Important Tax Information Response Required Granite State

What is the Important Tax Information Response Required Granite State

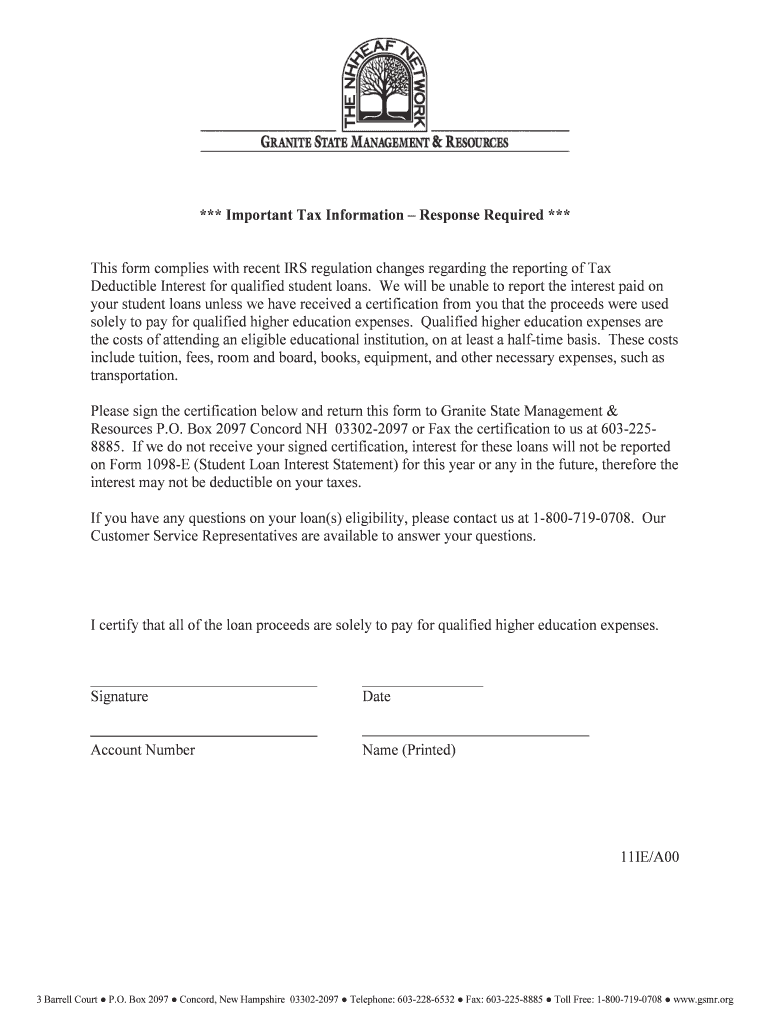

The Important Tax Information Response Required Granite State is a formal document that taxpayers in New Hampshire must complete to provide essential tax-related information to the state tax authority. This form is typically used to ensure compliance with state tax laws and regulations. It may include various sections that require taxpayers to disclose income, deductions, and other relevant financial information.

Steps to complete the Important Tax Information Response Required Granite State

Completing the Important Tax Information Response Required Granite State involves several key steps:

- Gather necessary documentation, including income statements, previous tax returns, and any relevant financial records.

- Carefully read the instructions provided with the form to understand the information required.

- Fill out the form accurately, ensuring all sections are completed as instructed.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline, either online, by mail, or in person, depending on the submission methods allowed.

Required Documents

To complete the Important Tax Information Response Required Granite State, taxpayers should have the following documents ready:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation of any other income sources

- Receipts for deductible expenses

- Previous tax returns for reference

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Important Tax Information Response Required Granite State. Typically, the form must be submitted by April fifteenth of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any additional deadlines for specific circumstances, such as extensions or amendments.

Penalties for Non-Compliance

Failing to submit the Important Tax Information Response Required Granite State by the deadline can result in penalties. These may include:

- Late filing fees, which can accumulate over time

- Interest on any unpaid taxes

- Potential legal action for continued non-compliance

It is essential for taxpayers to adhere to the submission requirements to avoid these consequences.

Who Issues the Form

The Important Tax Information Response Required Granite State is issued by the New Hampshire Department of Revenue Administration. This agency is responsible for overseeing tax compliance and ensuring that taxpayers meet their obligations under state law. Taxpayers can contact the department for any questions regarding the form or its requirements.

Quick guide on how to complete important tax information response required granite state

Effortlessly Prepare [SKS] on Any Device

Digital document management has become a trend among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with the airSlate SignNow apps for Android or iOS and advance any document-centric task today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your preference. Modify and eSign [SKS] to guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Important Tax Information Response Required Granite State

Create this form in 5 minutes!

How to create an eSignature for the important tax information response required granite state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of the 'Important Tax Information Response Required Granite State' feature?

The 'Important Tax Information Response Required Granite State' feature ensures that businesses can efficiently manage and respond to critical tax documents. This functionality helps streamline the process of collecting necessary signatures and responses, reducing the risk of delays in compliance.

-

How does airSlate SignNow handle pricing for the 'Important Tax Information Response Required Granite State' service?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring the 'Important Tax Information Response Required Granite State' feature. Our pricing is transparent, with no hidden fees, allowing businesses to choose a plan that fits their budget while ensuring compliance.

-

What are the key features of airSlate SignNow related to tax document management?

Key features of airSlate SignNow include customizable templates, secure eSigning, and automated workflows specifically designed for tax document management. These features enhance the handling of 'Important Tax Information Response Required Granite State' documents, making the process seamless and efficient.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow offers integrations with various accounting and tax management software. This allows users to easily incorporate the 'Important Tax Information Response Required Granite State' feature into their existing workflows, enhancing productivity and ensuring compliance.

-

What benefits does airSlate SignNow provide for businesses dealing with tax documents?

Businesses using airSlate SignNow benefit from increased efficiency, reduced paperwork, and enhanced security when managing tax documents. The 'Important Tax Information Response Required Granite State' feature specifically helps ensure timely responses and compliance, which is crucial for any business.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and utilize its features. Even those unfamiliar with eSigning can quickly learn how to manage 'Important Tax Information Response Required Granite State' documents with our intuitive interface.

-

How does airSlate SignNow ensure the security of tax documents?

airSlate SignNow prioritizes security by employing advanced encryption and compliance with industry standards. This ensures that all 'Important Tax Information Response Required Granite State' documents are protected, giving businesses peace of mind when handling sensitive information.

Get more for Important Tax Information Response Required Granite State

- Fillable online form it 203 tm att b fax email print

- Form7004 for instructions and the latest irs tax forms

- Suite 210 charlestown ma 02129 n 617 679 6877 n fax 617 679 1661 form

- Taxrigovabout uscontact usri division of taxation state of rhode island division of form

- Fillable kansas department of revenue power of attorney form

- Ce 5 petition for abatement collectability for businesses rev 8 19 form

- Exemption certificate forms ohio department of taxationexemptions ampamp exclusions vehicles vessels californiaexemption

- Kansas department of revenue 465818 statement for sales tax form

Find out other Important Tax Information Response Required Granite State

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy