470 4698 2018

What is the

The form is a crucial document used primarily for tax purposes in the United States. It is designed to assist taxpayers in reporting specific financial information to the Internal Revenue Service (IRS). This form helps ensure compliance with federal tax regulations and provides a structured way to disclose income, deductions, and other relevant financial data. Understanding the purpose and requirements of the is essential for accurate tax reporting and avoiding potential penalties.

How to use the

Using the form involves several key steps to ensure that all information is accurately reported. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect your financial situation. Once completed, review the form for any errors or omissions before submitting it to the IRS. Proper use of the can help streamline the tax filing process and maintain compliance with tax laws.

Steps to complete the

Completing the form requires a methodical approach. Follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and any other relevant financial records.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring that all sources of income are included.

- Detail any deductions or credits you are eligible for, providing necessary documentation to support your claims.

- Review the completed form for accuracy, checking all calculations and ensuring that no sections are left blank.

- Submit the form to the IRS by the specified deadline, either electronically or via mail.

Legal use of the

The form must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to guidelines regarding the accuracy of reported information and the timely submission of the form. Failure to comply with these regulations can result in penalties, including fines or additional scrutiny from the IRS. It is essential for taxpayers to understand their legal obligations when using the to avoid any potential legal issues.

Required Documents

To complete the form accurately, certain documents are required. These include:

- W-2 forms from employers to report wages and salaries.

- 1099 forms for reporting income from freelance work or other sources.

- Receipts and documentation for any deductions claimed, such as medical expenses or business-related costs.

- Previous tax returns, which can provide a reference for income and deductions.

Filing Deadlines / Important Dates

Filing the form must be done by specific deadlines to avoid penalties. Typically, individual tax returns are due on April fifteenth of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to keep track of these dates and plan accordingly to ensure timely submission of the form.

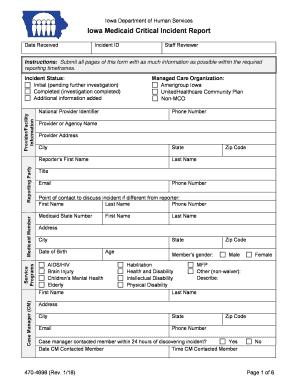

Quick guide on how to complete incident id

Experience the simpler method to manage your 470 4698

The traditional approaches to filling out and approving documentation consume an excessively long duration in comparison to contemporary document management systems. Previously, you would hunt for suitable social forms, print them, manually input all the details, and mail them. With airSlate SignNow, you can obtain, fill out, and sign your 470 4698 all in one browser tab. Compiling your 470 4698 is now easier than ever.

Steps to finalize your 470 4698 with airSlate SignNow

- Access the category page you require and find your state-specific 470 4698. Alternatively, utilize the search bar.

- Ensure the version of the form is accurate by previewing it.

- Click Get form to enter editing mode.

- Fill in your document with the required information using the editing features.

- Examine the information added and click the Sign tool to validate your form.

- Select the most convenient method to create your signature: generate it, draw your name, or upload a photo of it.

- Click DONE to save your changes.

- Download the document to your device or proceed to Sharing settings to send it electronically.

Robust online tools like airSlate SignNow streamline the process of completing and submitting your forms. Give it a try to discover how long document management and approval procedures should actually take. You will save a signNow amount of time.

Create this form in 5 minutes or less

Find and fill out the correct incident id

FAQs

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

How can I get over someone I still love and he cheated on me despite giving him several chances?

First of all a big hug. You tried your best and just for that you are the best.But then if all happy things were to be with us forever, then where would we learn the value of empathy, dignity and pain.Girl, you gave everything you had to the relationship and he it seems frittered it way. You tried to anchor him but he is still like a rudderless boat wanting to prove himself in the harsh world.Remember we live in a world that seems to be perfect, but the fact is that we all are imperfectly perfect. We have to accept our shortcomings to be happy in life. The clip below beautifully explains “Our problems are not too big. But we are too small because we can’t handle them.” We often think we can not handle our problem so we give up quickly, but for me, “Giving up is not an option. Failure is an option, you fail and you get back up.”When she says “I liberated myself by setting him free”…it sets the tone of how you need to be kind yourself.Girl set your self free…..and live your lifeWhile the therapist in me sees One pattern in what you write is that : is he seeking validation that he is still ‘desirable’ [for the want of a better word] and if that is the reason context things may change. But he has to seek answers you cant anchor him for life.BUT DONT HANG on to this thread…because if it is…let the circle be completed by him.Till then open that unopened door of options.take care and remember the human values I see in your responses will soon make you the happiest person soon.Best of Luck!!

-

How can I fill out the SSC CHSL application form twice from the same registration ID?

You cannot fill the application form again with same registration id . if something is going wrong in that application form then you fill another application form with new registration id. but you cannot give the ssc exam with both application form. you only once give the exam at one registration id. if you take the exam two types then SSC CANELLED your candidature. and also you debarred from SSC examination further for 3 years.

-

How can I create an auto-fill JavaScript file to fill out a Google form which has dynamic IDs that change every session?

Is it possible to assign IDs on the radio buttons as soon as the page loads ?

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

What incident made you cry in public?

