CT 1040ES Flat, Estimated Connecticut Income Tax Payment 2015

What is the CT 1040ES flat, Estimated Connecticut Income Tax Payment

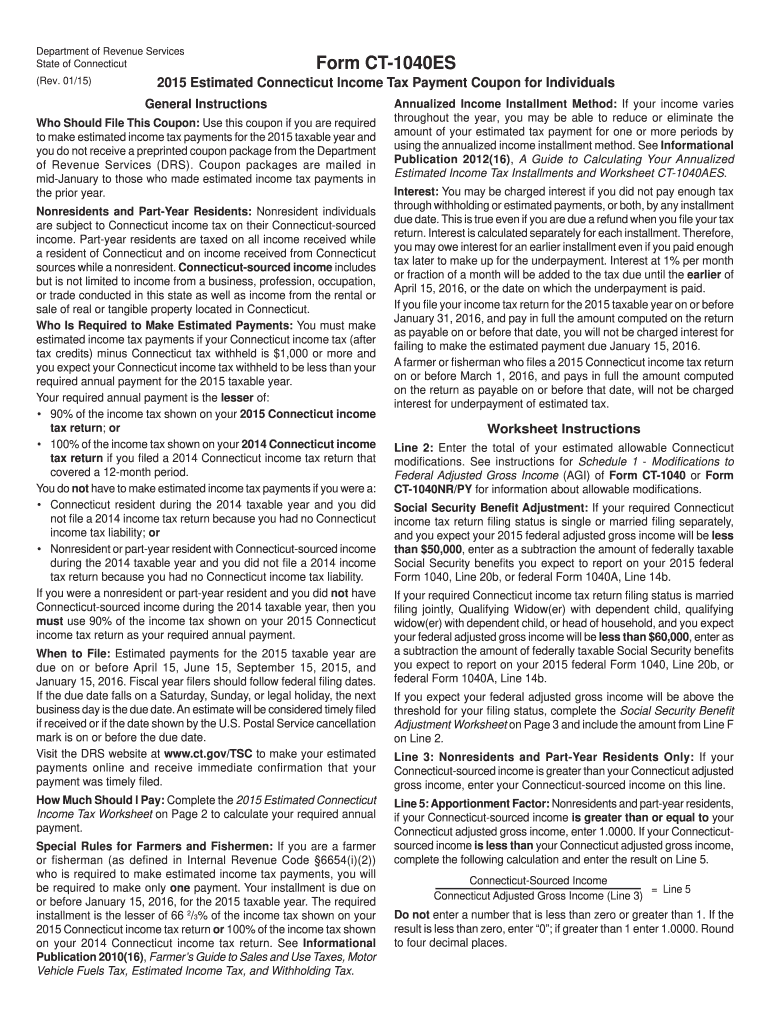

The CT 1040ES flat is a form used by residents of Connecticut to make estimated income tax payments. This form is essential for individuals who expect to owe tax of one thousand dollars or more when they file their annual income tax return. It allows taxpayers to pay their estimated tax liability in four installments throughout the year, helping to avoid penalties for underpayment. The form is specifically designed to simplify the process of reporting and paying state income taxes in Connecticut.

How to use the CT 1040ES flat, Estimated Connecticut Income Tax Payment

Using the CT 1040ES flat involves several straightforward steps. First, taxpayers must calculate their expected income for the year, including wages, self-employment income, and any other sources of revenue. Next, they should estimate their total tax liability based on their income and applicable deductions. Once the estimated tax is determined, individuals can fill out the CT 1040ES flat form, specifying the amount they plan to pay for each quarter. Finally, payments can be made by mail or electronically, depending on the taxpayer's preference.

Steps to complete the CT 1040ES flat, Estimated Connecticut Income Tax Payment

Completing the CT 1040ES flat requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, such as W-2s, 1099s, and previous tax returns.

- Calculate your expected income for the current tax year.

- Determine your estimated tax liability using the appropriate tax rates.

- Fill out the CT 1040ES flat form, ensuring all information is accurate.

- Choose your payment method: check, money order, or electronic payment.

- Submit the form and payment by the due date to avoid penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the CT 1040ES flat. Estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on unpaid amounts. Taxpayers should mark these dates on their calendars to ensure timely submissions and avoid complications.

Required Documents

To complete the CT 1040ES flat, taxpayers should have several documents on hand. These include:

- Previous year’s tax return for reference.

- W-2 forms from employers for wage information.

- 1099 forms for any freelance or self-employment income.

- Documentation of any deductions or credits that may apply.

Having these documents ready will facilitate accurate calculations and efficient completion of the form.

Penalties for Non-Compliance

Failure to file the CT 1040ES flat or to make estimated payments can lead to significant penalties. Connecticut imposes interest on underpayments and may assess additional fines for late submissions. It is important for taxpayers to understand these consequences and ensure they adhere to the payment schedule to avoid financial repercussions.

Quick guide on how to complete 2015 ct tax form

Your assistance manual on how to prepare your CT 1040ES flat, Estimated Connecticut Income Tax Payment

If you’re wondering how to finalize and submit your CT 1040ES flat, Estimated Connecticut Income Tax Payment, here are some straightforward instructions to facilitate tax filing.

To begin, you only need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to amend, generate, and finalize your income tax forms with ease. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and go back to adjust information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps listed below to complete your CT 1040ES flat, Estimated Connecticut Income Tax Payment in just a few minutes:

- Create your account and begin working on PDFs within a few moments.

- Browse our catalog to find any IRS tax form; examine different versions and schedules.

- Click Obtain form to open your CT 1040ES flat, Estimated Connecticut Income Tax Payment in our editor.

- Populate the necessary fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically using airSlate SignNow. Please keep in mind that filing in paper form can lead to return errors and delayed refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2015 ct tax form

Create this form in 5 minutes!

How to create an eSignature for the 2015 ct tax form

How to make an eSignature for your 2015 Ct Tax Form online

How to create an electronic signature for your 2015 Ct Tax Form in Google Chrome

How to generate an electronic signature for putting it on the 2015 Ct Tax Form in Gmail

How to generate an eSignature for the 2015 Ct Tax Form right from your smart phone

How to make an electronic signature for the 2015 Ct Tax Form on iOS

How to create an eSignature for the 2015 Ct Tax Form on Android devices

People also ask

-

What is the CT 1040ES flat, Estimated Connecticut Income Tax Payment for individuals?

The CT 1040ES flat, Estimated Connecticut Income Tax Payment is a required quarterly payment for individuals who anticipate owing tax to the state. By accurately calculating your expected income and utilizing the flat payment system, you can manage your tax obligations effectively. This simplifies your tax strategy and helps you avoid penalties for underpayment.

-

How do I make a CT 1040ES flat, Estimated Connecticut Income Tax Payment?

You can make a CT 1040ES flat, Estimated Connecticut Income Tax Payment online through the Connecticut Department of Revenue Services website. This makes it convenient to ensure that your payments are on time, and you can easily track your payment history. Alternatively, you can also mail your payment using the form provided by the state.

-

What are the deadlines for the CT 1040ES flat, Estimated Connecticut Income Tax Payment?

The CT 1040ES flat, Estimated Connecticut Income Tax Payment is typically due quarterly, with specific deadlines falling on April 15, June 15, September 15, and January 15 of the following year. It's essential to adhere to these deadlines to avoid penalties. Keeping a calendar will help you stay organized and ensure timely payments.

-

What happens if I miss a CT 1040ES flat, Estimated Connecticut Income Tax Payment deadline?

Missing a CT 1040ES flat, Estimated Connecticut Income Tax Payment deadline can result in penalties and interest on the unpaid tax amount. It's crucial to stay proactive and make timely payments to avoid these additional charges. If you've missed a payment, consider making it as soon as possible to mitigate penalties.

-

Can businesses use the CT 1040ES flat, Estimated Connecticut Income Tax Payment system?

The CT 1040ES flat, Estimated Connecticut Income Tax Payment is primarily aimed at individual taxpayers; however, businesses may also need to make estimated payments based on their income. It's essential to understand your business's tax obligations to ensure compliance with state regulations. Consulting a tax professional can help clarify your specific situation.

-

Are there penalties for overpaying my CT 1040ES flat, Estimated Connecticut Income Tax Payment?

While overpaying your CT 1040ES flat, Estimated Connecticut Income Tax Payment won't incur penalties, it can unnecessarily tie up your funds until you receive a refund. It's important to estimate your payments as accurately as possible to optimize your cash flow. You can apply for a refund if you end up overpaying.

-

How can airSlate SignNow assist with my CT 1040ES flat, Estimated Connecticut Income Tax Payment?

airSlate SignNow offers a streamlined document signing and management solution that can help you prepare and submit your CT 1040ES flat, Estimated Connecticut Income Tax Payment documents efficiently. With easy-to-use features, you can sign, send, and manage important tax documents securely and on time. This can help simplify your tax filing process.

Get more for CT 1040ES flat, Estimated Connecticut Income Tax Payment

Find out other CT 1040ES flat, Estimated Connecticut Income Tax Payment

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement