Form 5498 SA HSA, Archer MSA, or Medicare Advantage MSA Information 2023-2026

Understanding the IRS Form 433

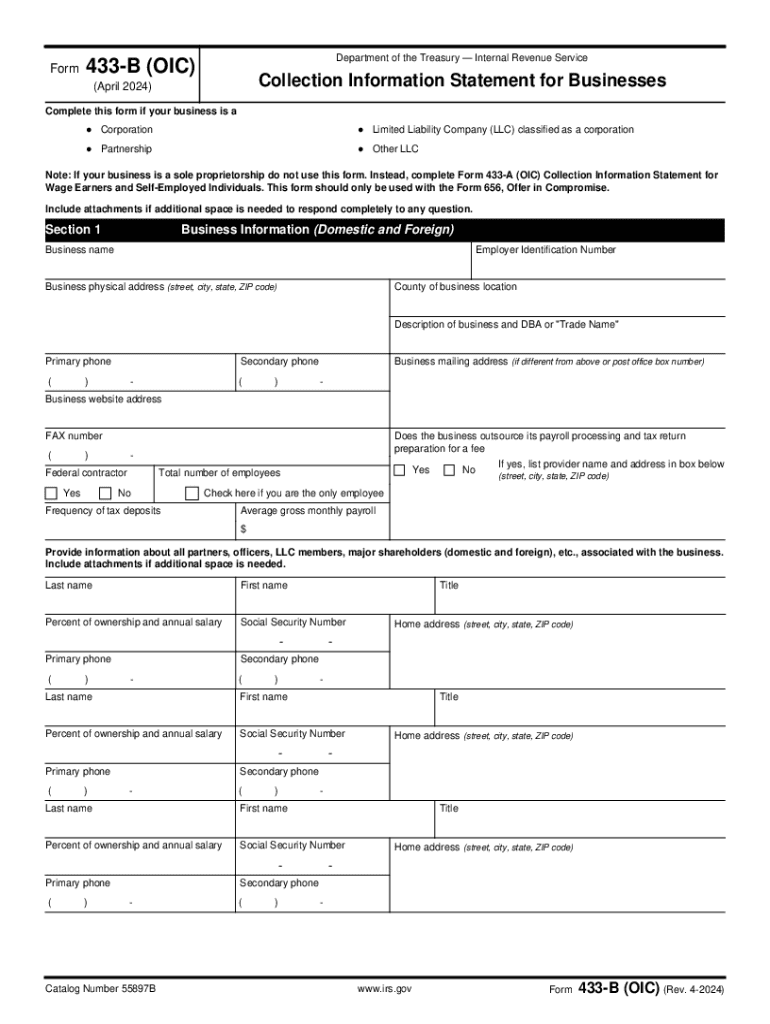

The IRS Form 433 is a crucial document used by individuals and businesses to provide financial information to the Internal Revenue Service (IRS). This form is particularly important for those who are undergoing a financial review or seeking to negotiate payment options with the IRS. The form comes in various versions, including Form 433-A for individuals and Form 433-B for businesses, each tailored to capture relevant financial data.

Steps to Complete the IRS Form 433

Completing the IRS Form 433 requires careful attention to detail. Here are the essential steps:

- Gather financial documents, including bank statements, pay stubs, and tax returns.

- Fill out personal information, including name, address, and Social Security number.

- Detail your income sources, including wages, self-employment income, and other earnings.

- List all monthly expenses, such as housing, utilities, and transportation costs.

- Provide information about assets, including real estate, vehicles, and savings accounts.

- Review the form for accuracy before submission.

Key Elements of the IRS Form 433

Understanding the key elements of the IRS Form 433 is essential for accurate completion. The form typically includes:

- Personal Information: Basic details such as name, address, and Social Security number.

- Income Information: A comprehensive list of all sources of income.

- Expense Breakdown: Monthly expenses categorized by type.

- Asset Listing: Detailed information about owned assets.

Filing Deadlines for the IRS Form 433

It's important to be aware of the filing deadlines associated with the IRS Form 433. Generally, the form should be submitted promptly if requested by the IRS, particularly during an audit or when negotiating payment plans. Missing deadlines can lead to complications in resolving tax liabilities.

Who Issues the IRS Form 433

The IRS Form 433 is issued by the Internal Revenue Service, which is the federal agency responsible for tax collection and enforcement in the United States. Individuals and businesses may be required to submit this form when they are unable to pay their tax liabilities in full.

Legal Use of the IRS Form 433

The IRS Form 433 serves a legal purpose in tax negotiations. It provides the IRS with a clear picture of an individual's or business's financial situation, which is essential for determining eligibility for payment plans or offers in compromise. Accurate and honest reporting on this form is critical, as discrepancies can lead to legal repercussions.

Quick guide on how to complete form 5498 sa hsa archer msa or medicare advantage msa information

Prepare Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information with ease on any device

Online document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information effortlessly

- Acquire Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate producing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from the device of your choice. Modify and eSign Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5498 sa hsa archer msa or medicare advantage msa information

Create this form in 5 minutes!

How to create an eSignature for the form 5498 sa hsa archer msa or medicare advantage msa information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable 433 form?

A fillable 433 form is a document that allows users to input information directly into designated fields. With airSlate SignNow, you can easily create and manage fillable 433 forms, streamlining the process of collecting necessary data for various applications.

-

How can I create a fillable 433 form using airSlate SignNow?

Creating a fillable 433 form with airSlate SignNow is simple. You can start by uploading your existing document, then use our intuitive editor to add fillable fields. This allows you to customize the form to meet your specific needs.

-

What are the pricing options for using fillable 433 forms?

airSlate SignNow offers competitive pricing plans that include access to fillable 433 forms. You can choose from various subscription tiers based on your business needs, ensuring you get the best value for your investment in document management.

-

What features come with fillable 433 forms in airSlate SignNow?

With airSlate SignNow, fillable 433 forms come equipped with features such as electronic signatures, real-time collaboration, and automated workflows. These features enhance efficiency and ensure that your documents are processed quickly and securely.

-

Can I integrate fillable 433 forms with other applications?

Yes, airSlate SignNow allows seamless integration of fillable 433 forms with various applications like Google Drive, Salesforce, and more. This integration helps streamline your workflow and enhances productivity by connecting your tools.

-

What are the benefits of using fillable 433 forms?

Using fillable 433 forms can signNowly reduce paperwork and improve data accuracy. With airSlate SignNow, you can automate the collection of information, minimize errors, and ensure that your documents are always compliant and up-to-date.

-

Is it easy to share fillable 433 forms with clients?

Absolutely! airSlate SignNow makes it easy to share fillable 433 forms with clients via email or direct links. This ensures that your clients can access and complete the forms quickly, enhancing their experience and speeding up your processes.

Get more for Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information

- Business credit application maine form

- Individual credit application maine form

- Interrogatories to plaintiff for motor vehicle occurrence maine form

- Interrogatories to defendant for motor vehicle accident maine form

- Llc notices resolutions and other operations forms package maine

- Notice of dishonored check civil keywords bad check bounced check maine form

- Mutual wills containing last will and testaments for unmarried persons living together with no children maine form

- Mutual wills package of last wills and testaments for unmarried persons living together not married with adult children maine form

Find out other Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy