Form 3540 Credit Carryover and Recapture Summary a UMI Dissertation

What is the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation

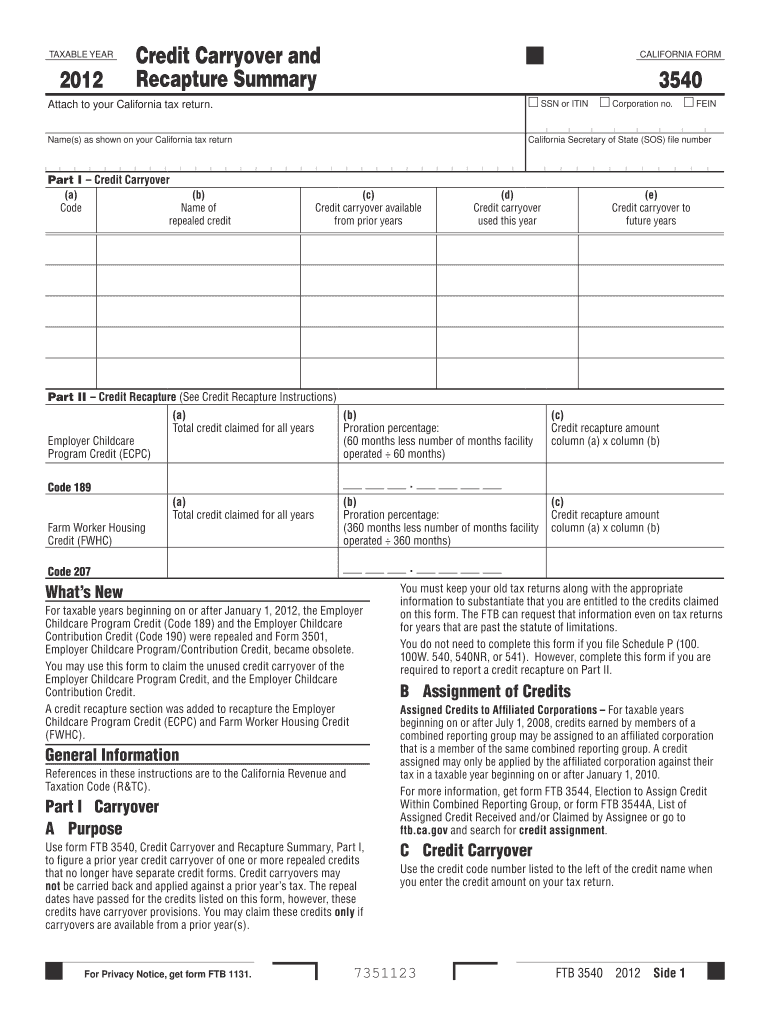

The Form 3540 Credit Carryover and Recapture Summary is a crucial document used in the context of UMI (University of Michigan Institute) dissertations. This form is designed to summarize the credit carryover and recapture details related to educational expenses. It provides a structured way for students to report any credits they may have earned and how they can be applied to future educational costs or recaptured if not used. Understanding this form is essential for students seeking to maximize their educational financial resources.

How to use the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation

Using the Form 3540 involves several steps to ensure accurate reporting of credits. First, gather all relevant documentation regarding your educational expenses and any credits received. Next, fill out the form by entering the required information, such as your student identification number and details of the credits. It's important to follow the guidelines provided by the university to ensure compliance. Once completed, the form should be submitted according to the university's specified submission methods.

Steps to complete the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation

Completing the Form 3540 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including receipts and previous credit summaries.

- Fill in your personal information at the top of the form, including your name and student ID.

- Detail the credits you have earned and any applicable carryover amounts.

- Review the form for accuracy, ensuring all figures are correctly calculated.

- Submit the completed form by the designated deadline, following the university's submission guidelines.

Key elements of the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation

The key elements of the Form 3540 include sections for personal information, a detailed account of credits earned, and any recapture amounts. Each section is designed to capture specific data that will help in assessing the educational credits available for future use. Additionally, the form may require signatures or endorsements from academic advisors to validate the information provided.

Eligibility Criteria

Eligibility for using the Form 3540 typically includes being a registered student at the University of Michigan and having incurred eligible educational expenses. Students must also have earned credits that can be carried over or recaptured. It is important for students to verify their eligibility status before completing the form to avoid complications during submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3540 are set by the University of Michigan and can vary by academic term. Students should be aware of these dates to ensure timely submission. Missing a deadline may result in the inability to carry over credits or recapture funds. It is advisable to check the university’s academic calendar for specific dates related to the submission of this form.

Quick guide on how to complete form 3540 credit carryover and recapture summary a umi dissertation

Manage [SKS] effortlessly on any device

Digital document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to generate, modify, and electronically sign your files quickly and without interruption. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget about misplaced or lost documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation

Create this form in 5 minutes!

How to create an eSignature for the form 3540 credit carryover and recapture summary a umi dissertation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation?

The Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation is a document used to summarize the carryover and recapture of tax credits. It is essential for businesses to accurately report their tax credits and ensure compliance with IRS regulations. Understanding this form can help businesses maximize their tax benefits.

-

How can airSlate SignNow help with the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation. Our user-friendly interface simplifies the document management process, ensuring that your forms are completed accurately and promptly. This can save time and reduce errors in your tax reporting.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to provide cost-effective solutions for managing documents, including the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation. You can choose a plan that fits your budget and needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features such as customizable templates, secure eSigning, and real-time tracking. These features streamline the process of handling documents like the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation. With our platform, you can enhance collaboration and ensure that all stakeholders are on the same page.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, including the ESIGN Act and UETA. This compliance ensures that documents like the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation are legally binding and secure. You can trust our platform to handle your sensitive documents with the utmost care.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow offers seamless integrations with various software tools, enhancing your workflow. Whether you need to connect with CRM systems, accounting software, or other applications, our platform can easily integrate to help you manage documents like the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation more efficiently.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation, offers numerous benefits. You can improve accuracy, reduce processing time, and enhance security. Our platform ensures that your documents are handled efficiently, allowing you to focus on your core business activities.

Get more for Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation

- Dap referral form

- Hsb claims serviceuk ampamp ireland form

- Alberta residential tenancy agreement form

- Top ten garda vetting errors early childhood ireland form

- Paysauce employee information form pdf

- Guidelines for completing parentguardian consent for form

- Oxted resources ltd form

- Plumbing permit pdf nbc form no a 06 republic of

Find out other Form 3540 Credit Carryover And Recapture Summary A UMI Dissertation

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now