Okay.. here i'm sharing my story..I still has those four hours of my journey before my eyes.I was traveling from Gorakhapur(home) to Agartala(college). My mother tried her well in cancelling my journey as she doesn't wanted me to leave on Saturday (She believes Saturday is not a good day for my family to start some work or to go other places due to some past happened incidents on this day)………. I don't believe such things so i started my journey in Amarnath express (my name too is amarnath).Sleeper ticket was not confirmed so i was compelled to go in general coach. You know it will take more than 26 hours to travel from Gorakhapur to Guwahati by train..somehow i was to manage everything…”Anand” my friend was also with me.Got seat to sit,i was relaxed and started to count hours and stations.Leaving Uttar Pradesh,travelling some parts of Bihar in 10 hours…it was 8 AM around ,someone just displaced my hand bag rudely to have some space.Now stop for sometime ..i wanna tell you what exactly was there in that bag.My whole life was there in form of documents.Yup , starting from Birth certificate and ending to btech admission letter……Highschool marksheet,Intermediate marksheet,other certificate of intermediate,ATM card,DD of fee submission,every id cards,some Education loan papers,income certificate,passbooks and much more thing i can't mention all…Whatever i has everything was inside that..Now come to journey again, when someone displaced my bag rudely i stopped him to do the same as actually there was my laptop also into that bag, So i said ..Go gently man….there is lappy inside it.You know,thieves have the best ear and eyes, and with such ear and eyes a person was there nearby my seat.Scroll Down..it's interesting story.Crowd starts to occupy space ,One Gentleman said me hey bro.. no need to be bother i have a shawl tied both sided there i will let you keep your bag there for safety of your lappy.I was happy to find that gentleman…Anand was silently watching everything and was thinking how to raise pointer in upcoming semester…Gentleman said to me ..i will get out of train next station muzaffarpur ,plz don't let anyone else sit here…i agreed.We arrived new station …although i was totally paying attention to my bag and gentlemen's seat but a 1 minute removal of my eye contact to bag..let someone exchanged my bag with his bag.I was still thinking that there's a bag that belongs to me..and exactly i was unable to know that i am seeing different bag.Train again starts and has speed..I was bother about why Gentleman didn't come yet.Immediately My mind said….fuck the gentleman .check your bag…ohh God Gentleman flew away with my bag….Although train was running but not left platform i jumped out of train.. Anand also stopped thinking about semester pointer.Now i was on platform..and my boot was on rail track.People outside and inside the train were staring at me.police scolded me but my eyes were searching for Gentleman (the thieve)..i roam here and there ..have my eyes every corner but i didn't find him..he vanished.So i ,alone on platform who couldn't move either of side.. started crying there in public. I decided to go home after 4 hours..took ticket and moved in train for home..Here the twist comes…My phone rang..one of my school friend did call me and asked..hey have u lost something bro?..i said.there is nothing which i didn't lost ..as i already told the incident to one of my friend i thought he spread the matter to others also..so i said him ..now i am coming to home.He said ..luggage mil gaya(luggage is found)..i was astonished how thieve can signNow in up again covering 12 hours distance in just 4 hours.Ok …the matter happened like that..thieve after befooling me went directly to shop for selling it..when he was asked for document ..he didn't give anything the shopkeeper had doubt and snatched my document file..he understood the whole matter and threatened him to go away.He checks everything but didn't find any contacts of mine in my file…but luckily… my brother left his diary in my file mistakenly that was having one only one contact number(saikat bhaiya) (so he contacted that number..and told the whole matter..again saikat bhaiya contacted my one classmate who called me and gave shopkeeper contact number)I again jumped out from running train ,this time i was able to manage my boot and moved to shopkeeper's address .Didn't meet thieve but got everything..Thanks God….

Create this form in 5 minutes!

How to create an eSignature for the incident id

How to make an electronic signature for the Incident Id in the online mode

How to create an electronic signature for your Incident Id in Google Chrome

How to make an eSignature for signing the Incident Id in Gmail

How to generate an eSignature for the Incident Id from your smartphone

How to generate an eSignature for the Incident Id on iOS devices

How to generate an electronic signature for the Incident Id on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 470 4698?

airSlate SignNow is a powerful eSignature solution that simplifies the process of sending and signing documents. The reference '470 4698' is often associated with our customer support or billing inquiries, ensuring you have direct access to assistance when using our services.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the plan you choose, with options designed to fit different business needs. For detailed pricing information, including any references to '470 4698' for support inquiries, please visit our pricing page.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a comprehensive suite of features, including document templates, real-time tracking, and secure eSigning. With these tools, you can easily manage and streamline your document workflow, making the most of your investment, especially if you're using the '470 4698' code for special promotions.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with numerous applications, enhancing your existing workflows. By incorporating platforms you already use, you can optimize your document management processes, making it easier to leverage the '470 4698' capabilities.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow allows businesses to save time and reduce costs associated with document management. The user-friendly interface and robust features make it an ideal choice for organizations looking to enhance efficiency, which is particularly relevant for users referencing '470 4698' for support.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with major regulations. You can trust that your documents are safe, allowing you to focus on your business without worrying about security, especially when referencing '470 4698' for security-related queries.

-

How can I get support for airSlate SignNow?

For support with airSlate SignNow, you can contact our customer service team directly or refer to the '470 4698' line for quick assistance. Our dedicated support staff is ready to help with any questions or issues you may encounter.

Get more for 470 4698

- Cvs caremark prolia prior authorization form

- Active reading minerals and mineral resources answer key form

- Form 20bb

- Aw3 2a new form notice required for filing application for place on ballot doc ci dumas tx

- Va fax cover sheet 45416947 form

- Usufruct agreement template form

- Utility easement agreement template form

- Utility agreement template 787748433 form

Find out other 470 4698

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself