Formulario1040NRSP Estado Civil Marque Slo Un Re 2024-2026

What is the Formulario1040NRSP Estado Civil Marque Slo Un Re

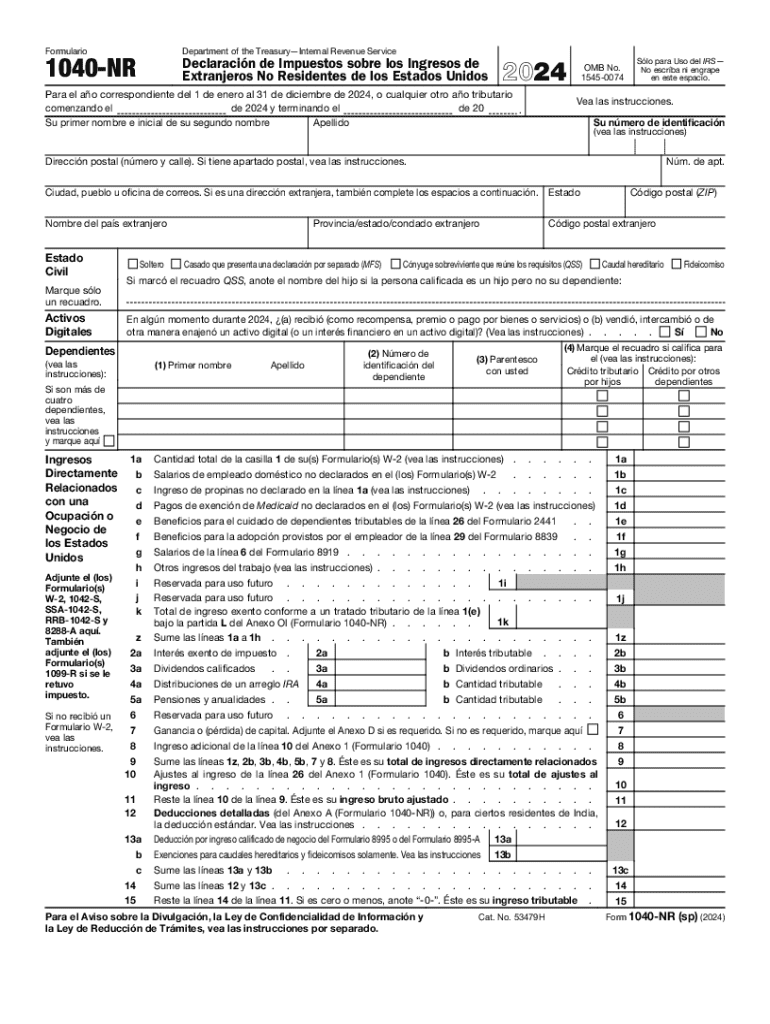

The Formulario1040NRSP Estado Civil Marque Slo Un Re is a tax form specifically designed for non-resident aliens in the United States. This form is essential for individuals who do not meet the criteria for residency but still have tax obligations in the U.S. It allows non-residents to report their income and determine their tax liability. The "Estado Civil" section of the form is crucial as it requires filers to indicate their marital status, which can significantly affect their tax calculations and eligibility for certain deductions or credits.

How to use the Formulario1040NRSP Estado Civil Marque Slo Un Re

Using the Formulario1040NRSP Estado Civil Marque Slo Un Re involves several steps that ensure accurate reporting of income and tax obligations. First, gather all necessary financial documents, including income statements and any relevant tax documents. Next, complete the form by filling in personal information, including your name, address, and Social Security number, if applicable. Pay special attention to the marital status section, as this will influence your tax calculations. Once completed, review the form for accuracy before submitting it to the IRS.

Steps to complete the Formulario1040NRSP Estado Civil Marque Slo Un Re

Completing the Formulario1040NRSP Estado Civil Marque Slo Un Re requires careful attention to detail. The following steps outline the process:

- Gather all relevant financial documents, such as W-2s or 1099s.

- Fill out your personal information, including your name and address.

- Indicate your marital status in the "Estado Civil" section, selecting the appropriate option.

- Report your income accurately, ensuring all amounts are correct.

- Calculate your tax liability based on the reported income and applicable tax rates.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline.

Key elements of the Formulario1040NRSP Estado Civil Marque Slo Un Re

Several key elements make up the Formulario1040NRSP Estado Civil Marque Slo Un Re. These include:

- Personal Information: This section requires basic details such as name, address, and identification numbers.

- Marital Status: The "Estado Civil" section is critical for determining tax rates and eligibility for deductions.

- Income Reporting: Accurate reporting of all income sources is essential for compliance.

- Tax Calculation: This section involves calculating the total tax owed based on reported income.

- Signature: The form must be signed and dated to validate the information provided.

Legal use of the Formulario1040NRSP Estado Civil Marque Slo Un Re

The legal use of the Formulario1040NRSP Estado Civil Marque Slo Un Re is paramount for non-resident aliens fulfilling their tax obligations in the U.S. Filing this form correctly ensures compliance with federal tax laws and helps avoid potential penalties. It is important to understand that failure to file or inaccuracies in the form can lead to legal repercussions, including fines or audits. Therefore, it is advisable to consult with a tax professional if there are uncertainties regarding the form or tax liabilities.

Required Documents

To complete the Formulario1040NRSP Estado Civil Marque Slo Un Re, certain documents are necessary. These typically include:

- Income statements, such as W-2s or 1099s, that detail earnings.

- Proof of residency or non-residency status, if applicable.

- Identification numbers, such as a Social Security number or Individual Taxpayer Identification Number (ITIN).

- Any relevant tax documents that may affect deductions or credits.

Create this form in 5 minutes or less

Find and fill out the correct formulario1040nrsp estado civil marque slo un re

Create this form in 5 minutes!

How to create an eSignature for the formulario1040nrsp estado civil marque slo un re

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Formulario1040NRSP Estado Civil Marque Slo Un Re?

The Formulario1040NRSP Estado Civil Marque Slo Un Re is a specific tax form used by non-resident aliens in the United States to report their income. It is essential for ensuring compliance with U.S. tax laws. Understanding this form can help you accurately file your taxes and avoid potential penalties.

-

How can airSlate SignNow help with the Formulario1040NRSP Estado Civil Marque Slo Un Re?

airSlate SignNow provides a streamlined platform for sending and eSigning the Formulario1040NRSP Estado Civil Marque Slo Un Re. Our user-friendly interface allows you to complete and manage your documents efficiently, ensuring that you can focus on your tax obligations without hassle.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are an individual or a large organization, you can choose a plan that fits your budget while accessing features that simplify the handling of the Formulario1040NRSP Estado Civil Marque Slo Un Re.

-

Are there any features specifically designed for the Formulario1040NRSP Estado Civil Marque Slo Un Re?

Yes, airSlate SignNow includes features tailored for the Formulario1040NRSP Estado Civil Marque Slo Un Re, such as customizable templates and automated reminders. These features help ensure that you complete your forms accurately and on time, enhancing your overall filing experience.

-

What benefits does airSlate SignNow provide for eSigning documents?

Using airSlate SignNow for eSigning documents like the Formulario1040NRSP Estado Civil Marque Slo Un Re offers numerous benefits, including increased efficiency and security. Our platform ensures that your documents are signed quickly and securely, reducing the time spent on paperwork and enhancing compliance.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to incorporate the Formulario1040NRSP Estado Civil Marque Slo Un Re into your existing workflows. This flexibility allows you to streamline your processes and improve productivity across your organization.

-

Is airSlate SignNow suitable for small businesses handling the Formulario1040NRSP Estado Civil Marque Slo Un Re?

Yes, airSlate SignNow is an excellent solution for small businesses managing the Formulario1040NRSP Estado Civil Marque Slo Un Re. Our cost-effective pricing and user-friendly features make it accessible for businesses of all sizes, helping you efficiently handle your documentation needs.

Get more for Formulario1040NRSP Estado Civil Marque Slo Un Re

Find out other Formulario1040NRSP Estado Civil Marque Slo Un Re

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free