Department of the TreasuryInternal Revenue Service 1040 NRSP 2022

What is the Department Of The TreasuryInternal Revenue Service 1040 NRSP

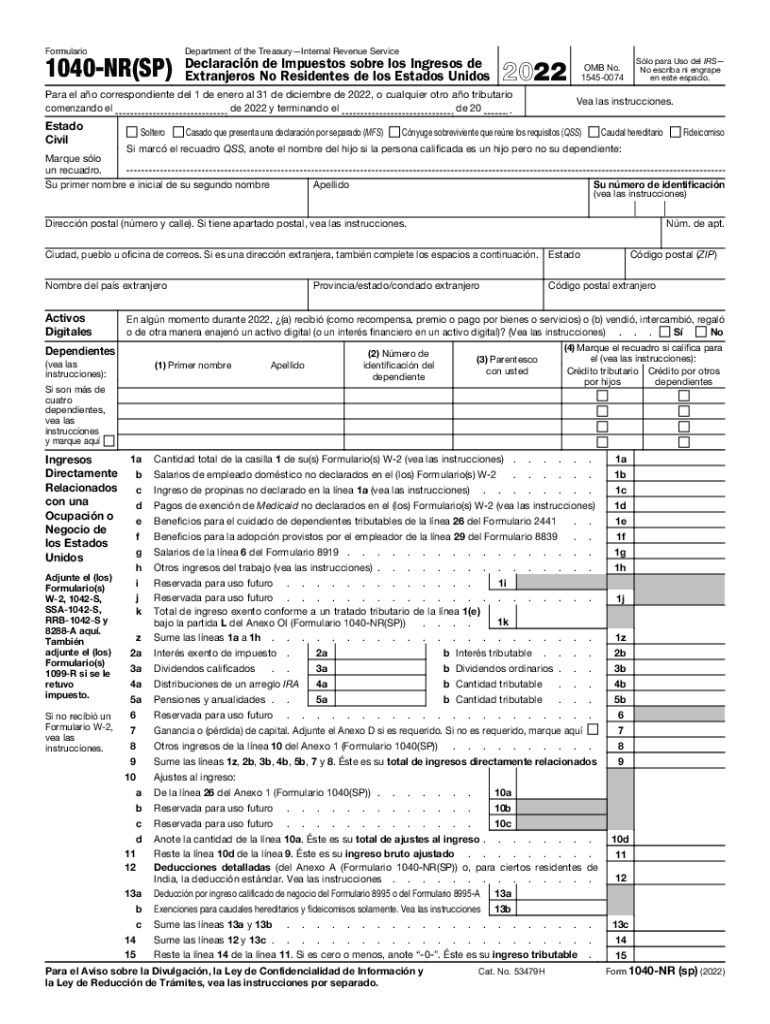

The Department Of The TreasuryInternal Revenue Service 1040 NRSP is a specific tax form designed for non-resident aliens who need to report their income to the Internal Revenue Service (IRS). This form allows individuals who are not U.S. citizens or residents to fulfill their tax obligations while ensuring compliance with U.S. tax laws. It is essential for accurately reporting income earned in the United States, as well as for claiming any applicable deductions or credits.

How to use the Department Of The TreasuryInternal Revenue Service 1040 NRSP

Using the 1040 NRSP involves several steps. First, gather all necessary financial documents, including income statements and records of any deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided by the IRS for each section of the form. Once completed, the form can be submitted either electronically or by mail, depending on the preference and circumstances of the filer.

Steps to complete the Department Of The TreasuryInternal Revenue Service 1040 NRSP

Completing the 1040 NRSP requires a systematic approach:

- Collect all relevant financial documents, such as W-2s or 1099s.

- Review the instructions for the 1040 NRSP to understand each section.

- Fill out personal information, including name, address, and taxpayer identification number.

- Report all income earned in the U.S. and any applicable deductions.

- Double-check all entries for accuracy before submission.

Required Documents

To successfully complete the 1040 NRSP, certain documents are necessary. These typically include:

- Income statements, such as W-2 or 1099 forms.

- Proof of residency or visa status.

- Records of any deductions or credits being claimed.

- Tax identification number or Social Security number.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 NRSP are crucial for compliance. Generally, non-resident aliens must file their tax return by April fifteenth of the following year. However, if additional time is needed, an extension can be requested, allowing for an extended deadline. It is important to stay informed of any changes to filing dates, as these can vary based on specific circumstances or IRS announcements.

Penalties for Non-Compliance

Failing to file the 1040 NRSP on time or inaccurately reporting income can lead to penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, interest may be charged on any unpaid taxes. To avoid these penalties, it is advisable to file accurately and on time, ensuring that all required information is included.

Quick guide on how to complete department of the treasuryinternal revenue service 1040 nrsp

Complete Department Of The TreasuryInternal Revenue Service 1040 NRSP effortlessly on any device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to swiftly create, modify, and electronically sign your documents without delays. Manage Department Of The TreasuryInternal Revenue Service 1040 NRSP on any device with the airSlate SignNow applications available for Android or iOS and streamline any document-related process today.

How to modify and eSign Department Of The TreasuryInternal Revenue Service 1040 NRSP with ease

- Obtain Department Of The TreasuryInternal Revenue Service 1040 NRSP and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal significance as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Department Of The TreasuryInternal Revenue Service 1040 NRSP to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of the treasuryinternal revenue service 1040 nrsp

Create this form in 5 minutes!

How to create an eSignature for the department of the treasuryinternal revenue service 1040 nrsp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Department Of The TreasuryInternal Revenue Service 1040 NRSP?

The Department Of The TreasuryInternal Revenue Service 1040 NRSP is a specific tax form used by non-resident aliens to report their income to the IRS. It is essential for individuals who earn income in the United States but do not qualify as residents. Understanding this form is crucial for compliance with U.S. tax laws.

-

How can airSlate SignNow help with the Department Of The TreasuryInternal Revenue Service 1040 NRSP?

airSlate SignNow simplifies the process of completing and submitting the Department Of The TreasuryInternal Revenue Service 1040 NRSP by allowing users to eSign documents securely. Our platform ensures that all necessary forms are filled out correctly and can be sent directly to the IRS, streamlining the tax filing process.

-

What are the pricing options for using airSlate SignNow for the Department Of The TreasuryInternal Revenue Service 1040 NRSP?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for handling the Department Of The TreasuryInternal Revenue Service 1040 NRSP. You can choose from monthly or annual subscriptions, with options that provide access to various features tailored for tax document management.

-

What features does airSlate SignNow offer for the Department Of The TreasuryInternal Revenue Service 1040 NRSP?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, specifically designed to assist with the Department Of The TreasuryInternal Revenue Service 1040 NRSP. These tools enhance efficiency and ensure that all documents are managed seamlessly throughout the tax filing process.

-

Are there any integrations available with airSlate SignNow for the Department Of The TreasuryInternal Revenue Service 1040 NRSP?

Yes, airSlate SignNow integrates with various applications and services that can assist in managing the Department Of The TreasuryInternal Revenue Service 1040 NRSP. This includes accounting software and cloud storage solutions, allowing for a more streamlined workflow and easier access to your tax documents.

-

What are the benefits of using airSlate SignNow for tax documents like the Department Of The TreasuryInternal Revenue Service 1040 NRSP?

Using airSlate SignNow for tax documents such as the Department Of The TreasuryInternal Revenue Service 1040 NRSP offers numerous benefits, including enhanced security, reduced processing time, and improved accuracy. Our platform ensures that your documents are handled efficiently, helping you meet deadlines and stay compliant with tax regulations.

-

Is airSlate SignNow user-friendly for filing the Department Of The TreasuryInternal Revenue Service 1040 NRSP?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the process of filing the Department Of The TreasuryInternal Revenue Service 1040 NRSP. Our intuitive interface allows users to complete and eSign documents without any technical expertise.

Get more for Department Of The TreasuryInternal Revenue Service 1040 NRSP

Find out other Department Of The TreasuryInternal Revenue Service 1040 NRSP

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF