Corporate Tax Refund, that Will Be Electronically Transmitted with the Corporations Federal Income Tax Return 2017

Understanding the Corporate Tax Refund

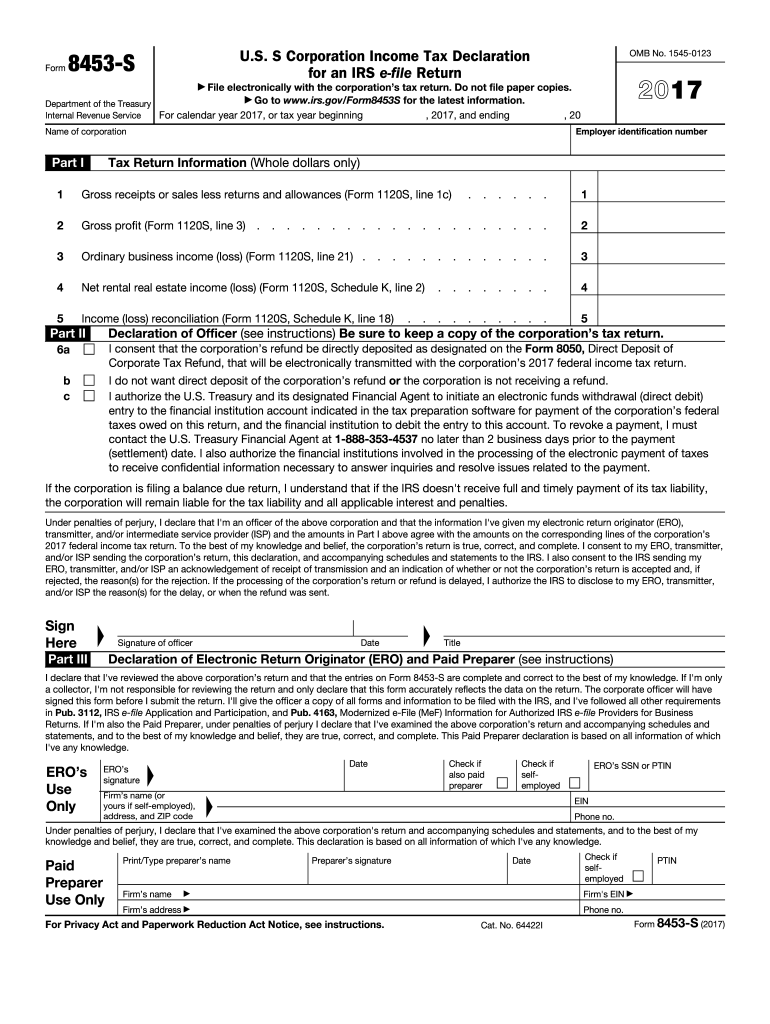

The Corporate Tax Refund that will be electronically transmitted with the corporations federal income tax return is a mechanism that allows businesses to recover overpaid taxes. This refund is typically processed when a corporation's tax liabilities are lower than what was initially paid. It is essential for corporations to understand the eligibility criteria and documentation required to ensure a smooth refund process.

Steps to Complete the Corporate Tax Refund

To complete the Corporate Tax Refund that will be electronically transmitted with the corporations federal income tax return, follow these steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Ensure that all required information is accurately filled out on the tax return form.

- Review the form for any errors or omissions before submission.

- Submit the tax return electronically through an approved platform to facilitate faster processing.

Required Documents for the Corporate Tax Refund

When applying for the Corporate Tax Refund that will be electronically transmitted with the corporations federal income tax return, several documents are necessary:

- Form 1120 or 1120-S, depending on the corporation type.

- Supporting schedules that detail income, deductions, and credits.

- Any prior year tax returns that may affect the current year’s refund.

- Documentation of estimated tax payments made throughout the year.

IRS Guidelines for Corporate Tax Refunds

The IRS provides specific guidelines for obtaining a Corporate Tax Refund that will be electronically transmitted with the corporations federal income tax return. Corporations must adhere to the following:

- File the tax return by the designated deadline to avoid penalties.

- Ensure all information is complete and accurate to prevent delays.

- Maintain records of all submitted documents for future reference.

Eligibility Criteria for the Corporate Tax Refund

To qualify for the Corporate Tax Refund that will be electronically transmitted with the corporations federal income tax return, corporations must meet certain eligibility criteria:

- Must be recognized as a legal corporation under U.S. law.

- Must have overpaid federal income taxes in the previous tax year.

- Must file the appropriate tax forms within the required timeframe.

Form Submission Methods

Corporations can submit the Corporate Tax Refund that will be electronically transmitted with the corporations federal income tax return through various methods:

- Electronically via tax preparation software approved by the IRS.

- By mail, using the appropriate address provided by the IRS for corporate returns.

- In-person at designated IRS offices, if necessary.

Quick guide on how to complete corporate tax refund that will be electronically transmitted with the corporations 2017 federal income tax return

Discover the simplest method to complete and endorse your Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return

Are you still spending time preparing your official paperwork on paper rather than online? airSlate SignNow presents a superior approach to complete and endorse your Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return and similar forms for public services. Our advanced eSignature solution equips you with all the tools required to handle documents swiftly and in line with official standards - comprehensive PDF editing, managing, safeguarding, endorsing, and sharing capabilities at your fingertips within an intuitive interface.

Only a few steps are necessary to complete filling out and endorsing your Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return:

- Upload the editable template to the editor using the Get Form button.

- Identify the information you need to include in your Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to input the relevant information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is truly important or Conceal sections that are no longer relevant.

- Click on Sign to create a legally binding eSignature using any method you prefer.

- Include the Date beside your signature and finalize your work with the Done button.

Store your completed Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return in the Documents folder within your account, download it, or send it to your preferred cloud storage. Our solution also offers flexible form sharing. There’s no need to print your forms when you have to send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct corporate tax refund that will be electronically transmitted with the corporations 2017 federal income tax return

FAQs

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Will Indian tax be levied on the income earned by an NRI in the foreign country if he/she returns to their home state in the future with that amount? How does it differ for both DTAA and non-DTAA countries?

The incidence of income tax in India is dependent upon the residential status of the person concerned ( the assessee ). Residential status is determined every financial year which is based on the number of days that individual has been present in India during the said financial year. To determine the residential status of an individual, section 6(1) prescribes two tests. An individual who fulfills any one of the following two tests is called Resident under the provisions of this Act. These tests are :(a) If he is in India during the relevant financial year for a period amounting in all to 182 days or more.(b) If he was in India for a period or periods amounting in all to 365 days or more during the four years preceding the relevant financial year and he was in India for a period or periods amounting in all to 60 days or more in that relevant previous year. The period of 60 days in this clause is extended to 182 days in the case of a seafarers or person leaving India for employment abroad and also in case of an individual being a citizen of India, or a person of Indian origin who being outside India, comes on a visit to India in any financial year. The determination of residential status is relevant because if a person is resident in India in any financial year as per above rule, his global income during that year becomes taxable in India. The period of 182 days need not be at a stretch. But physical presence for an aggregate of 182 days in the relevant previous year is enough.There is one more test to be applied if he is Resident in India during any financial year that is of `ordinarily resident’. To become an ordinary resident of India an individual has to fulfill both the following two conditions :(1) He has been resident of India (fulfilling at least one test given above) in at least 2 previous years out of 10 previous years immediately prior to the previous year in question.(2) He has stayed in India for at least 730 days in 7 previous years immediately preceding the previous year in question.If by the above test, a person is a Resident and Ordinarily resident in India during any financial year than his global income of that year becomes taxable in India. If a person is Resident but not Ordinarily resident in India in any financial year than his income which accrues or arises outside India will be liable to tax in India ONLY if it is derived from a business controlled in or a profession set up in India. Otherwise not.Coming back to question if the NRI returns to India and in the financial year of his return his stay in India during that financial year is more than 60 days and in the preceding four financial year his total stay in India is for 365 days or more or he is present in India during that financial year for 182 days or more than he is caught in the mischief of clause (a) or (b) above and his status will be Resident in India during that year making his global income earned during that particular year liable to tax in India. As far as his accumulated savings from his income earned during earlier years is concerned, it will not be liable to tax in India simply because it has been repatriated to India.The DTAA with other countries provides for relief to a taxpayer if an income becomes taxable in two jurisdictions, one on the basis of residence and the other on the basis of source or for any other reason. The relief would depend upon the nature of income, the country of source or residence and the provisions of DTAA. If the provisions of DTAA are more favourable to the assessee than the normal law than the provisions of DTAA which are more favourable to the assessee will be adopted.

-

I have been paying federal income taxes on the income received from renting out my garage apartment. The city and state wants their cut too so I have been paying that quarterly as well. But now they want us to register with their new Short Term Rental office and pay a hefty fee. Problem is that there is no Certificate of Occupancy for the structure. The inspection will be kinda pricey and I suspect I will have to sink a lot of money into this to get it up to code. So if I tell the city I am no l

If you are on International Building Code I believe the onus is on the city for maintaining CO records. They should have one for when the structure was built or replace it free of charge. If it didn’t have a CO how did the water get turned on?If you are talking a CO for a short term rental as opposed to a house then yes you are probably going to have to do code work for it. Biggest differences are going to be fire code. You also probably don’t have zoning for short term rentals. They have Airbnb just like everyone else.

Create this form in 5 minutes!

How to create an eSignature for the corporate tax refund that will be electronically transmitted with the corporations 2017 federal income tax return

How to create an electronic signature for your Corporate Tax Refund That Will Be Electronically Transmitted With The Corporations 2017 Federal Income Tax Return in the online mode

How to generate an electronic signature for your Corporate Tax Refund That Will Be Electronically Transmitted With The Corporations 2017 Federal Income Tax Return in Google Chrome

How to make an electronic signature for putting it on the Corporate Tax Refund That Will Be Electronically Transmitted With The Corporations 2017 Federal Income Tax Return in Gmail

How to make an electronic signature for the Corporate Tax Refund That Will Be Electronically Transmitted With The Corporations 2017 Federal Income Tax Return right from your mobile device

How to make an electronic signature for the Corporate Tax Refund That Will Be Electronically Transmitted With The Corporations 2017 Federal Income Tax Return on iOS devices

How to create an electronic signature for the Corporate Tax Refund That Will Be Electronically Transmitted With The Corporations 2017 Federal Income Tax Return on Android OS

People also ask

-

What is the Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return?

The Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return, refers to the refunds businesses are entitled to receive from overpayments in federal income tax. With airSlate SignNow, these refunds can be seamlessly integrated into your tax documentation process, ensuring that all necessary documents are in order and submitted efficiently.

-

How does airSlate SignNow facilitate the Corporate Tax Refund process?

airSlate SignNow simplifies the Corporate Tax Refund process by allowing businesses to electronically sign and submit all required documentation alongside their Federal Income Tax Returns. Our platform ensures that each document is securely stored and easily retrievable, making it easier to track and manage your tax refunds.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various corporations. By using our platform for managing the Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return, businesses can save time and reduce costs associated with traditional document handling.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting software to streamline the submission of the Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return. This integration allows for a centralized financial management system, enhancing efficiency and accuracy.

-

What security features does airSlate SignNow provide?

airSlate SignNow prioritizes security to protect sensitive information related to the Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return. Our platform utilizes advanced encryption and secure access controls to ensure your documents are safe and compliant with industry regulations.

-

How can airSlate SignNow benefit my corporation?

Using airSlate SignNow helps corporations improve workflow efficiency by simplifying document management, eSignatures, and tax filing processes. This means you can focus more on your core business activities while ensuring that your Corporate Tax Refund is processed accurately and timely.

-

What types of documents can be signed electronically with airSlate SignNow?

airSlate SignNow allows you to electronically sign a wide variety of documents, including tax forms related to the Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return. This feature contributes to a faster and more reliable document signing process for your business.

Get more for Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return

Find out other Corporate Tax Refund, That Will Be Electronically Transmitted With The Corporations Federal Income Tax Return

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement