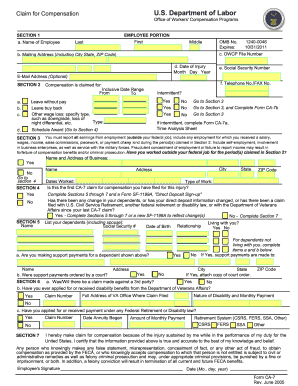

You Must Report All Earnings from Employment Outside Your Federal Job; Include Any Employment for Which You Received a Salary, Form

Understanding the Requirement to Report Earnings

The requirement to report all earnings from employment outside your federal job is crucial for maintaining compliance with federal regulations. This includes any employment for which you received a salary, whether it is part-time, full-time, or contractual work. Accurate reporting ensures that you fulfill your obligations and avoid potential penalties.

Steps to Report Your Earnings

To report your earnings accurately, follow these steps:

- Gather documentation of all income sources, including pay stubs, tax forms, and contracts.

- Complete the necessary forms, ensuring that you include all relevant employment details.

- Submit the completed forms to the appropriate federal agency, ensuring you meet any deadlines.

Legal Implications of Non-Compliance

Failing to report earnings can lead to serious legal consequences. Non-compliance may result in penalties, including fines or disciplinary action from your employer. It is essential to understand the legal ramifications to protect yourself and your career.

Required Documentation for Reporting

When reporting your earnings, you will need specific documents to support your claims. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Pay stubs or bank statements showing direct deposits

Examples of Reporting Earnings

Consider the following scenarios for clarity:

- If you work as a part-time consultant while employed full-time by the federal government, you must report the consulting income.

- Freelancers who receive payments for services rendered must include those earnings in their reports.

Filing Deadlines and Important Dates

It is vital to be aware of filing deadlines to avoid late submissions. Typically, earnings must be reported annually, but specific deadlines may vary based on your employment status and the forms you are required to submit. Check the IRS guidelines for precise dates relevant to your situation.

Submitting Your Earnings Report

You can submit your earnings report through various methods. Options may include:

- Online submission through official government portals

- Mailing paper forms to designated addresses

- In-person submissions at local government offices

Quick guide on how to complete you must report all earnings from employment outside your federal job include any employment for which you received a salary

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can obtain the right format and securely store it on the web. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Alter and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to send your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to You Must Report All Earnings From Employment outside Your Federal Job; Include Any Employment For Which You Received A Salary,

Create this form in 5 minutes!

How to create an eSignature for the you must report all earnings from employment outside your federal job include any employment for which you received a salary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of reporting earnings from employment outside my federal job?

You must report all earnings from employment outside your federal job; include any employment for which you received a salary. This ensures compliance with federal regulations and helps avoid potential penalties. Accurate reporting also contributes to your overall financial transparency.

-

How does airSlate SignNow help with document management related to employment earnings?

airSlate SignNow provides a streamlined platform for managing documents related to your employment earnings. You can easily create, send, and eSign documents that require reporting of your earnings. This simplifies the process of maintaining accurate records for your federal job and any outside employment.

-

What features does airSlate SignNow offer for tracking employment earnings?

With airSlate SignNow, you can utilize features like document templates and automated workflows to track your employment earnings efficiently. You must report all earnings from employment outside your federal job; include any employment for which you received a salary, and our platform helps you keep everything organized. This ensures you have all necessary documentation ready for reporting.

-

Is airSlate SignNow cost-effective for small businesses managing multiple employment records?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. It offers flexible pricing plans that cater to small businesses needing to manage multiple employment records. You must report all earnings from employment outside your federal job; include any employment for which you received a salary, and our platform helps you do this without breaking the bank.

-

Can I integrate airSlate SignNow with other software for better financial tracking?

Absolutely! airSlate SignNow offers integrations with various financial and accounting software. This allows you to streamline your processes and ensure that you must report all earnings from employment outside your federal job; include any employment for which you received a salary, seamlessly within your existing systems.

-

What benefits does airSlate SignNow provide for ensuring compliance with federal reporting?

Using airSlate SignNow helps ensure compliance with federal reporting requirements by providing tools to manage and document your earnings accurately. You must report all earnings from employment outside your federal job; include any employment for which you received a salary, and our platform simplifies this process. This reduces the risk of errors and potential penalties.

-

How user-friendly is the airSlate SignNow platform for new users?

The airSlate SignNow platform is designed with user-friendliness in mind, making it accessible for new users. With intuitive navigation and helpful resources, you can quickly learn how to manage your documents effectively. You must report all earnings from employment outside your federal job; include any employment for which you received a salary, and our platform makes this easy.

Get more for You Must Report All Earnings From Employment outside Your Federal Job; Include Any Employment For Which You Received A Salary,

- Visio meridian hp of il rx 140115 vsd form

- Follow up documentation form summahealth

- Department of the treasuryinternal revenue service 1040 nrsp form

- Camco purchaser guide to condocerts 2 form

- Wccp chassis fill and sign printable template online form

- Conservaton program application conservation program application form

- Va form 29 389 veterans benefits administration

- Downloadrepossessed affidavit dispostion of motor vehicle under form

Find out other You Must Report All Earnings From Employment outside Your Federal Job; Include Any Employment For Which You Received A Salary,

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document