Form 901 Business Personal Property Rendition

What is the Form 901 Business Personal Property Rendition

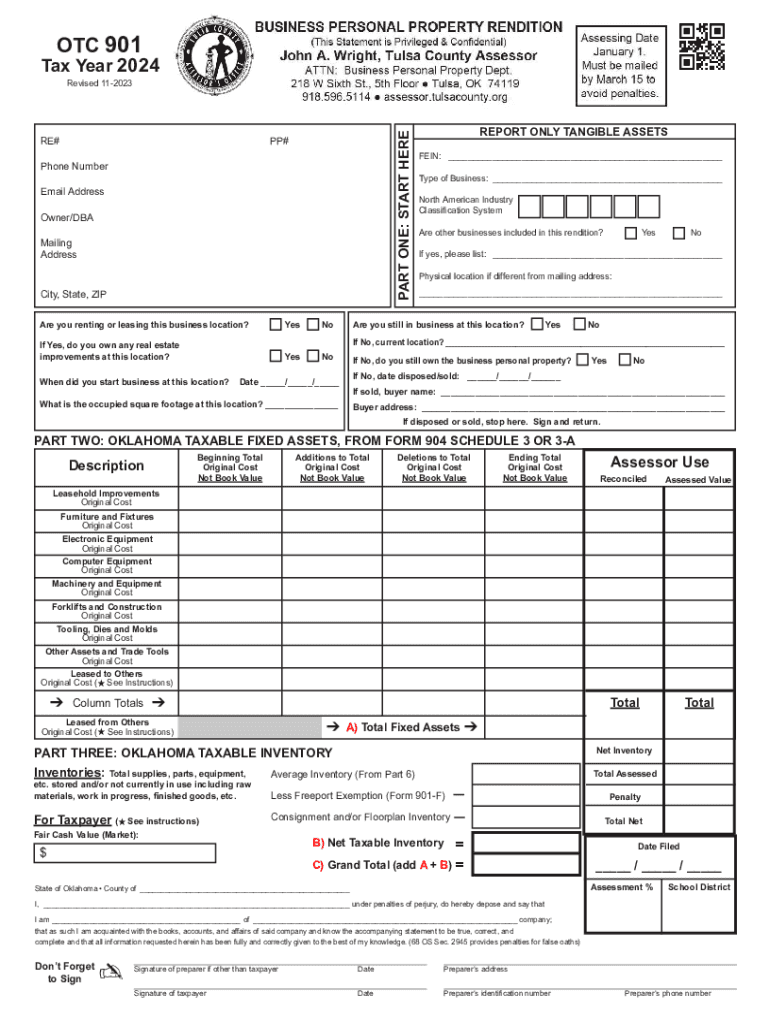

The Tulsa County Form 901, also known as the Business Personal Property Rendition, is a document used by businesses to report personal property for tax purposes. This form is essential for accurately assessing the value of business assets, which can include equipment, furniture, and inventory. By submitting this form, businesses provide the local tax authority with necessary information to calculate property taxes owed, ensuring compliance with local tax regulations.

How to use the Form 901 Business Personal Property Rendition

Using the Tulsa County Form 901 involves several steps. First, gather all relevant information about your business assets, including their purchase dates, values, and descriptions. Next, fill out the form with accurate details, ensuring that all required fields are completed. Once the form is filled out, review it for accuracy before submitting it to the appropriate local tax authority. This process helps ensure that your business is assessed fairly and that you meet all legal obligations.

Steps to complete the Form 901 Business Personal Property Rendition

Completing the Tulsa County Form 901 involves a systematic approach:

- Collect information on all business personal property, including acquisition dates and costs.

- Fill in the form with the collected data, ensuring accuracy in all entries.

- Double-check the form for any errors or omissions.

- Submit the completed form to the local tax authority by the specified deadline.

Key elements of the Form 901 Business Personal Property Rendition

The Tulsa County Form 901 includes several key elements that are crucial for proper completion. These elements typically encompass:

- Business name and address

- Description of personal property

- Purchase dates and values of the assets

- Signature of the business owner or authorized representative

Each element must be filled out accurately to avoid potential penalties or issues with tax assessments.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Tulsa County Form 901. Typically, the form must be submitted by a specific date each year, often aligned with the local tax calendar. Missing these deadlines can result in penalties or additional fees, so businesses should mark these dates on their calendars and ensure timely submission of the form.

Penalties for Non-Compliance

Failure to submit the Tulsa County Form 901 or inaccuracies in the information provided can lead to significant penalties. These may include fines or increased property tax assessments. It is essential for businesses to comply with all requirements and deadlines to avoid these consequences and ensure fair treatment in the tax assessment process.

Quick guide on how to complete form 901 business personal property rendition

Complete Form 901 Business Personal Property Rendition effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 901 Business Personal Property Rendition on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 901 Business Personal Property Rendition with ease

- Locate Form 901 Business Personal Property Rendition and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize essential sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about misplaced or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Form 901 Business Personal Property Rendition to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 901 business personal property rendition

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tulsa County Form 901?

The Tulsa County Form 901 is a specific document required for various legal and administrative processes in Tulsa County. It is essential for ensuring compliance with local regulations and can be easily completed and submitted using airSlate SignNow.

-

How can airSlate SignNow help with the Tulsa County Form 901?

airSlate SignNow provides a user-friendly platform to fill out, sign, and send the Tulsa County Form 901 electronically. This streamlines the process, reduces paperwork, and ensures that your documents are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the Tulsa County Form 901?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value for the features offered, including the ability to manage the Tulsa County Form 901 efficiently.

-

What features does airSlate SignNow offer for managing the Tulsa County Form 901?

airSlate SignNow includes features such as customizable templates, electronic signatures, and document tracking, which are all beneficial for managing the Tulsa County Form 901. These features enhance productivity and ensure that your documents are processed quickly.

-

Can I integrate airSlate SignNow with other applications for the Tulsa County Form 901?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Tulsa County Form 901. This means you can connect with tools you already use, enhancing efficiency.

-

What are the benefits of using airSlate SignNow for the Tulsa County Form 901?

Using airSlate SignNow for the Tulsa County Form 901 provides numerous benefits, including time savings, reduced errors, and enhanced security. The platform simplifies the signing process, making it easier for all parties involved.

-

Is airSlate SignNow secure for submitting the Tulsa County Form 901?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Tulsa County Form 901 is submitted safely. The platform uses advanced encryption and security protocols to protect your sensitive information.

Get more for Form 901 Business Personal Property Rendition

Find out other Form 901 Business Personal Property Rendition

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple