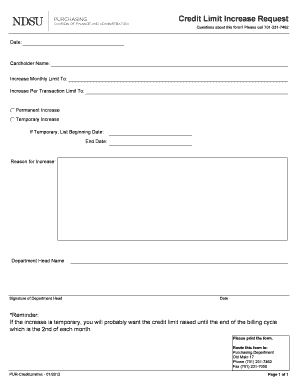

Credit Limit Increase Request Form

What is the Credit Limit Increase Request

The Credit Limit Increase Request is a formal document that individuals or businesses submit to their credit card issuer to request an increase in their available credit limit. This request typically outlines the reasons for the increase, such as improved financial circumstances or increased spending needs. By increasing the credit limit, cardholders can enhance their purchasing power and potentially improve their credit utilization ratio, which may positively impact their credit score.

Steps to complete the Credit Limit Increase Request

Completing a Credit Limit Increase Request involves several straightforward steps:

- Review your current credit situation: Assess your credit score, payment history, and current credit utilization.

- Gather necessary information: Prepare personal and financial details, including income, employment status, and monthly expenses.

- Access the request form: Obtain the Credit Limit Increase Request form from your credit card issuer's website or customer service.

- Fill out the form: Provide accurate information, including your reason for the increase and any supporting documentation.

- Submit the request: Follow the issuer’s instructions for submission, which may include online submission, mailing the form, or visiting a branch.

Eligibility Criteria

To qualify for a Credit Limit Increase Request, applicants typically need to meet specific criteria set by their credit card issuer. Common eligibility factors include:

- Good to excellent credit score, usually above a certain threshold.

- Consistent on-time payments over the past several months.

- A stable income that supports the requested credit limit.

- Low credit utilization ratio, indicating responsible credit management.

Required Documents

When submitting a Credit Limit Increase Request, certain documents may be required to support your application. These documents can include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, like a driver’s license or Social Security number.

- Any additional documentation that may demonstrate financial stability, such as bank statements.

Form Submission Methods

There are various methods for submitting a Credit Limit Increase Request, depending on the credit card issuer's policies. Common submission methods include:

- Online: Many issuers allow you to submit your request through their secure online portal.

- Mail: You can print the completed form and send it via postal mail to the address provided by the issuer.

- In-Person: Some issuers may permit you to visit a local branch to submit your request directly.

Application Process & Approval Time

The application process for a Credit Limit Increase Request can vary by issuer, but it generally follows these steps:

- Submission of the request form with all required documents.

- Review by the credit card issuer, which may involve a soft or hard credit inquiry.

- Notification of the decision, typically within a few days to a couple of weeks.

Approval times can vary based on the issuer's processes and the complexity of the request.

Quick guide on how to complete credit limit increase request

Complete Credit Limit Increase Request with ease on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Credit Limit Increase Request on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Credit Limit Increase Request with no hassle

- Access Credit Limit Increase Request and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Credit Limit Increase Request and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit limit increase request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Credit Limit Increase Request?

A Credit Limit Increase Request is a formal application submitted to a financial institution to request an increase in your credit limit. This process can help improve your credit utilization ratio and potentially boost your credit score. Understanding how to effectively submit a Credit Limit Increase Request can enhance your financial flexibility.

-

How can airSlate SignNow assist with Credit Limit Increase Requests?

airSlate SignNow provides a streamlined platform for creating and sending Credit Limit Increase Requests. With our easy-to-use eSignature features, you can quickly prepare and sign documents, ensuring your requests are processed efficiently. This saves time and enhances the overall experience of managing your credit.

-

Are there any costs associated with using airSlate SignNow for Credit Limit Increase Requests?

airSlate SignNow offers a cost-effective solution for managing your Credit Limit Increase Requests. Our pricing plans are designed to fit various business needs, ensuring you get the best value for your investment. You can choose from different tiers based on your usage and features required.

-

What features does airSlate SignNow offer for managing Credit Limit Increase Requests?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities for Credit Limit Increase Requests. These tools help you create professional documents quickly and track their status in real-time. This ensures a smooth process from request to approval.

-

Can I integrate airSlate SignNow with other applications for Credit Limit Increase Requests?

Yes, airSlate SignNow offers integrations with various applications to enhance your Credit Limit Increase Request process. You can connect with CRM systems, cloud storage services, and other productivity tools to streamline your workflow. This integration capability allows for a more cohesive management experience.

-

What are the benefits of using airSlate SignNow for Credit Limit Increase Requests?

Using airSlate SignNow for your Credit Limit Increase Requests provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are securely stored and easily accessible. Additionally, the eSigning feature speeds up the approval process, allowing you to focus on other important tasks.

-

How secure is the information shared in a Credit Limit Increase Request using airSlate SignNow?

Security is a top priority at airSlate SignNow. All information shared in a Credit Limit Increase Request is encrypted and stored securely. We comply with industry standards to protect your data, ensuring that your sensitive information remains confidential throughout the process.

Get more for Credit Limit Increase Request

- Demand to produce copy of will from heir to executor or person in possession of will nevada form

- New york form 497321067

- Bill of sale of automobile and odometer statement new york form

- Bill of sale for automobile or vehicle including odometer statement and promissory note new york form

- Promissory note in connection with sale of vehicle or automobile new york form

- Bill of sale for watercraft or boat new york form

- Bill of sale of automobile and odometer statement for as is sale new york form

- Construction contract cost plus or fixed fee new york form

Find out other Credit Limit Increase Request

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document