CAR LOAN REFERENCE FORM

What is the car loan reference form?

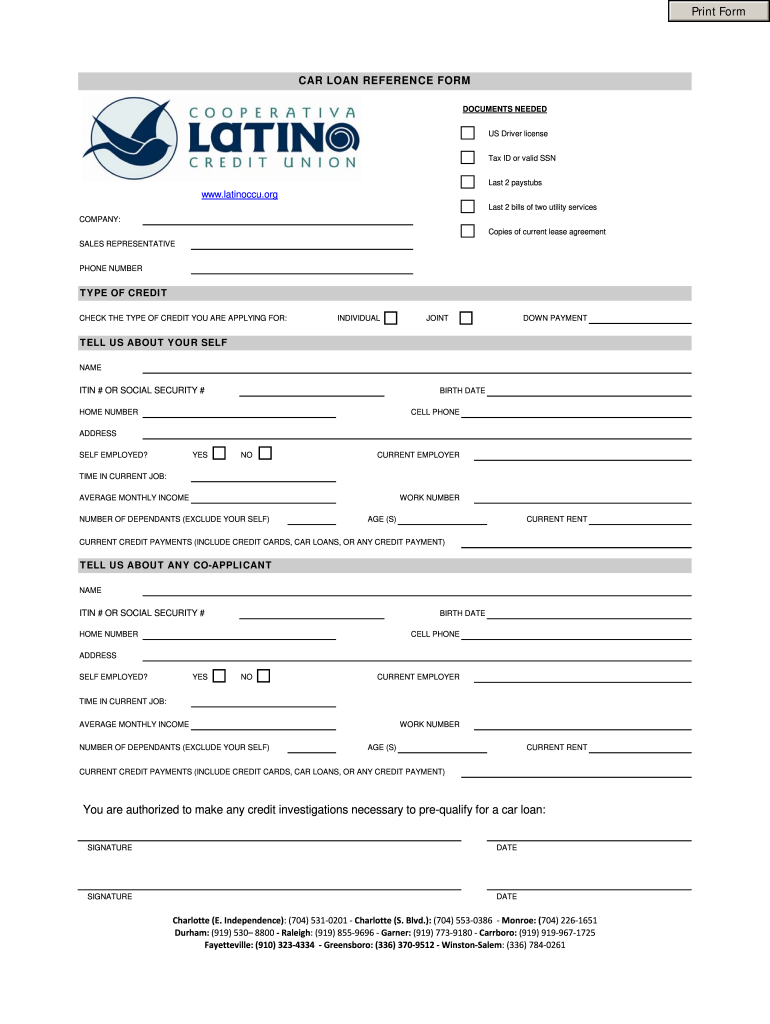

The car loan reference form is a document used by lenders to verify the identity and creditworthiness of an applicant seeking a car loan. This form typically requires the applicant to provide personal information, including their name, address, and employment details, as well as references who can attest to their reliability and financial responsibility. The purpose of the form is to help lenders assess the risk associated with granting the loan and to ensure that the applicant meets the necessary criteria for approval.

Key elements of the car loan reference form

Several key elements are essential for a comprehensive car loan reference form. These include:

- Personal Information: Full name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, and length of employment.

- References: Names and contact information for individuals who can vouch for the applicant's character and financial habits.

- Financial Information: Details about income, existing debts, and monthly expenses.

- Signature: A signature confirming that the information provided is accurate and complete.

Steps to complete the car loan reference form

Completing the car loan reference form involves several straightforward steps:

- Gather Information: Collect all necessary personal and financial details, including references.

- Fill Out the Form: Carefully enter the gathered information into the form, ensuring accuracy.

- Review: Double-check all entries for correctness and completeness.

- Sign the Form: Provide your signature to validate the information.

- Submit: Send the completed form to the lender through the preferred submission method.

How to obtain the car loan reference form

The car loan reference form can typically be obtained directly from the lender or financial institution where you are applying for the loan. Many lenders provide this form online, allowing applicants to download and print it. Alternatively, you can request a physical copy during your loan application process. It is important to ensure you have the most current version of the form, as requirements may vary by lender.

Legal use of the car loan reference form

The car loan reference form is legally binding, meaning that the information provided must be truthful and accurate. Providing false information can lead to severe consequences, including loan denial or legal action. It is essential for applicants to understand their rights and responsibilities when filling out this form, ensuring compliance with all applicable laws and regulations related to lending and consumer protection.

Eligibility criteria for a car loan reference

Eligibility criteria for providing references on a car loan application typically include:

- Age: References must be at least eighteen years old.

- Relationship: References should have a personal or professional relationship with the applicant.

- Willingness: References must agree to be contacted by the lender and provide information about the applicant.

Having reliable and trustworthy references can significantly improve the chances of loan approval, as lenders often look for evidence of the applicant's character and financial responsibility.

Quick guide on how to complete car loan reference form

Manage CAR LOAN REFERENCE FORM with ease on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and secure it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without hold-ups. Handle CAR LOAN REFERENCE FORM on any device with airSlate SignNow's Android or iOS applications and streamline any document processing today.

The easiest way to modify and electronically sign CAR LOAN REFERENCE FORM effortlessly

- Obtain CAR LOAN REFERENCE FORM and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark key sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, be it email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign CAR LOAN REFERENCE FORM to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the car loan reference form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the necessary references for a car loan application?

When applying for a car loan, you typically need to provide personal references who can vouch for your character and reliability. These references for a car loan should ideally be individuals who know you well, such as friends or family members. It's important to inform them beforehand, as lenders may contact them during the approval process.

-

How can airSlate SignNow help with managing references for a car loan?

airSlate SignNow streamlines the process of collecting and managing references for a car loan by allowing you to send and eSign documents quickly. This ensures that all necessary paperwork is completed efficiently, reducing delays in your loan application. With our easy-to-use platform, you can keep track of all your references and their responses in one place.

-

Are there any costs associated with using airSlate SignNow for car loan documents?

Yes, airSlate SignNow offers a cost-effective solution for managing your car loan documents, including references for a car loan. Our pricing plans are designed to fit various business needs, ensuring you get the best value for your investment. You can choose from different tiers based on your usage and features required.

-

What features does airSlate SignNow offer for handling references for a car loan?

airSlate SignNow provides features such as document templates, eSignature capabilities, and automated workflows to simplify the management of references for a car loan. These tools help you create, send, and track documents seamlessly, ensuring that all necessary references are collected and processed efficiently. Additionally, our platform is user-friendly, making it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other tools for my car loan process?

Absolutely! airSlate SignNow offers integrations with various applications that can enhance your car loan process. By connecting with CRM systems, payment processors, and other tools, you can streamline the collection of references for a car loan and manage your documents more effectively. This integration capability helps create a cohesive workflow.

-

What benefits does airSlate SignNow provide for businesses dealing with car loans?

Using airSlate SignNow for car loans offers numerous benefits, including increased efficiency and reduced paperwork. By digitizing the process of collecting references for a car loan, businesses can save time and minimize errors. Additionally, our secure platform ensures that all sensitive information is protected, giving you peace of mind.

-

How does airSlate SignNow ensure the security of my references for a car loan?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect all documents, including references for a car loan. This ensures that your information remains confidential and secure throughout the entire loan application process.

Get more for CAR LOAN REFERENCE FORM

- Molina healthcare health delivery organization hdo application form

- Ups teamcare plan benefit profile form

- Multistate fixed rate note single family fannie mae freddie mac uniform instrument

- Residential broker price opinion template form

- Western reserve life insurance change of beneficiary form

- Okaloosa county hardship form

- Real estate addendum ohio form

- Admissions amp registration important contact information

Find out other CAR LOAN REFERENCE FORM

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free