263a1a De Minimis Safe Harbor Election Form

What is the 263a1a De Minimis Safe Harbor Election

The 263a1a De Minimis Safe Harbor Election is an important tax provision that allows businesses to deduct certain costs associated with tangible property. This election simplifies the accounting process for small businesses by enabling them to write off expenditures that would otherwise need to be capitalized and depreciated over time. Under this election, businesses can treat amounts paid for tangible property as an expense rather than a capital expenditure, provided these amounts fall below a specified threshold. This can significantly reduce the administrative burden associated with tracking and reporting these costs.

How to use the 263a1a De Minimis Safe Harbor Election

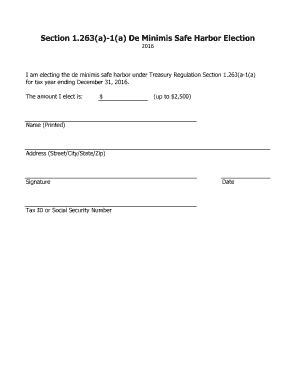

To utilize the 263a1a De Minimis Safe Harbor Election, businesses must make a formal election on their tax return. This involves attaching a statement to the return that indicates the election is being made. The statement should include the taxpayer's name, address, and taxpayer identification number, along with a declaration that the taxpayer is electing the safe harbor under section 263a1a. It is essential to keep accurate records of all expenditures to ensure compliance and to substantiate the amounts claimed under this election.

Steps to complete the 263a1a De Minimis Safe Harbor Election

Completing the 263a1a De Minimis Safe Harbor Election involves several key steps:

- Determine eligibility by assessing the total amount of tangible property expenditures.

- Prepare a statement that includes your business information and the election declaration.

- Attach the statement to your tax return for the year in which you want to make the election.

- Maintain detailed records of all relevant expenses to support your election.

Eligibility Criteria

Eligibility for the 263a1a De Minimis Safe Harbor Election is generally based on the total amount of expenditures related to tangible property. Businesses must ensure that the costs claimed under this election do not exceed the threshold set by the IRS, which is typically a specific dollar amount per item. Additionally, the election is available to all businesses regardless of their size, provided they meet the expenditure criteria. It is advisable for businesses to consult IRS guidelines or a tax professional to confirm their eligibility.

Required Documents

To successfully make the 263a1a De Minimis Safe Harbor Election, businesses need to prepare and maintain several key documents:

- A completed tax return for the year in which the election is made.

- A statement declaring the election and including the taxpayer's identifying information.

- Records of all tangible property expenditures, including invoices and receipts.

IRS Guidelines

The IRS provides specific guidelines regarding the 263a1a De Minimis Safe Harbor Election. These guidelines outline the eligibility criteria, the required documentation, and the procedures for making the election. Businesses should refer to IRS publications and instructions for the most current information, as tax laws and regulations can change. Understanding these guidelines is crucial for ensuring compliance and maximizing potential tax benefits.

Quick guide on how to complete 263a1a de minimis safe harbor election

Complete 263a1a De Minimis Safe Harbor Election easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage 263a1a De Minimis Safe Harbor Election on any device using airSlate SignNow Android or iOS applications and enhance any document-based operation today.

How to modify and eSign 263a1a De Minimis Safe Harbor Election effortlessly

- Find 263a1a De Minimis Safe Harbor Election and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight signNow sections of your documents or blackout sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign 263a1a De Minimis Safe Harbor Election and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 263a1a de minimis safe harbor election

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 263a1a De Minimis Safe Harbor Election?

The 263a1a De Minimis Safe Harbor Election allows businesses to deduct certain expenses without having to capitalize them. This election simplifies tax reporting and can lead to signNow savings for small businesses. Understanding this election is crucial for effective financial planning.

-

How can airSlate SignNow help with the 263a1a De Minimis Safe Harbor Election?

airSlate SignNow provides an efficient platform for managing documents related to the 263a1a De Minimis Safe Harbor Election. With our eSigning capabilities, you can quickly sign and send necessary forms, ensuring compliance and timely submissions. This streamlines your tax processes and saves valuable time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Our plans are designed to provide cost-effective solutions for managing documents, including those related to the 263a1a De Minimis Safe Harbor Election. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features enhance your ability to manage documents related to the 263a1a De Minimis Safe Harbor Election efficiently. Our platform ensures that you have all the tools necessary for effective document handling.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for the 263a1a De Minimis Safe Harbor Election, offers numerous benefits. You can ensure compliance, reduce processing time, and enhance security. Our platform simplifies the entire process, allowing you to focus on your business.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow can integrate with various accounting and tax management software. This integration allows for seamless handling of documents related to the 263a1a De Minimis Safe Harbor Election. By connecting your tools, you can streamline your workflow and improve efficiency.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and compliance. Our platform uses advanced encryption and security protocols to protect sensitive documents, including those related to the 263a1a De Minimis Safe Harbor Election. You can trust us to keep your information safe.

Get more for 263a1a De Minimis Safe Harbor Election

- Delaware non disclosure agreement nda template form

- Delaware self proving affidavit form

- Petitionerstepparent form

- Petition for stepparent adoption minnesota judicial branch courts mn form

- 2 petition adultdocx form

- Content disposition http mdn 530667935 form

- Family forms nm courts

- Affidavit of publication of minor form

Find out other 263a1a De Minimis Safe Harbor Election

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form