.

- Submit the completed form along with your e-filed tax return.

Legal use of the Form 8453

The legal validity of the Form 8453 is essential for ensuring compliance with IRS regulations. This form acts as an official record of consent for e-filing, making it a necessary component of the electronic filing process. Taxpayers must ensure that they use the most current version of the form and that it is filled out completely and accurately to avoid any issues with their tax submissions.

Filing deadlines / Important dates

Filing deadlines for the Form 8453 align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to be aware of these dates to ensure timely submission of their forms and avoid penalties.

Form submission methods (Online / Mail / In-Person)

The Form 8453 can be submitted through various methods, depending on how the taxpayer files their tax return:

- Online: When e-filing, the Form 8453 is submitted electronically with the tax return.

- Mail: If filing a paper return, the form must be printed, signed, and mailed to the IRS along with the tax return.

- In-Person: Taxpayers can also submit the form in person at designated IRS offices, though this method is less common.

Quick guide on how to complete 2018 form 8453 s us s corporation income tax declaration for an irs e file return

Discover the easiest method to complete and sign your Form 8453 For

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior way to fill out and sign your Form 8453 For and associated forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to handle documents swiftly and in compliance with legal standards - robust PDF editing, management, protection, signing, and sharing tools, all available within a user-friendly interface.

There are just a few steps needed to fill out and sign your Form 8453 For:

- Insert the fillable template into the editor by clicking the Get Form button.

- Review the information you need to include in your Form 8453 For.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Obscure fields that are no longer relevant.

- Select Sign to produce a legally binding electronic signature using any option of your choice.

- Insert the Date next to your signature and finish your work by clicking the Done button.

Store your completed Form 8453 For in the Documents folder of your profile, download it, or upload it to your preferred cloud storage. Our service also provides flexible form sharing options. There’s no need to print your forms when you need to submit them at the appropriate public office - simply do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 8453 s us s corporation income tax declaration for an irs e file return

FAQs

-

I'm non resident alien based out of U.S., having an EIN, but no income from US. in 2015, Am I supposed to file any form with IRS? Thanks,

As a nonresident alien, only U.S. sources of income are taxable here so you don't need to file.Taxation of Nonresident Aliens

-

What's the quickest, easiest way to file for an extension on my U.S. Income Tax returns?

Free File Fillable Forms:http://www.irs.gov/efile/article...

-

Is the filing of Individual Income tax returns mandatory to claim Relief u/s 89(1) of the income tax act? Suppose I received arrears of 2014-15 in 2017-18, is ITR mandatory for 2014-15? Or is relief allowed by filing form 10E?

Its not mandatory to file ITR for 2014–15. However you need to consider the income of 2014–15, to calculate the relief u.s 89(1), basically the calculation is to consider the fact that had the amount been received in 2014–15, what would be tax liablity, and its not appropriate to pay the tax liablity on arrears received, considering it completely in 2017–18.For any further information you can ping me at sfstaxsolutions17@gmail.com

-

I’m on a H1B visa, single and have been in the U.S. for less than 5 years. Are the forms 1040A and 1040EZ the only ones that I need to fill for my tax return? Should I just use a software like TurboTax or hire an accountant?

It’s tax time.Taxation of immigrants by the United States is signNowly affected by the immigration status of such immigrants. Although the immigration laws of the United States refer to aliens as immigrants, nonimmigrants, and undocumented (illegal) aliens, the tax laws of the United States refer only to “resident aliens” and “nonresident aliens”.In general, the controlling principle is that resident aliens are taxed in the same manner as U.S. citizens on their worldwide income, and nonresident aliens are taxed according to special rules contained in certain parts of the Internal Revenue Code.Holders of nonimmigrant visas or temporary visas may or may not have to report income and pay taxes to the United States Government. Holders of nonimmigrant visas only become tax residents if they spend at least 183 days of the current year within the United States. If you have spent more than 183 days of the current year in the U.S., you are considered a “resident alien.”A nonresident alien/nonimmigrant visa holder (with certain narrowly defined exceptions) is subject to federal income tax only on income which is derived from sources within the United States and or income that is effectively connected with a U.S. trade or business.Nonresident aliens who are required to file an income tax return must use:Form 1040NR, U.S. Nonresident Alien Income Tax Return or,Form 1040NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents, if qualified.Resident aliens who are required to file an income tax return must use:Form 1040, U.S. Individual Income Tax Return,Form 1040A, U.S. Individual Income Tax Return, orForm 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents.According to TurboTax, its software does not support the filing of Form 1040NR. However, it has a partnership with Sprintax that does support such filings. I would recommend that you also consult with a certified public accountant because depending on your circumstances, s/he may be able to identify other IRS forms and or deductions that may be applicable to you.For more information on the intersection of US taxation and immigration, go here.For more information on immigration, please visit here.

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 8453 s us s corporation income tax declaration for an irs e file return

How to generate an electronic signature for the 2018 Form 8453 S Us S Corporation Income Tax Declaration For An Irs E File Return online

How to generate an eSignature for your 2018 Form 8453 S Us S Corporation Income Tax Declaration For An Irs E File Return in Chrome

How to make an eSignature for signing the 2018 Form 8453 S Us S Corporation Income Tax Declaration For An Irs E File Return in Gmail

How to create an eSignature for the 2018 Form 8453 S Us S Corporation Income Tax Declaration For An Irs E File Return straight from your mobile device

How to generate an eSignature for the 2018 Form 8453 S Us S Corporation Income Tax Declaration For An Irs E File Return on iOS

How to create an eSignature for the 2018 Form 8453 S Us S Corporation Income Tax Declaration For An Irs E File Return on Android OS

People also ask

-

What is the form 8453 c fillable 2017?

The form 8453 C fillable 2017 is a tax form used by taxpayers to authorize the electronic filing of their returns. This form allows you to submit your tax information securely while maintaining compliance with IRS regulations. Using an electronic format also enhances the ease of filling it out and ensures accuracy.

-

How do I access the form 8453 c fillable 2017?

You can access the form 8453 C fillable 2017 through various online platforms, including the IRS website and electronic filing software. Additionally, airSlate SignNow provides a seamless way to create and manage this form securely. Just sign up and use our tools to easily navigate the process.

-

Is the form 8453 c fillable 2017 compatible with e-signature solutions?

Yes, the form 8453 C fillable 2017 is fully compatible with e-signature solutions, including those offered by airSlate SignNow. Our platform allows you to electronically sign this form, making the filing process smoother and faster. Ensure your documents are both legally binding and efficient.

-

What are the benefits of using airSlate SignNow for the form 8453 c fillable 2017?

Using airSlate SignNow for the form 8453 C fillable 2017 means you can streamline your document management and signing processes. Our platform is user-friendly and offers features like templates, document tracking, and secure storage. Save time and enhance productivity with our cost-effective solution.

-

Can I integrate airSlate SignNow with other software for the form 8453 c fillable 2017?

Absolutely! airSlate SignNow integrates with various applications, making it easy to manage the form 8453 C fillable 2017 alongside your preferred tools. Enhance your existing workflows by connecting with software such as CRM systems, accounting software, and collaboration tools.

-

What is the pricing structure for using airSlate SignNow to handle the form 8453 c fillable 2017?

airSlate SignNow offers a variety of pricing plans tailored to suit different business needs. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while providing comprehensive features for managing the form 8453 C fillable 2017. Explore our pricing page for specific details.

-

Is it safe to submit the form 8453 c fillable 2017 using airSlate SignNow?

Yes, submitting the form 8453 C fillable 2017 using airSlate SignNow is safe and secure. Our platform utilizes advanced encryption methods to protect your data during transmission and storage. You can have peace of mind knowing your sensitive information is well-guarded.

Get more for Form 8453 For

Find out other Form 8453 For

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer