Form 8453 S IRS Irs 2003

What is the Form 8453 S IRS

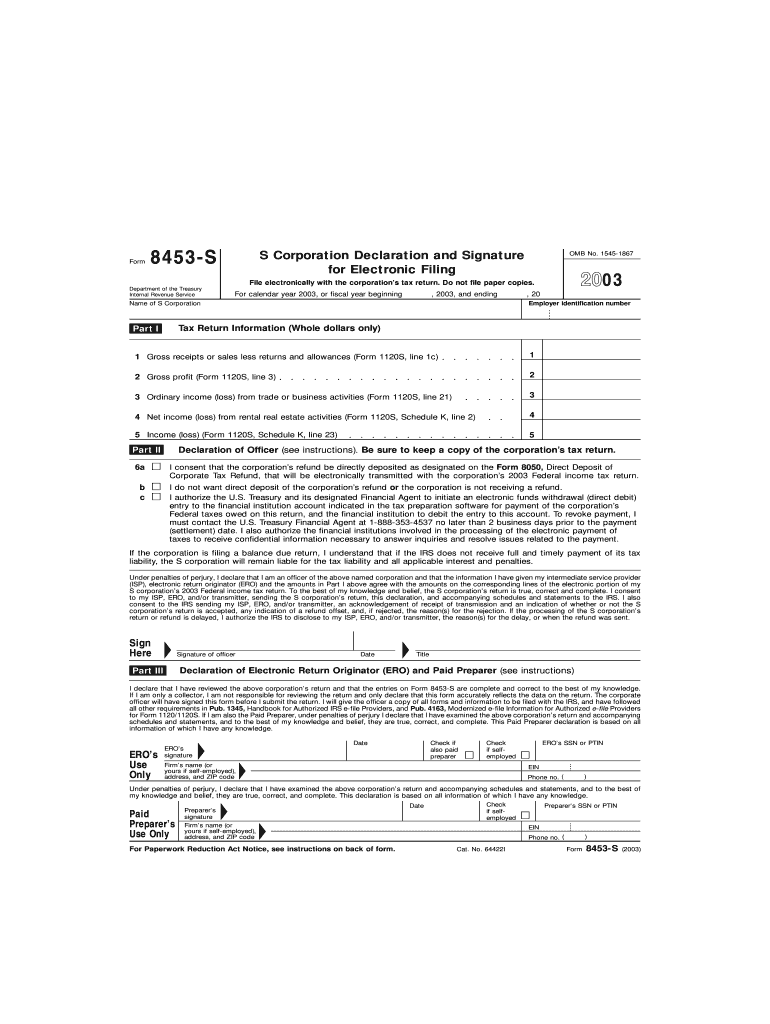

The Form 8453 S is a tax form used by S corporations to authorize the electronic filing of their income tax returns. This form serves as a declaration that the S corporation's return is being submitted electronically and that the taxpayer agrees to the terms of electronic filing. It is essential for ensuring compliance with IRS regulations regarding electronic submissions, providing a secure method for S corporations to file their taxes while maintaining the integrity of their data.

How to use the Form 8453 S IRS

Utilizing the Form 8453 S involves several key steps. First, ensure that all necessary information is accurately filled out, including the S corporation's name, Employer Identification Number (EIN), and the tax year for which the return is being filed. Once the form is completed, it should be signed by an authorized officer of the corporation. This signature confirms that the information provided is accurate and that the signer is authorized to act on behalf of the corporation. After signing, the form must be submitted along with the electronic tax return to the IRS.

Steps to complete the Form 8453 S IRS

Completing the Form 8453 S requires attention to detail. Follow these steps:

- Gather necessary information, including the S corporation's name and EIN.

- Fill out the form accurately, ensuring all fields are completed.

- Have an authorized officer review the form for accuracy.

- Sign the form electronically or physically, depending on the filing method.

- Submit the signed form along with the electronic tax return to the IRS.

Legal use of the Form 8453 S IRS

The legal use of Form 8453 S is crucial for compliance with IRS regulations. By signing this form, the authorized officer of the S corporation affirms that the electronic submission is legitimate and that the corporation agrees to the terms of electronic filing. This form also helps protect against unauthorized filings and serves as a record of consent for the electronic submission of tax information.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8453 S align with the general deadlines for S corporation tax returns. Typically, the due date for filing Form 1120-S, the income tax return for S corporations, is March 15 for the previous tax year. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is important to ensure that the Form 8453 S is submitted in conjunction with the tax return by this deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 8453 S is primarily submitted electronically, as it accompanies the electronic filing of the S corporation's tax return. However, if the corporation is filing a paper return, the form can also be submitted by mail. In-person submissions are not typical for this form, as electronic filing is encouraged for efficiency and security. Always check for the latest IRS guidelines regarding submission methods to ensure compliance.

Quick guide on how to complete form 8453 s irs irs

Complete Form 8453 S IRS Irs effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely save them online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Form 8453 S IRS Irs on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 8453 S IRS Irs without stress

- Locate Form 8453 S IRS Irs and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant portions of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Craft your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8453 S IRS Irs and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8453 s irs irs

Create this form in 5 minutes!

How to create an eSignature for the form 8453 s irs irs

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 8453 S IRS Irs?

Form 8453 S IRS Irs is a document used for the electronic filing of tax returns. It allows taxpayers to authorize e-filing and is necessary for certain tax situations. By utilizing airSlate SignNow, you can easily prepare and send Form 8453 S IRS Irs for signature, streamlining the tax filing process.

-

How can airSlate SignNow help with Form 8453 S IRS Irs?

airSlate SignNow simplifies the process of managing Form 8453 S IRS Irs by allowing users to send, sign, and store documents securely. The platform ensures that your form is properly filled out and e-signed, providing an efficient solution for your IRS needs. Additionally, you can track the status of your documents instantly.

-

What is the pricing structure for using airSlate SignNow?

AirSlate SignNow offers a competitive pricing structure that ensures affordability for all businesses. Different plans are available based on features and usage, allowing users to choose the best option for processing their Form 8453 S IRS Irs. Check the website for current pricing and explore the features included in each plan.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers a range of integrations with popular applications such as Google Drive, Dropbox, and CRM systems. These integrations facilitate the seamless execution of Form 8453 S IRS Irs alongside other workflows. This flexibility enhances productivity and ensures your forms are managed effectively.

-

Is airSlate SignNow secure for handling sensitive information?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive information like Form 8453 S IRS Irs. The platform utilizes advanced encryption methods to protect your documents throughout their lifecycle, ensuring that your data remains confidential and secure during e-signing.

-

What features does airSlate SignNow offer for document signing?

AirSlate SignNow provides a variety of features that enhance the document signing process, including customizable templates, automated reminders, and the ability to capture signatures on any device. These functionalities make it easy to handle Form 8453 S IRS Irs efficiently, accelerating your workflow and reducing delays.

-

What are the benefits of eSigning Form 8453 S IRS Irs?

E-signing Form 8453 S IRS Irs through airSlate SignNow offers numerous benefits, such as increased speed and reduced paperwork. It eliminates the need for physical signatures, allowing you to file tax returns faster and more efficiently. Additionally, eSigning enhances accuracy and reduces the risk of errors in your filings.

Get more for Form 8453 S IRS Irs

- Rejection compensation form

- Exclusion of uncompensated officials for workers compensation colorado form

- Petition to modify for workers compensation colorado form

- Objection petition colorado form

- Colorado workers compensation 497300802 form

- Request for offset of liability for workers compensation colorado form

- Colorado workers compensation form

- Settlement order for workers compensation colorado form

Find out other Form 8453 S IRS Irs

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement