Louisiana Monthly Waste Tire Fee Report 2016-2026

What is the Louisiana Monthly Waste Tire Fee Report

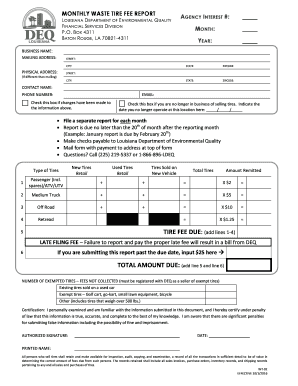

The Louisiana Monthly Waste Tire Fee Report is a document required by the Louisiana Department of Environmental Quality (DEQ) for businesses that generate waste tires. This report tracks the number of waste tires generated and the associated fees that must be paid to ensure proper disposal and recycling. The fee helps fund the state's waste tire management program, which aims to reduce environmental impact and promote responsible tire disposal practices.

How to use the Louisiana Monthly Waste Tire Fee Report

To effectively use the Louisiana Monthly Waste Tire Fee Report, businesses must accurately record the number of waste tires they generate each month. This information is then compiled into the report format, detailing the total fee owed. It is important to maintain accurate records throughout the month to ensure compliance and avoid penalties. The report must be submitted to the Louisiana DEQ by the specified deadline each month.

Steps to complete the Louisiana Monthly Waste Tire Fee Report

Completing the Louisiana Monthly Waste Tire Fee Report involves several key steps:

- Gather data on the number of waste tires generated during the month.

- Calculate the total fee based on the number of tires, according to the current fee structure.

- Fill out the report form, ensuring all required fields are completed accurately.

- Review the report for any errors or omissions before submission.

- Submit the completed report to the Louisiana DEQ by the deadline.

Legal use of the Louisiana Monthly Waste Tire Fee Report

The Louisiana Monthly Waste Tire Fee Report must be completed and submitted in accordance with state regulations. Legal use of the report ensures that businesses comply with environmental laws and contribute to the state's waste tire management efforts. Failure to submit the report or inaccuracies in reporting can lead to penalties, including fines and potential legal action.

Key elements of the Louisiana Monthly Waste Tire Fee Report

Key elements of the Louisiana Monthly Waste Tire Fee Report include:

- Business identification information, including name and address.

- Details on the total number of waste tires generated during the reporting period.

- Calculation of the waste tire fee based on the number of tires.

- Signature of the authorized representative certifying the accuracy of the report.

Form Submission Methods

The Louisiana Monthly Waste Tire Fee Report can be submitted through various methods. Businesses may choose to submit the report online via the Louisiana DEQ's designated portal, by mail, or in person at a local DEQ office. Each submission method has its own guidelines, and it is essential to follow the instructions to ensure timely processing of the report.

Quick guide on how to complete monthly waste tire fee report late filing fee failure

Manage Louisiana Monthly Waste Tire Fee Report anywhere, anytime

Your daily business activities may require extra focus when handling state-specific forms. Reclaim your working hours and reduce the expenses related to paper-based operations with airSlate SignNow. airSlate SignNow offers a range of pre-designed business forms, such as Louisiana Monthly Waste Tire Fee Report, that you can utilize and distribute to your business associates. Oversee your Louisiana Monthly Waste Tire Fee Report effortlessly with robust editing and eSignature capabilities and send it directly to your recipients.

How to obtain Louisiana Monthly Waste Tire Fee Report in a few clicks:

- Select a form pertinent to your state.

- Click Learn More to view the document and ensure its accuracy.

- Choose Get Form to start working on it.

- Louisiana Monthly Waste Tire Fee Report will automatically display in the editor. No further actions are required.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or alter the form.

- Select the Sign feature to generate your signature and electronically sign your form.

- Once ready, click Done, save changes, and access your document.

- Distribute the form via email or text, or use a link-to-fill option with your partners or allow them to download the document.

airSlate SignNow signNowly conserves your time managing Louisiana Monthly Waste Tire Fee Report and allows you to locate necessary documents in a single place. A broad selection of forms is organized and designed to address essential business operations needed for your enterprise. The advanced editor minimizes the likelihood of errors, enabling you to easily correct mistakes and review your documents on any device before sending them out. Begin your free trial today to discover all the benefits of airSlate SignNow for your daily business processes.

Create this form in 5 minutes or less

Find and fill out the correct monthly waste tire fee report late filing fee failure

FAQs

-

How much will be the fee to fill out the XAT form?

The XAT Registration fee is Rs. 1700(late fee Rs. 2000). This is had increased from last year.If you want to apply for XLRI programmes then pay additional Rs.300 (late fee Rs. 500)The last date for registration is 30th Nov 2018. The exam is on 6th Jan 2019.All the best

-

What are the penalties, interest and late fee if one fails to file TDS on GST (form GSTR-7) before the 10th of the following month?

The due date for filing TDS returns(GSTR-7) under GST for the October-December period has been extended to 31st January, 2019.If the taxpayer fails to file GSTR-7 before the due date, it shall attract a penalty(Late Fee) of 200/- per day (Rs 100 under CGST & Rs 100 under SGST) starting from next day of the due date of filing the return. This penalty is subject to a maximum of Rs. 5,000.Further interest has to be paid at 18% per annum. The period to be considered is from due date of filling till date of payment.I hope that this answer satisfies your requirement.For any query, please feel free to write to me at badlaniassociates@gmail.com

-

How much amount of late fees are to be paid for the non-filling of GST Nil Return? What is the maximum for a month?

Click here digital signature for GSTLate Fees and Interest on GST ReturnWhen a Registered Dealer misses filing GST Returns within due date late fees is levied by the government.GSTR-1 due date for the months of July to Nov 2017 (monthly) and July to Sept 2017 (quarterly) was 10th Jan 2018. If GSTR-1 is not filed within this due date you will be liable to pay late fees of Rs. 200* for every day of delay.Also, non-payment or late payment of GST attracts Interest.* Subject to change via CBEC notificationsLate Fees on GST ReturnsWhen a GST Return is filed after the due date, late fees to be applicable.Note that the maximum late fees that can be charged cannot exceed Rs 5,000.For example, a Taxpayer has filed GSTR-3B for the month of December 2017 (due date 20th Jan 2018) on 23rd January 2018.Amount of late fees to be paid:Rs. 50 per day * 3 days = Rs. 150 (Rs. 75 CGST + Rs. 75 SGST)If the above return was a return with ‘Zero’ tax liability then late fees will be:Rs. 20 per day * 3 days = Rs. 60 (Rs. 30 CGST + Rs. 30 SGST)Late Fees for GSTR-3B of July to September WaivedThe government has waived late fees for GSTR-3B from July to September 2017. Any late fees paid for these months will be credited back to Electronic Cash Ledger under Tax. This can be later utilized for payment of GST Liability.For example, a taxpayer files his GSTR-3B for the month of July, 3 days after due. He had to pay a late fee of Rs. 600 (Rs 200 per day * 3 days). This amount will be refunded in the taxpayers Electronic Cash LedgerLate Fees for GST Return as per GST Act*All returns except Annual Returns: Rs. 200 per day (Rs. 100 CGST + Rs. 100 SGST) of default up to a maximum of Rs 5,000.Annual Returns: Rs. 200 per day (Rs. 100 CGST + Rs. 100 SGST) of default up to a maximum of 0.25% of Turnover.

-

How many months is the last date for filling fees for provisional patent? What happens to provisional patent after six months if we didn't pay any fees? Is there any chance to file petition to get it back?

If you filed a provisional and received a filing date from the patent office, you should have received a Notice to File Missing parts within a few weeks of the filing date. That Notice gives you two months from it’s mailing date to pay the fees and the two months is extendible for up to an additional four months for a fee.Therefore, if you are six months from the filing date right now, you can file a Petition for Extension of Time and pay both the provisional filing fee and the extension of time fee, and you’ll be all set. If you go past six months from the mail date of the Notice to File Missing Parts, your application becomes abandoned.In the old days, that was it, the application becomes irrevocably abandoned. I have not checked on the rules for provisionals but other similar abandonment scenarios can nowadays be remedied within two months of abandonment by filing (and paying for) a relatively expensive (e.g., $2500) Petition to Revive.

Create this form in 5 minutes!

How to create an eSignature for the monthly waste tire fee report late filing fee failure

How to create an eSignature for your Monthly Waste Tire Fee Report Late Filing Fee Failure in the online mode

How to create an electronic signature for the Monthly Waste Tire Fee Report Late Filing Fee Failure in Chrome

How to make an eSignature for signing the Monthly Waste Tire Fee Report Late Filing Fee Failure in Gmail

How to create an eSignature for the Monthly Waste Tire Fee Report Late Filing Fee Failure right from your smart phone

How to make an electronic signature for the Monthly Waste Tire Fee Report Late Filing Fee Failure on iOS

How to create an eSignature for the Monthly Waste Tire Fee Report Late Filing Fee Failure on Android

People also ask

-

What is the louisiana waste tire fee?

The Louisiana waste tire fee is a charge implemented by the state to promote proper waste disposal and recycling of used tires. This fee helps fund waste tire management programs aimed at reducing environmental hazards. Understanding this fee is essential for businesses involved in the disposal of tires in Louisiana.

-

How is the louisiana waste tire fee calculated?

The louisiana waste tire fee is typically calculated based on the number of tires being disposed of or sold. Businesses must pay this fee for each new tire purchased, ensuring compliance with state regulations. It's important to factor this fee into your overall tire management costs.

-

What are the consequences of not paying the louisiana waste tire fee?

Failing to pay the louisiana waste tire fee can lead to signNow penalties, including fines and legal action. Non-compliance not only affects your business financially but also damages your reputation. It's crucial to stay informed about tire fee obligations to avoid these consequences.

-

How can airSlate SignNow help with managing the louisiana waste tire fee documentation?

airSlate SignNow simplifies the documentation process related to the louisiana waste tire fee by enabling businesses to electronically sign and send compliance documents. This streamlines record-keeping and ensures you stay organized. Our platform also enhances collaboration among team members handling tire management.

-

Is there a specific feature in airSlate SignNow for tracking the louisiana waste tire fee?

While airSlate SignNow does not have a dedicated feature specifically for tracking the louisiana waste tire fee, its robust document management system allows businesses to create and maintain records related to tire fees. Utilizing templates and automations can help you stay on top of your fee-related documentation effortlessly.

-

Can I integrate airSlate SignNow with other software to manage the louisiana waste tire fee?

Yes, airSlate SignNow offers various integrations that can assist in managing the louisiana waste tire fee. By connecting with accounting or compliance software, businesses can enhance their ability to track fees and adhere to state regulations seamlessly. This integration allows for more efficient financial management.

-

What are the benefits of using airSlate SignNow for handling the louisiana waste tire fee?

Using airSlate SignNow to manage the louisiana waste tire fee offers several benefits, including increased efficiency and reduced paperwork. The electronic signature feature ensures quicker approvals, and the user-friendly interface makes it easy for businesses of all sizes to comply with fee requirements. This solution provides a cost-effective way to streamline compliance.

Get more for Louisiana Monthly Waste Tire Fee Report

Find out other Louisiana Monthly Waste Tire Fee Report

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word