Irs Form 433 B 2001

What is the IRS Form 433-B?

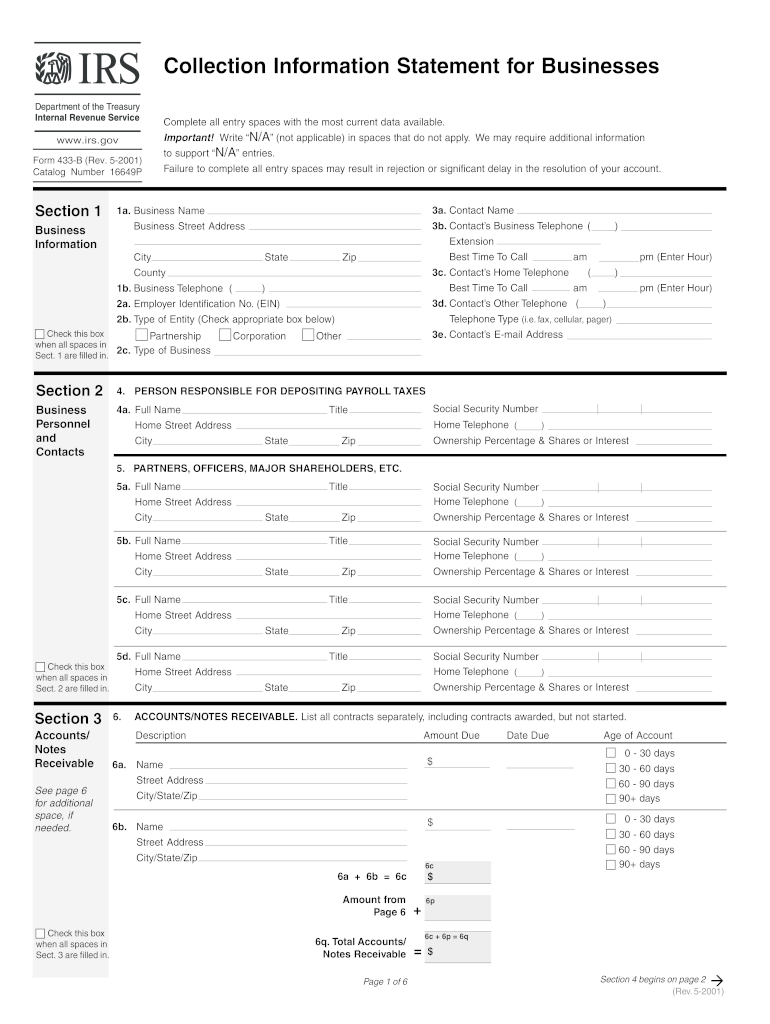

The IRS Form 433-B is a financial statement used by businesses to provide the Internal Revenue Service (IRS) with detailed information about their financial situation. This form is primarily utilized when a business is seeking to negotiate a payment plan or settle tax liabilities. It requires the disclosure of assets, liabilities, income, and expenses, enabling the IRS to assess the taxpayer's ability to pay their tax obligations. Understanding the purpose and requirements of this form is essential for businesses facing tax issues.

Steps to Complete the IRS Form 433-B

Completing the IRS Form 433-B involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including bank statements, income statements, and expense reports. Follow these steps:

- Provide basic business information, including the business name, address, and employer identification number (EIN).

- Detail the business's assets, including cash, accounts receivable, and inventory.

- List all liabilities, such as loans and outstanding debts.

- Outline the monthly income and expenses, ensuring to include all sources of revenue and costs associated with running the business.

- Review the completed form for accuracy and completeness before submission.

How to Obtain the IRS Form 433-B

The IRS Form 433-B can be obtained directly from the IRS website or through a tax professional. To access the form online, visit the IRS forms section and search for Form 433-B. It is available in a downloadable PDF format, which can be printed and filled out manually or completed electronically using compatible software. Ensure you have the most current version of the form to comply with IRS requirements.

Legal Use of the IRS Form 433-B

The IRS Form 433-B must be completed accurately and submitted in accordance with IRS guidelines to be considered legally binding. It is crucial to provide truthful and complete information, as any discrepancies can lead to penalties or complications in resolving tax issues. The form serves as a critical document in negotiations with the IRS, and its proper use can significantly impact the outcome of a taxpayer's case.

Key Elements of the IRS Form 433-B

Several key elements are essential to the IRS Form 433-B, which include:

- Business Information: Name, address, and EIN.

- Assets: A detailed list of all business assets.

- Liabilities: A comprehensive overview of all debts and obligations.

- Income: Monthly income from all sources.

- Expenses: Detailed monthly operating expenses.

Form Submission Methods

The IRS Form 433-B can be submitted through various methods, including:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the IRS portal.

- Mail: The completed form can be mailed to the appropriate IRS address, which can be found on the form instructions.

- In-Person: Taxpayers may also choose to deliver the form in person at a local IRS office.

Quick guide on how to complete irs form 433 b 2001

Complete Irs Form 433 B effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 433 B on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The simplest method to alter and eSign Irs Form 433 B with ease

- Obtain Irs Form 433 B and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight signNow parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a typical wet ink signature.

- Review all the details and then click the Done button to secure your changes.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Irs Form 433 B and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 433 b 2001

Create this form in 5 minutes!

How to create an eSignature for the irs form 433 b 2001

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is IRS Form 433 B?

IRS Form 433 B is a financial statement used by businesses to provide the IRS with a complete picture of their financial situation. This form is often required for various tax matters, including establishing payment plans or settling tax debts. Understanding how to accurately fill out this form is crucial for compliance and can be streamlined with tools like airSlate SignNow.

-

How can airSlate SignNow help with IRS Form 433 B?

airSlate SignNow simplifies the process of completing and signing IRS Form 433 B. With user-friendly e-signature capabilities, businesses can securely fill out the form online and send it directly to the IRS. This not only saves time but ensures that all necessary documents are filed correctly.

-

Is there a cost associated with using airSlate SignNow for IRS Form 433 B?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans are budget-friendly and designed to provide signNow value, especially for those who frequently deal with documents like IRS Form 433 B. Choose a plan that fits your requirements and enjoy cost-effective solutions for e-signing and document management.

-

What features does airSlate SignNow offer for handling IRS Form 433 B?

airSlate SignNow provides robust features for managing IRS Form 433 B, including template creation, customizable workflows, and secure document storage. Additionally, the platform supports collaboration, allowing multiple users to review and sign the form seamlessly. These features enhance efficiency and accuracy for businesses navigating tax compliance.

-

Can I integrate airSlate SignNow with other applications for IRS Form 433 B?

Absolutely! airSlate SignNow integrates easily with a variety of applications and platforms, which can enhance the management of IRS Form 433 B. Whether you need to connect with accounting software, customer relationship management tools, or cloud storage services, airSlate SignNow's integration capabilities offer convenience and flexibility.

-

How does airSlate SignNow ensure the security of IRS Form 433 B documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption methods and secure cloud storage to protect your IRS Form 433 B and other sensitive documents. Additionally, compliance with industry standards ensures that your data remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for IRS Form 433 B?

Using airSlate SignNow for IRS Form 433 B offers numerous benefits, including faster document turnaround, reduced paperwork, and the ability to sign documents from anywhere. Moreover, the intuitive interface makes it easy to manage forms without extensive training, enabling businesses to focus on their core operations instead of getting bogged down by paperwork.

Get more for Irs Form 433 B

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property illinois form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential illinois form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property illinois form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497306197 form

- Illinois lease tenant form

- Illinois right form

- Breach lease tenant 497306202 form

- Illinois violating form

Find out other Irs Form 433 B

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service