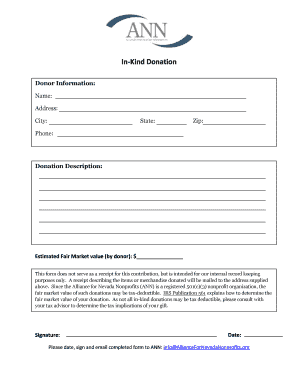

In Kind Donation Alliance for Nevada Nonprofits Form

What is the In Kind Donation Alliance For Nevada Nonprofits

The In Kind Donation Alliance For Nevada Nonprofits is a framework designed to facilitate the process of donating goods and services to nonprofit organizations throughout Nevada. This initiative aims to streamline the donation process, ensuring that nonprofits can easily receive and utilize in-kind contributions for their operations and programs. In-kind donations can include a variety of items such as food, clothing, equipment, or professional services, which are essential for nonprofits to fulfill their missions effectively.

How to use the In Kind Donation Alliance For Nevada Nonprofits

Utilizing the In Kind Donation Alliance involves a straightforward process. Donors can begin by identifying the nonprofit organizations they wish to support. Once a nonprofit is selected, donors should reach out to the organization to discuss their intended in-kind donation. This communication ensures that the nonprofit can effectively use the contribution. After confirming the details, donors may need to complete specific documentation to formalize the donation, which can often be done electronically for convenience.

Steps to complete the In Kind Donation Alliance For Nevada Nonprofits

Completing an in-kind donation through the Alliance involves several key steps:

- Identify the nonprofit organization you wish to support.

- Contact the nonprofit to discuss potential in-kind contributions.

- Gather necessary information regarding the donation, including its value and the type of goods or services being offered.

- Complete any required documentation, which may include a donation receipt or acknowledgment form.

- Deliver the in-kind donation to the nonprofit, either in person or by coordinating a pickup.

Legal use of the In Kind Donation Alliance For Nevada Nonprofits

In-kind donations are subject to specific legal guidelines to ensure compliance with federal and state laws. Donors should be aware of the IRS regulations regarding the valuation of in-kind contributions, as accurate documentation is essential for tax purposes. Nonprofits receiving these donations must also adhere to legal requirements, including maintaining records of all in-kind contributions for their financial reporting and accountability.

IRS Guidelines

The IRS provides clear guidelines on how to report in-kind donations for tax purposes. Donors can typically deduct the fair market value of the donated items or services on their tax returns, provided they meet certain criteria. It is crucial for donors to maintain proper documentation, such as receipts or acknowledgment letters from the nonprofits, to substantiate their claims. Understanding these guidelines helps ensure that both donors and nonprofits comply with tax regulations.

Eligibility Criteria

Eligibility to participate in the In Kind Donation Alliance For Nevada Nonprofits generally includes any individual or business wishing to contribute goods or services to recognized nonprofit organizations. Donors should ensure that the nonprofit is registered and in good standing with the state of Nevada. Additionally, donors may need to verify that their contributions align with the nonprofit's mission and operational needs.

Quick guide on how to complete in kind donation alliance for nevada nonprofits

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious substitute to conventional printed and signed papers, as you can locate the appropriate template and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without any holdups. Handle [SKS] on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to In Kind Donation Alliance For Nevada Nonprofits

Create this form in 5 minutes!

How to create an eSignature for the in kind donation alliance for nevada nonprofits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS rule for donations over $500?

You must file one or more Forms 8283 if the amount of your deduction for each noncash contribution is more than $500. You must also file Form 8283 if you have a group of similar items for which a total deduction of over $500 is claimed. See Similar Items of Property, later.

-

What is an example of an in-kind donation?

This can range from donations of food and clothing to event space, legal services, and property and art. Unlike cash, not all in-kind donations are accepted by all nonprofits.

-

What are the IRS rules for in-kind donations?

In-kind donations of property are typically tax deductible, but the IRS will not allow taxpayers to deduct contributions of $250 or more unless they obtain a written acknowledgment from the recipient charitable organization.

-

What are the IRS rules for goodwill donations?

How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of the item when new and its age must be considered. The IRS requires an item to be in good condition or better to take a deduction.

-

What is required on a receipt for in-kind donation?

In-kind donation receipt. The donor, not the nonprofit, must determine the monetary value of goods donated. In-kind donation receipts should include the donor's name, the description of the gift, and the date the gift was received.

-

What is an in-kind donation receipt for nonprofit?

In-kind donation receipt. The donor, not the nonprofit, must determine the monetary value of goods donated. In-kind donation receipts should include the donor's name, the description of the gift, and the date the gift was received.

-

How do nonprofits account for in-kind donations?

The accepted way to record in-kind donations is to set up a separate revenue account but the expense side of the transaction should be recorded in its functional expense account. For example, revenue would be recorded as Gifts In-Kind – Services, and the expense would be recorded as Professional Services.

-

What qualifies as an in-kind donation?

An in-kind contribution is a non-monetary contribution. Goods or services offered free or at less than the usual charge result in an in-kind contribution.

Get more for In Kind Donation Alliance For Nevada Nonprofits

- Registration renewal notice tennessee form

- Renewal application tn gov tennessee form

- Copy request form tn gov tennessee

- Jammin39 runnin39 volunteer interest form tennessee

- Charitable organization and solicitor complaint form tennessee

- Deadline october 1 tn gov tennessee form

- Your present registration which authorizes you to conduct tn gov tennessee form

- Futuro tax irs gov form

Find out other In Kind Donation Alliance For Nevada Nonprofits

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure