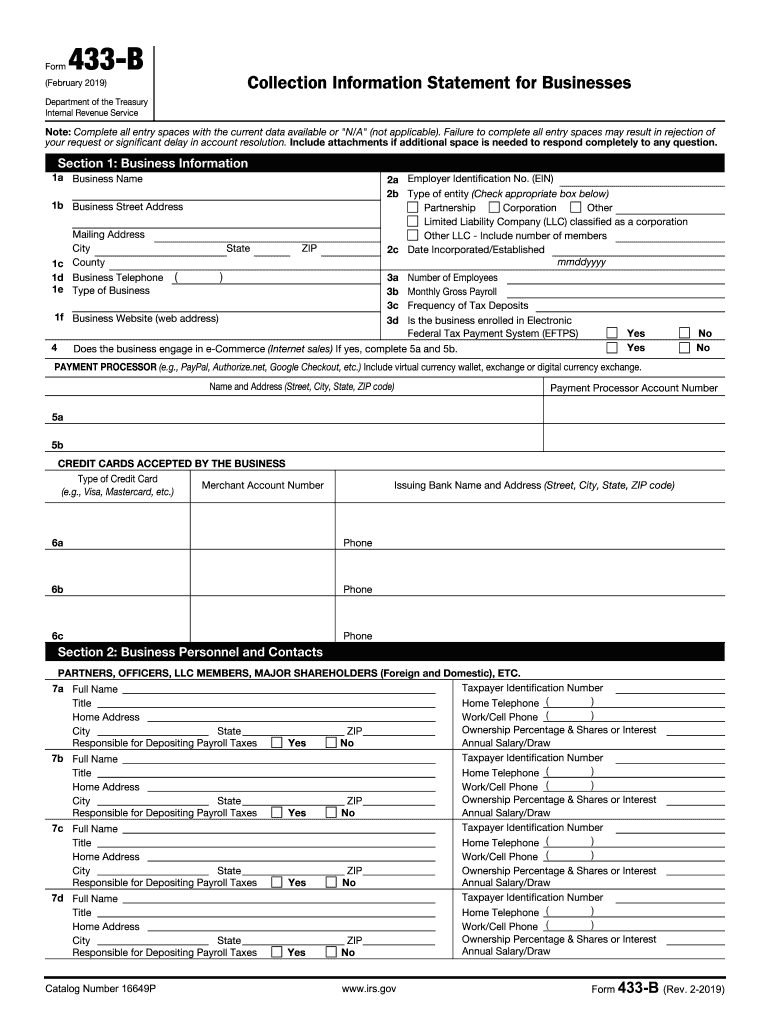

433b 2019

What is the IRS Form 433-A?

The IRS Form 433-A is a financial disclosure form used by individuals to provide the Internal Revenue Service with detailed information about their financial situation. This form is typically required during the process of negotiating a payment plan or settling tax debts. It includes sections for personal information, income, expenses, assets, and liabilities, allowing the IRS to assess a taxpayer's ability to pay their tax obligations.

Steps to Complete the IRS Form 433-A

Completing the IRS Form 433-A involves several key steps to ensure accuracy and compliance:

- Gather Financial Documents: Collect necessary documents such as pay stubs, bank statements, and records of expenses.

- Fill Out Personal Information: Provide your name, Social Security number, and contact details at the top of the form.

- Detail Income Sources: List all sources of income, including wages, self-employment income, and any other earnings.

- Outline Monthly Expenses: Document all monthly living expenses, including housing, utilities, food, and transportation.

- List Assets and Liabilities: Include information about your assets, such as property and savings, as well as any debts owed.

- Review for Accuracy: Double-check all entries for completeness and correctness before submission.

Where to Mail IRS Form 433-A

Mailing the IRS Form 433-A requires attention to detail regarding the correct address. The submission address may vary based on your location and the specific circumstances of your tax situation. Generally, the form should be sent to the address provided in the IRS notice or letter that prompted the submission of the form. If no address is specified, you can send it to the appropriate IRS service center for your state, which can be found on the IRS website or by contacting the IRS directly.

IRS Guidelines for Form 433-A Submission

The IRS has established specific guidelines for submitting Form 433-A to ensure compliance and proper processing:

- Timeliness: Submit the form promptly to avoid penalties or delays in your tax resolution process.

- Complete Information: Ensure all sections of the form are filled out completely to prevent processing issues.

- Sign and Date: Don’t forget to sign and date the form before mailing it to validate your submission.

- Keep Copies: Retain copies of the completed form and any supporting documents for your records.

Required Documents for Form 433-A

When submitting IRS Form 433-A, certain documents are necessary to support the information provided. These may include:

- Recent pay stubs or proof of income.

- Bank statements for the past few months.

- Documentation of monthly expenses, such as bills and receipts.

- Tax returns for the previous year.

- Any other relevant financial documents that provide insight into your financial situation.

Legal Use of IRS Form 433-A

The IRS Form 433-A is legally recognized as a binding document when completed accurately and submitted according to IRS guidelines. It serves as an official declaration of your financial status and can be used in negotiations with the IRS regarding payment plans, offers in compromise, or other tax relief options. It is essential to provide truthful and complete information, as any discrepancies may lead to legal consequences or denial of your request.

Quick guide on how to complete 433b

Prepare 433b effortlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 433b on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign 433b without difficulty

- Find 433b and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Modify and eSign 433b to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 433b

Create this form in 5 minutes!

How to create an eSignature for the 433b

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is IRS Form 433-A and why might I need it?

IRS Form 433-A is used to provide the IRS with information about your financial status when applying for a payment plan or an offer in compromise. Knowing where to mail IRS Form 433-A is crucial for ensuring it signNowes the right department for processing. This form helps the IRS assess your ability to pay and can signNowly impact your tax situation.

-

Where should I mail IRS Form 433-A?

Where to mail IRS Form 433-A depends on your location and the specifics of your case. Generally, you should send it to the address specified in the form instructions, reflecting your current status with the IRS. Ensure you verify the mailing address to avoid delays in processing.

-

What features does airSlate SignNow offer for IRS forms?

airSlate SignNow offers an easy-to-use platform for preparing, signing, and sending IRS forms electronically. Features like customizable templates and secure e-signatures streamline the process, making it simple to manage documents, including knowing where to mail IRS Form 433-A efficiently.

-

How does airSlate SignNow ensure the security of my documents?

With airSlate SignNow, your documents are protected with industry-standard encryption, ensuring confidentiality and integrity. When you are ready to send IRS Form 433-A, you can feel secure knowing that all information is transmitted safely and that you will receive confirmation of completion.

-

Are there any costs associated with using airSlate SignNow?

Yes, airSlate SignNow offers a range of pricing plans suited for different business needs. Take advantage of any free trials to explore features, including eSigning and document tracking, which can help you manage where to mail IRS Form 433-A efficiently and cost-effectively.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow easily integrates with various software solutions including Google Drive, Salesforce, and more. This flexibility enhances your workflow, allowing you to efficiently manage where to mail IRS Form 433-A alongside other essential documents.

-

How can airSlate SignNow help in tracking my IRS submissions?

With airSlate SignNow, you can track the status of your submissions, including your IRS Form 433-A, ensuring you never lose sight of important documents. The platform provides real-time updates and notifications, making it easy to know if and when your form has been received by the IRS.

Get more for 433b

- Virginia warranty deed formget a warranty deed online deedclaim

- Quit claim deed to llc what you need to know upcounsel form

- Next read the document and make any changes desired to the text of the form

- Quoteither of themquot or quotany one of themquot to indicate how they must act as form

- Wa 00llc 1 form

- Hereinafter referred to as grantors do hereby remise release quitclaim grant and convey unto form

- Centime nocturne dance club form

- Probate application form pa1 simply law england wales

Find out other 433b

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast