Student Non Tax Filer Statement University of Virginia Form

What is the Student Non Tax Filer Statement University Of Virginia

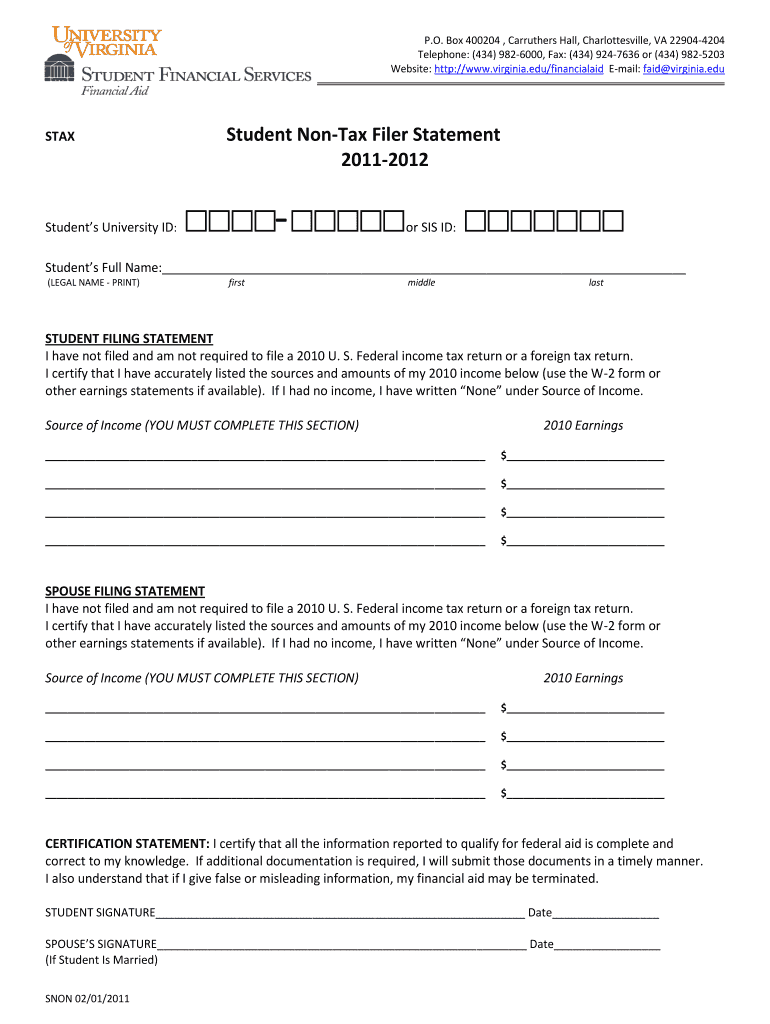

The Student Non Tax Filer Statement is a document used by students at the University of Virginia who do not have a tax return to submit. This form is essential for students who may be applying for financial aid and need to verify their income status. By completing this statement, students can provide the necessary information to demonstrate that they did not earn enough income to file a federal tax return for the relevant year.

How to obtain the Student Non Tax Filer Statement University Of Virginia

Students can obtain the Student Non Tax Filer Statement directly from the University of Virginia's financial aid office or their official website. It is typically available as a downloadable PDF form. Students may also request a copy via email or by visiting the office in person. It is important to ensure that the form is the most current version to avoid any issues during the financial aid application process.

Steps to complete the Student Non Tax Filer Statement University Of Virginia

Completing the Student Non Tax Filer Statement involves several straightforward steps:

- Download the form from the University of Virginia's official website or obtain it from the financial aid office.

- Fill in personal information, including your name, student ID, and contact details.

- Indicate your income status, confirming that you did not earn enough to file a tax return.

- Provide any additional information requested, such as the sources of income, if applicable.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Student Non Tax Filer Statement University Of Virginia

The Student Non Tax Filer Statement is legally recognized as a valid document for verifying income status in various financial aid applications. It is important for students to understand that providing false information on this form can lead to serious consequences, including penalties from the university or federal financial aid programs. Therefore, students should ensure that all information is truthful and accurate when completing the statement.

Required Documents

When filling out the Student Non Tax Filer Statement, students may need to provide additional documentation to support their claims. Commonly required documents include:

- A copy of the student’s Social Security card or other identification.

- Documentation of any income received, such as pay stubs or bank statements, if applicable.

- Any other financial documents that may be requested by the financial aid office.

Eligibility Criteria

To complete the Student Non Tax Filer Statement, students must meet certain eligibility criteria. Generally, this form is intended for students who:

- Are enrolled at the University of Virginia.

- Did not earn enough income to require filing a federal tax return.

- Are applying for financial aid and need to demonstrate their financial status.

Quick guide on how to complete student non tax filer statement university of virginia

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important portions of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Revise and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Student Non Tax Filer Statement University Of Virginia

Create this form in 5 minutes!

How to create an eSignature for the student non tax filer statement university of virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Student Non Tax Filer Statement University Of Virginia?

The Student Non Tax Filer Statement University Of Virginia is a document that students can use to signNow that they did not file a federal tax return for a specific year. This statement is often required for financial aid applications and helps the university assess a student's financial situation accurately.

-

How can airSlate SignNow help with the Student Non Tax Filer Statement University Of Virginia?

airSlate SignNow provides an efficient platform for students to create, send, and eSign their Student Non Tax Filer Statement University Of Virginia. With its user-friendly interface, students can easily manage their documents and ensure they meet submission deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for the Student Non Tax Filer Statement University Of Virginia?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Students can choose a plan that fits their budget while benefiting from a cost-effective solution for managing their Student Non Tax Filer Statement University Of Virginia and other important documents.

-

What features does airSlate SignNow offer for the Student Non Tax Filer Statement University Of Virginia?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features streamline the process of preparing and submitting the Student Non Tax Filer Statement University Of Virginia, making it easier for students to stay organized.

-

Can I integrate airSlate SignNow with other tools for the Student Non Tax Filer Statement University Of Virginia?

Absolutely! airSlate SignNow offers integrations with various applications, allowing students to connect their workflow seamlessly. This means you can easily incorporate the Student Non Tax Filer Statement University Of Virginia into your existing systems for enhanced efficiency.

-

What are the benefits of using airSlate SignNow for the Student Non Tax Filer Statement University Of Virginia?

Using airSlate SignNow for the Student Non Tax Filer Statement University Of Virginia provides numerous benefits, including time savings and increased accuracy. The platform ensures that your documents are securely signed and stored, reducing the risk of errors and delays in your financial aid process.

-

How secure is airSlate SignNow when handling the Student Non Tax Filer Statement University Of Virginia?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents. When handling the Student Non Tax Filer Statement University Of Virginia, you can trust that your sensitive information is safe and secure throughout the signing process.

Get more for Student Non Tax Filer Statement University Of Virginia

Find out other Student Non Tax Filer Statement University Of Virginia

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT