Form 433b 2012

What is the Form 433b

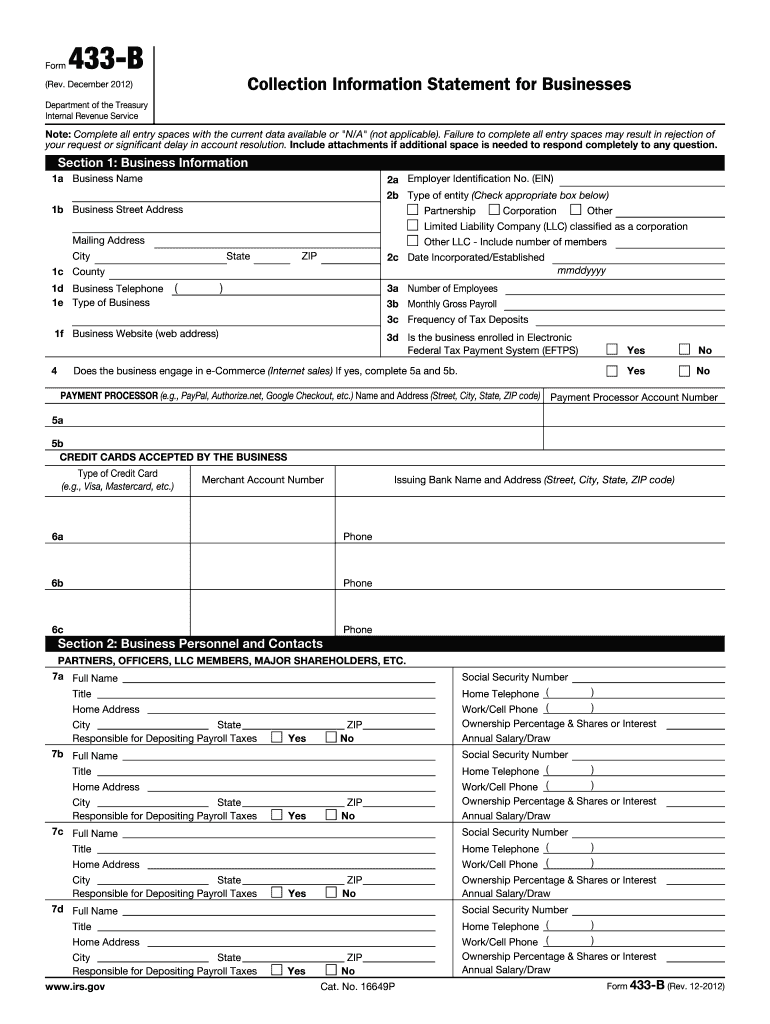

The Form 433b is a financial statement used by the Internal Revenue Service (IRS) to assess an individual's ability to pay tax debts. This form is primarily utilized in situations where taxpayers are seeking to establish a payment plan or settle their tax liabilities. It collects detailed information about the taxpayer's income, expenses, assets, and liabilities, enabling the IRS to evaluate their financial situation accurately.

How to use the Form 433b

To effectively use the Form 433b, taxpayers must gather all necessary financial information before starting the form. This includes details about income sources, monthly expenses, assets such as bank accounts and property, and any outstanding debts. Once the form is completed, it should be submitted to the IRS as part of a request for a payment plan or an offer in compromise. Proper completion is crucial, as inaccuracies can delay processing or lead to rejection of the request.

Steps to complete the Form 433b

Completing the Form 433b involves several key steps:

- Gather financial documents, including pay stubs, bank statements, and bills.

- Provide personal information, including your name, address, and Social Security number.

- Detail your income sources, listing all forms of income received.

- Outline monthly expenses, ensuring all necessary living costs are included.

- List all assets and liabilities, providing accurate values for each.

- Review the form for accuracy before submission.

Legal use of the Form 433b

The Form 433b is legally binding when completed accurately and submitted to the IRS. It is essential to ensure that all information provided is truthful and complete, as providing false information can lead to penalties. The form is governed by IRS regulations, and compliance with these regulations is necessary to avoid legal repercussions.

Required Documents

When filling out the Form 433b, certain documents are required to support the information provided. These may include:

- Recent pay stubs or proof of income.

- Bank statements for all accounts.

- Documentation of monthly expenses, such as bills and receipts.

- Statements for any debts or loans.

Form Submission Methods

The Form 433b can be submitted to the IRS through various methods, including:

- Online submission via the IRS website, if applicable.

- Mailing a physical copy to the appropriate IRS office.

- In-person submission at designated IRS locations.

Eligibility Criteria

Eligibility to use the Form 433b typically applies to individuals who owe taxes and are seeking to negotiate payment terms with the IRS. This includes those who may be facing financial hardship or who are unable to pay their tax liabilities in full. Understanding the eligibility criteria is essential for a successful application process.

Quick guide on how to complete form 433b 2012 2019

Manage Form 433b effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 433b on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Form 433b effortlessly

- Obtain Form 433b and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form 433b and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433b 2012 2019

Create this form in 5 minutes!

How to create an eSignature for the form 433b 2012 2019

How to create an electronic signature for your Form 433b 2012 2019 online

How to generate an electronic signature for your Form 433b 2012 2019 in Google Chrome

How to create an electronic signature for signing the Form 433b 2012 2019 in Gmail

How to make an electronic signature for the Form 433b 2012 2019 from your smart phone

How to create an eSignature for the Form 433b 2012 2019 on iOS devices

How to generate an electronic signature for the Form 433b 2012 2019 on Android OS

People also ask

-

What is Form 433b and why is it important?

Form 433b is a financial disclosure form used by the IRS to evaluate an individual's or business's ability to pay tax debts. It provides essential information about your income, expenses, and assets, making it a crucial document in any tax negotiation or resolution process.

-

How can airSlate SignNow help with completing Form 433b?

airSlate SignNow streamlines the process of completing Form 433b by allowing users to fill out, sign, and send the document electronically. Our platform ensures that all information is securely stored and easily accessible, making it simple to manage your tax-related documents.

-

Is there a cost associated with using airSlate SignNow for Form 433b?

Yes, airSlate SignNow offers various pricing plans, including a free trial, to accommodate different business needs. Our cost-effective solutions allow you to efficiently manage your Form 433b and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 433b?

airSlate SignNow provides a variety of features such as customizable templates, in-app signing, and document tracking specifically designed for managing Form 433b. These features enhance efficiency and ensure that your documents are legally compliant and securely processed.

-

Can I integrate airSlate SignNow with other software for my Form 433b?

Absolutely! airSlate SignNow seamlessly integrates with popular software applications, allowing you to enhance your workflow when managing Form 433b. This integration helps streamline your document management process and ensures all your data is in one place.

-

What are the benefits of using airSlate SignNow for Form 433b?

Using airSlate SignNow for Form 433b simplifies the document signing process, saves time, and enhances security. Our platform's ease of use allows you to focus on more important tasks while ensuring your Form 433b is completed accurately and efficiently.

-

Is airSlate SignNow compliant with regulations when handling Form 433b?

Yes, airSlate SignNow is fully compliant with industry regulations, ensuring that your Form 433b and other sensitive documents are handled securely. We prioritize data protection and privacy, giving you peace of mind when managing your tax documents.

Get more for Form 433b

Find out other Form 433b

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF