Fiscal Closeout Report for State and Federal Grant Programs Form

Understanding the Fiscal Closeout Report for State and Federal Grant Programs

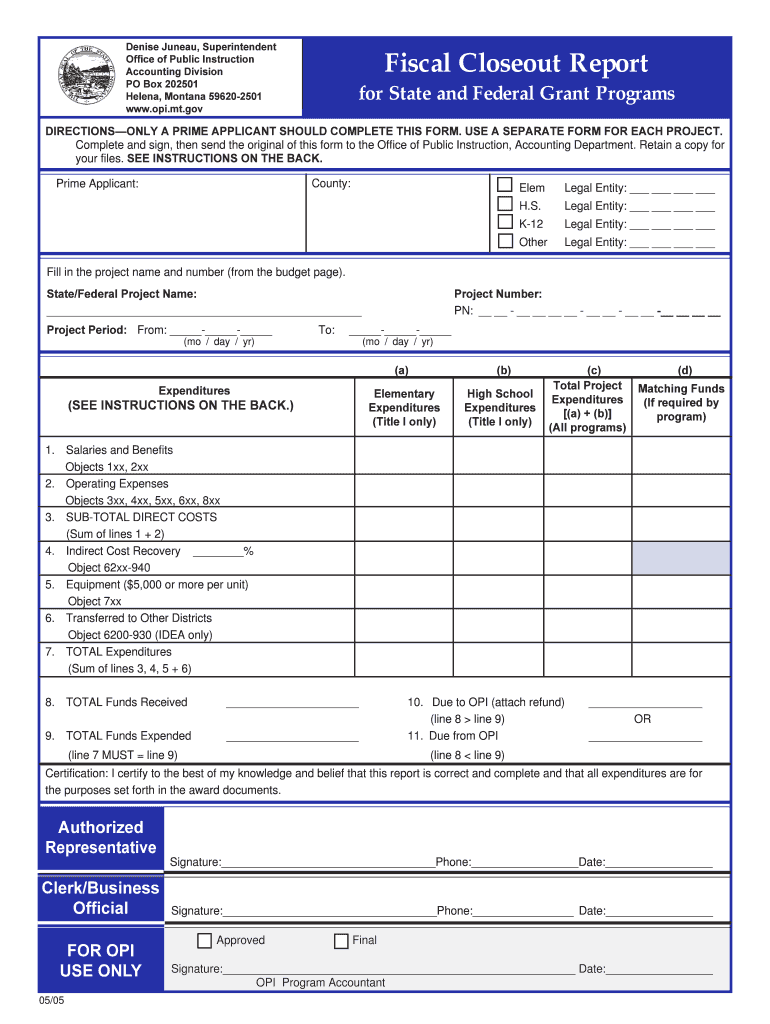

The Fiscal Closeout Report for State and Federal Grant Programs is a critical document that summarizes the financial activities associated with grant funding. This report provides an overview of how grant funds were utilized, including expenditures, income, and any remaining balances. It is essential for ensuring compliance with federal and state regulations, as it helps grant recipients demonstrate accountability and transparency in their financial management.

Steps to Complete the Fiscal Closeout Report for State and Federal Grant Programs

Completing the Fiscal Closeout Report involves several key steps:

- Gather all financial records related to the grant, including receipts, invoices, and bank statements.

- Compile a detailed summary of expenditures, categorizing them by type (e.g., personnel, materials, travel).

- Calculate any program income generated from the grant activities, if applicable.

- Determine the total amount of grant funds spent and identify any unspent funds.

- Complete the report form accurately, ensuring all required fields are filled out.

- Review the report for accuracy and completeness before submission.

Key Elements of the Fiscal Closeout Report for State and Federal Grant Programs

Several key elements must be included in the Fiscal Closeout Report:

- Grant Identification: Include the grant number, title, and funding agency.

- Financial Summary: Provide a breakdown of total expenditures and any program income.

- Compliance Statements: Affirm adherence to grant conditions and regulations.

- Final Budget Report: Compare actual expenditures against the original budget.

- Signature Section: Ensure authorized personnel sign the report to validate its authenticity.

Legal Use of the Fiscal Closeout Report for State and Federal Grant Programs

The Fiscal Closeout Report serves a legal purpose by documenting the proper use of grant funds. It is often required by funding agencies to ensure compliance with applicable laws and regulations. Failure to submit an accurate report can result in penalties, including the potential for funding to be revoked or the requirement to repay funds. Therefore, it is crucial for organizations to understand the legal implications and maintain accurate records throughout the grant period.

Filing Deadlines and Important Dates

Timely submission of the Fiscal Closeout Report is essential. Each grant program may have specific deadlines for submission, typically outlined in the grant agreement. It is important to be aware of these dates to avoid penalties. Common deadlines include:

- Final report submission date, often within 30 to 90 days after the grant period ends.

- Any interim reporting deadlines, if applicable.

Who Issues the Fiscal Closeout Report for State and Federal Grant Programs

The Fiscal Closeout Report is typically issued by the grant recipient organization. However, it is often required to be submitted to the funding agency, which may be a federal or state government entity. Each agency may have its own guidelines and formats for the report, so it is important for organizations to familiarize themselves with the specific requirements of their funding source.

Quick guide on how to complete fiscal closeout report for state and federal grant programs

Easily Prepare Fiscal Closeout Report For State And Federal Grant Programs on Any Device

Digital document management has become favored by both businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Fiscal Closeout Report For State And Federal Grant Programs on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The Easiest Way to Edit and Electronically Sign Fiscal Closeout Report For State And Federal Grant Programs

- Find Fiscal Closeout Report For State And Federal Grant Programs and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fiscal Closeout Report For State And Federal Grant Programs to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fiscal closeout report for state and federal grant programs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fiscal Closeout Report For State And Federal Grant Programs?

A Fiscal Closeout Report For State And Federal Grant Programs is a comprehensive document that summarizes the financial activities of a grant. It includes details on expenditures, revenues, and compliance with grant requirements. This report is essential for ensuring transparency and accountability in the use of grant funds.

-

How can airSlate SignNow help with creating a Fiscal Closeout Report For State And Federal Grant Programs?

airSlate SignNow streamlines the process of creating a Fiscal Closeout Report For State And Federal Grant Programs by providing easy-to-use templates and eSignature capabilities. Users can quickly gather necessary approvals and ensure that all documentation is securely stored. This efficiency saves time and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing grant documentation?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning to manage grant documentation effectively. These tools simplify the preparation of a Fiscal Closeout Report For State And Federal Grant Programs, making it easier to track and manage all necessary documents. Additionally, the platform ensures compliance with grant regulations.

-

Is airSlate SignNow cost-effective for small organizations managing grants?

Yes, airSlate SignNow is designed to be a cost-effective solution for organizations of all sizes, including small entities managing grants. With flexible pricing plans, users can choose a package that fits their budget while still accessing essential features for creating a Fiscal Closeout Report For State And Federal Grant Programs. This affordability helps organizations maximize their grant funding.

-

Can airSlate SignNow integrate with other software used for grant management?

Absolutely! airSlate SignNow offers integrations with various software solutions commonly used in grant management. This allows users to seamlessly incorporate the creation of a Fiscal Closeout Report For State And Federal Grant Programs into their existing workflows. Integrations enhance productivity and ensure that all data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for grant reporting?

Using airSlate SignNow for grant reporting provides numerous benefits, including increased efficiency, improved accuracy, and enhanced collaboration. The platform simplifies the process of preparing a Fiscal Closeout Report For State And Federal Grant Programs, allowing teams to focus on analysis rather than paperwork. Additionally, secure eSigning ensures that all stakeholders can approve documents quickly.

-

How secure is the data when using airSlate SignNow for grant documentation?

Data security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect sensitive information related to the Fiscal Closeout Report For State And Federal Grant Programs. Users can trust that their data is safe and compliant with industry standards.

Get more for Fiscal Closeout Report For State And Federal Grant Programs

- Abc analysis data sheet webrichmondk12vaus form

- The goal of iss is to encourage hackers form

- Ib learner profile self assessment omsd home page omsd omsd k12 ca form

- Image form

- Anne arundel county public schools division of folgermckinsey form

- Standard ce7a structure and powers of the state government form

- Blank progressive insurance card form

- Jump start what is jump start at fill out the isd721 form

Find out other Fiscal Closeout Report For State And Federal Grant Programs

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter