Use Tax Exemption Form 2015

What is the Use Tax Exemption Form

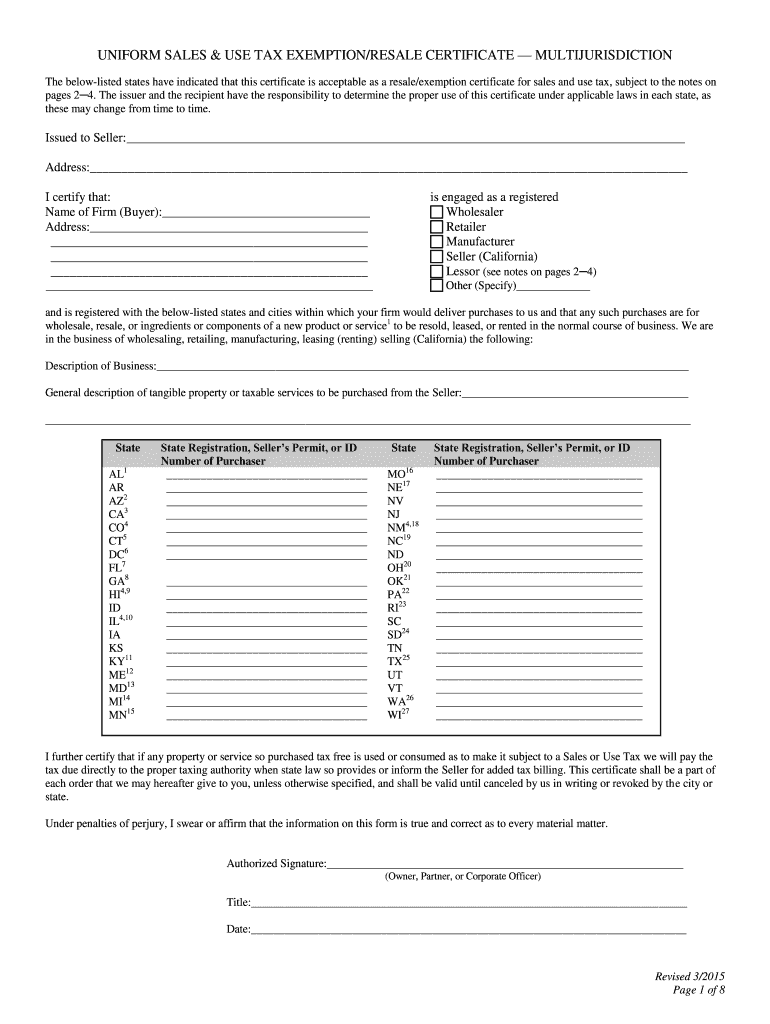

The Use Tax Exemption Form is a document that allows businesses and individuals to claim exemptions from use tax on certain purchases. Use tax is typically applied to goods purchased for use in a state where sales tax has not been paid. This form is essential for ensuring compliance with state tax laws while allowing for legitimate exemptions, such as purchases made for resale or specific business purposes. Understanding the purpose of this form helps taxpayers navigate their tax responsibilities effectively.

How to use the Use Tax Exemption Form

Using the Use Tax Exemption Form involves several straightforward steps. First, identify the items for which you are claiming an exemption. Next, accurately fill out the form, providing necessary details such as your name, address, and the nature of the exemption. Once completed, present the form to the seller at the time of purchase. This ensures that the seller can process the exemption correctly, preventing any unnecessary tax charges. Keeping a copy of the completed form for your records is also advisable.

Steps to complete the Use Tax Exemption Form

Completing the Use Tax Exemption Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary information, including your business details and the items for which you seek exemption.

- Clearly indicate the reason for the exemption, ensuring it aligns with state regulations.

- Provide accurate descriptions of the items and their intended use.

- Review the form for completeness and accuracy before submission.

- Submit the form to the seller or relevant authority as required.

Legal use of the Use Tax Exemption Form

The legal use of the Use Tax Exemption Form is governed by state tax laws, which outline the specific criteria for exemptions. To be legally valid, the form must be completed accurately and submitted in accordance with the regulations of the state where the purchase occurs. Misuse of the form can lead to penalties, including back taxes and fines. It is crucial for taxpayers to familiarize themselves with their state’s laws to ensure compliance and avoid any legal complications.

Eligibility Criteria

Eligibility for using the Use Tax Exemption Form varies by state but generally includes specific categories such as businesses purchasing goods for resale, non-profit organizations, and government entities. To qualify, the purchaser must demonstrate that the items will not be subject to use tax under applicable laws. It is essential to review state-specific guidelines to confirm eligibility and ensure that the exemption is justified.

Required Documents

To complete the Use Tax Exemption Form, several documents may be required. These typically include proof of business status, such as a business license or tax identification number, and any relevant purchase receipts. Depending on the state, additional documentation may be necessary to substantiate the claim for exemption. Keeping organized records of these documents can facilitate a smoother process when filling out and submitting the form.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the Use Tax Exemption Form can result in significant penalties. Tax authorities may impose back taxes on the exempted purchases, along with interest and fines. Additionally, repeated non-compliance can lead to more severe consequences, including audits or legal action. Understanding the importance of accurate and honest reporting when using this form is vital for avoiding these penalties.

Quick guide on how to complete use tax exemption form

Discover how to effortlessly navigate the Use Tax Exemption Form completion with this simple guide

Online filing and signNowing of forms is becoming more widespread and is the preferred choice for a diverse range of clients. It offers numerous benefits compared to traditional printed documents, such as ease of use, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can access, edit, signNow, and enhance and send your Use Tax Exemption Form without the hassle of constant printing and scanning. Follow this concise guide to begin and complete your form.

Follow these steps to obtain and complete Use Tax Exemption Form

- Begin by selecting the Get Form button to access your form in our editor.

- Observe the green marker on the left indicating required fields so you don’t miss any.

- Utilize our professional tools to annotate, edit, sign, secure, and improve your form.

- Protect your document or convert it into a fillable form using the features on the right panel.

- Review the form and check for errors or inconsistencies.

- Click DONE to complete your editing.

- Rename your document or keep it unchanged.

- Select the storage option you prefer to save your form, send it via USPS, or click the Download Now button to save your file.

If Use Tax Exemption Form isn’t what you were searching for, you can explore our extensive selection of pre-loaded templates that you can fill out with minimal effort. Take a look at our solution today!

Create this form in 5 minutes or less

Find and fill out the correct use tax exemption form

FAQs

-

What requirements are there for building a startup?

There are no requirements to actually building a startup.Every startup will have its own special way that it will start up and its own bespoke path to the road for success. That being said, there are guidelines that most startups follow in order to increase their chances of success. Let me share them with you.LegalMaking sure that a startup begins on the right legal footing is crucial for success. You will want to make sure that the startup is registered, has the right structure and all the proper legal documents and certifications.You would be surprised by the number of startups that don’t have all of the followings! If you aren’t legally covered from the beginning, it can cause serious trouble for your startup in the future.For example, imagine you are running a Fintech startup.You might be unaware of all the regulations that your startup must abide by.Hence, you might be accidentally be violating one or more of them if you don’t have the proper supervision or license.A regulatory body like the Financial Conduct Authority (FCA) might find out about this and either give you a hefty fine or even ask for your business to shut down due to its illegal nature.Either way, your startup has just been dealt a massive blow that will be almost impossible to come back from.TeamEvery startup needs to be started with the best possible team to run and have a vision of the future for it.Then from there, they will need to hire the best possible talent that they can.Why? Because having the best people working for your startup will help it scale for the future.That is why companies like Google, Facebook, Amazon, Apple and etc spend so much money and time on hiring the best people out there for the job. When raising funds, investors will want to see why your team is the best team for the job.That is why having the best talent is so important. It will show investors and the world that your team has what it takes to take this idea into the future.In the startup world, no matter how amazing your idea is, if you don’t have the right team to execute it, it will fail.IdeaWhich brings us to the idea itself. At the end of the day, the idea itself will be fundamental to building your startup and its success.This means that you have to be 100% convinced that what you will be working on has the potential to actually change the world or industry.You will have to do a crazy amount of research on your industry, competitors, current trends, future trends, the market, consumer research and so on and so on.The fundamental question you should be able to answer is whether or not the pain point you are trying to solve really exists and if your product would be the best one to solve it.Then from there, you will have to be able to take the next step in the journey which is to actually start the business.Starting a company is not easy and it will require a lot of blood, sweat, tears and sacrifices but, speaking from experience it is completely worth it!I recommend you read as many books as you can from past founders (like Tools of Titans, The Hard Thing About Hard Things and etc), blogs, videos, podcasts and etc as you can to gain as much knowledge as you can before jumping in.At the end of the day, your ability to learn (because no one knows everything, no matter how many times they have done it) and grow will be fundamental to your success with your startup and with life!I hope this has helped you and if you have any legal questions or need legal assistance for your startup, feel free to contact me or visit our website. We offer a FREE Startup Legal Consultation, check it out!

-

What is required to set up a non profit NGO in Portugal?

Non-profits are great, but they can certainly require a lot of work to get off the ground. I am not telling you that to try and dissuade you from forming one. Having worked with several, I understand the passion involved and sometimes that passion can blind well-meaning people from the business aspects.Your first step is to do some research. You want to look into your fundraising options, look for potential sponsors, and consider drafting a list of things that you could do throughout the year to keep money coming into your organization. You also need to decide if you’re going to provide money or services directly to your specified cause or if you’re going to donate what you raise to another charity.Your second step is to have a plan. Just because you’re forming a non-profit doesn’t mean that you can ignore a business plan. People who donate their money, resources, or time will want to know what they are supporting. A well-written business plan can help legitimize what you’re doing. To write one, you need to make sure that you’ve completed step one!Your third step is to complete the non-profit paperwork. You can do this on your own or you can get help from an attorney. It is very important that the documents are properly completed. If they aren’t completed properly, your organization will not be tax-exempt. You can register your non-profit in your own state or in any state that you’d like. You do this through the Secretary of State website. However, before you complete and turn in the documents, make sure that you do a name search. You can’t use a name that’s already in use or one that is so similar to an existing business name that the public could be confused. You pay the state filing fee with the completed paperwork.Your fourth step is to complete the IRS form. In order for you to be granted tax-exempt status, you must complete Form 1023-series application.You must name a board and adopt your bylaws. You must name people to your board and adopt the bylaws of your non-profit. Bylaws explain exactly how your non-profit operates. You must keep minutes during this board meeting (and all other board meetings). Your best bet is to hire an attorney who specializes in non-profits to take care of all these tedious requirements.As you see, the process for forming a non-profit can be time consuming. If your documents aren’t properly filled out, you could lose your tax-exempt status. If you’d like help with forming your non-profit, consider the attorneys on LawTrades. We are a legal marketplace that makes it easy and efficient for entrepreneurs to hire and work with vetted lawyers for transparent, flat-fees! Hope this helps.

-

I am a minor in Maryland. How do I start a nonprofit organization? My mom is helping me.

Here's a good summary of what's involved in Maryland: How to Form a Maryland Nonprofit Corporation | Nolo.com. The big problem you're going to run into is that all the incorporators of the corporation need to be over 18. Assuming your mother is willing to serve as an incorporator in your stead. You also need $170. The form is pretty simple to fill out, and importantly has the boilerplate text that the feds require. Fill out the form, pay your money, and you're a Maryland non-profit corporation. Well, you need to create bylaws, and such, but there are copy-and-paste samples out there you can use to create one from.Unfortunately, registering with the state gets you pretty close to bupkis. If you want to solicit funds from the public and have the be tax-exempt (and not have the donations be taxable income from the perspective of the feds and Maryland), you need to snag a federal 501(c)3 status, and that's a much more involved process involving more filing fees and more forms (and probably a lawyer, unless you really know what you're doing.) It took us nearly a year and a lot of back-and-forth with the IRS to get our 501(c)3, although things have evidently loosened up quick a bit since the scandals of a few years ago.

-

What are some ideas to start an NGO?

For starters, an NGO (non-governmental organization) is a non-profit entity (for anyone reading who may not know the acronym). One thing to consider is whether you’re looking to start a charity or a non-profit business. With a charity, the money or services donated would be placed into the hands of those who need it. If you were to start a nonprofit business, you’d have to consider inventory as well as selling the inventory. So, deciding between those two should be your first step.Others have mentioned knowing what problem you’d like to solve. This is absolutely true. Knowing where you’d like to direct your attention and your resources is important. Is it an underserved area or will you be another resource to people in need? If it is the latter, you might also consider creating a list of others serving the same demographic so that you can refer out if you don’t have the resources to help.You’re going to need:- Choose a name for your NGO. You should do a little research on the Secretary of State website for your state to make sure that no one is using the name you have in mind or that it wouldn’t create confusion because your NGO name is similar to the name of another business (for profit or nonprofit).- You’ll need to complete the right paperwork with the state. After completion, the documents are filed with the Secretary of State and you’ll also need to pay a filing fee. You may also be required to turn in copies of certain documents such as your Articles of Incorporation. Articles of Incorporation include basic business information like the name of your NGO, the address, and contact information for a registered agent. You must be extremely careful when completing all of your paperwork because you want to make sure that you receive tax-exempt status.- You need to apply with the IRS for tax exemption. The application is known as a 501(c)(3) application (Application for Recognition of Exemption). You’ll need to fill it out and include a copy of your filed articles.- In some states, you may need to apply separately for state tax exemption. Talk to a representative of your state tax agency or a lawyer.- You need to write nonprofit bylaws. These bylaws govern your nonprofit.- Appoint your directors. The job of the directors is to make policy and financial decisions. How many directors you must appoint will depend on the state you live in.- Hold your first board meeting. This is when bylaws will officially be adopted, officers will be elected, and your nonprofit will record the receipt of its federal and state tax exemptions. You need to keep copies of the minutes for this meeting (and all other board meetings). Create a records binder for this.- Get the proper licenses and permits. Depending on what your nonprofit will do (or sell), you may be required to have licenses or permits. Check at the city level and at the state level.Starting a nonprofit is a noble aspiration. It can also be extremely confusing because of the amount of paperwork. LawTrades can help. Our nonprofit attorneys can provide affordable help with the documents you need to start your nonprofit and have the reassurance that they’re done the right way in order for you to receive and maintain your tax exempt status. Visit us for a complimentary consultation!

-

What if a 2 months old new employee need to submit tax proofs for tax excemption?

Normally the employee submits a W-4 upon hire, and is not asked to prove anything. The IRS has been inconsistent about employer obligation to reject clearly false W-4s. The only clear guidance is if the employee says or writes something to the effect that the W-4 is invalid, the employer should not accept it.If the employer decides to ask for proof two months after hire, assuming the employee has not filed a new W-4, it could be because the employer has become suspicious and wants to avoid IRS liability. Perhaps the employee was overheard saying, “I always claim exemption from withholding, and then just pay my full tax on April 15,” or the employer got a lock-in letter for another employee claiming 999 exemptions, so it decided to check all W-4s with more than ten exemptions or the employee sent emai from a work computer indicating membership in a tax protest group that refuses to file taxes. Or it could just be a change in policy based on a new HR head or new legal advice.If it's the IRS asking for proof, then it's likely they’re investigating the employee. The request could come from State tax authorities as well. These could be broad sweeps (check all programmers who switched from contract employee to full-time employee and make more than $80,000) or something specific to the employee (the ex-girlfriend of her boyfriend called the IRS to say “she never pays taxes”).Basically, it could mean anything or nothing.

-

What are the pros and cons of Indian budget 2017?

Here are some PROS of the budget:If your income is less than Rs. 5 lakhs, you need to fill just a one-page tax form.If your annual income is between Rs. 50 lakhs and Rs. 1 crore, you will need to pay a surcharge of 10%.Self-employed? You can get higher deductions for your contributions to the National Pension Scheme (NPS). The deduction can be raised to 20% from 10% earlier.The base used for computing indexation benefits in the case of Long Term Capital Gains (LTCG) has been changed. This will now be 1st April, 2001 and not 1st April, 1981. What’s more? Now, you need to hold your land or building for just two years to enjoy LTCG. Earlier, this was three years. Wait! Read on for some more good news. You can now reinvest your capital gains in notified, redeemable bonds other than those issued by NHAI and REC to get a capital gains exemption.Love the NPS? Your partial withdrawal from NPS will now be tax-exempt up to 25% of your contributions.Living in a rented house and paying more than Rs. 50,000 a month? You have the right to deduct 5% Tax Deducted at Source (TDS).If you love booking rail tickets online, here’s some good news. There will be no service tax on rail tickets booked online through the Indian Railway Catering and Tourism Corporation (IRCTC) website.Running a business with a turnover of less than Rs. 50 crores? Your tax rate has now been cut to 25% for the Financial Year (FY) 2015-16.Start-ups can avail a tax holiday for 3 years out of 7 years. Earlier, this was 3 out of 5 years.An Aadhaar enabled payment system will be launched soon. You just need your Aadhaar number and biometrics to make and receive payments. How cool is that? 14 banks have already been roped in for the Aadhaar payment service. More are expected to come on board soon.Have you tried out the Bharat Interface for Money (BHIM) app? Then, do it now. The Government is all set to introduce a referral bonus and cashback for BHIM users.Now, any political party in India cannot receive a cash donation of more than Rs. 2,000 from any source.Here are some CONS:Love using cash? Uh-oh! Cash transactions of over Rs. 3 lakhs will be banned from 1st April, 2017.If your income is less than Rs. 3.5 lakhs, the tax rebate has been halved from Rs. 5,000 to Rs.2,500 now.Contemplating buying a home? You may not like this. The tax deduction that you were claiming for a Home Loan under Section 24, has been reduced to Rs. 2 lakhs for rented homes. Earlier, it was unlimited. This means that whether you purchased the property for self-occupation or for letting out, you can claim only Rs. 2 lakhs as tax deduction on the interest paid. And it doesn’t matter whether it is your first or second home.Delaying filing your taxes? Don’t! You may have to shell out Rs. 10,000 if you file your returns late.Heavy smoker? Be ready to pay more for your cigarettes as excise duty on them has gone up. Ditto for pan masala, gutkha, and bidis.Additional Read: An Overview Of The Union Budget 2017Union Budget 2017: What You Need To KnowWhat The 2017 Budget Means For Individual TaxpayersHere’s a video showcasing the budget highlights:If you have any other personal finance queries, feel free to signNow out - Adhil Shetty

-

My wife and I both had 0 exemptions on our W4s, no extra untaxed income and one dependent. How could we still owe money for federal income tax when filing jointly?

Welcome to the marriage tax. We tax married couples more than we do two single people. It’s flat wrong, but we do it. Rich people like it because often in wealthy couples, one of the two doesn’t work and this system gives wealthy one income couples a tax advantage.But for the majority of two income married couples, you are taxed more. Some couples secretly/legally divorce and then file seperately. If one person loses their job, they may qualify for food stamps and free healthcare that would not be available to them if they were married.Our tax program in the US is incredibly unfair to young couples. Often as much as half of apartment rent is property tax passed on by your land lord. The wealthy of course pay a shelter tax, but it’s a pittance of their income compared to the amount of wages seized from the dying middle class.As described in a previous post, a wal-mart worker pays 100 percent of their wealth or more in taxes. A Walton likely pays less than .1 percent of their wealth in taxes. We need a wealth tax to replace all other taxes. Out tax code is destroying the American Dream.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

Create this form in 5 minutes!

How to create an eSignature for the use tax exemption form

How to generate an electronic signature for your Use Tax Exemption Form in the online mode

How to generate an electronic signature for your Use Tax Exemption Form in Google Chrome

How to generate an electronic signature for signing the Use Tax Exemption Form in Gmail

How to create an eSignature for the Use Tax Exemption Form straight from your mobile device

How to generate an electronic signature for the Use Tax Exemption Form on iOS devices

How to create an eSignature for the Use Tax Exemption Form on Android

People also ask

-

What is a Use Tax Exemption Form?

A Use Tax Exemption Form is a document that businesses can use to claim exemption from sales tax on certain purchases. By submitting this form, you can legally avoid paying sales tax on qualifying items, which can lead to signNow savings. airSlate SignNow simplifies the process of creating and managing your Use Tax Exemption Form digitally.

-

How can I create a Use Tax Exemption Form with airSlate SignNow?

Creating a Use Tax Exemption Form with airSlate SignNow is straightforward. Simply log in to your account, select the template for the Use Tax Exemption Form, and customize it to fit your specific needs. Our user-friendly interface allows you to add fields, signatures, and other necessary information quickly.

-

Is there a cost associated with using a Use Tax Exemption Form on airSlate SignNow?

Using a Use Tax Exemption Form on airSlate SignNow is part of our subscription plans, which are designed to be cost-effective for businesses of all sizes. We offer different pricing tiers based on your needs, ensuring you can find a plan that fits your budget while allowing you to manage your documents efficiently.

-

What features does airSlate SignNow offer for managing Use Tax Exemption Forms?

airSlate SignNow offers a range of features to enhance your experience with Use Tax Exemption Forms. You can easily create, edit, and send forms for eSignature, track their status in real-time, and store them securely in the cloud. Our platform also helps you automate workflows, reducing the time spent on document management.

-

Can I integrate airSlate SignNow with other software for my Use Tax Exemption Form?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow for Use Tax Exemption Forms. Whether you use CRM systems, accounting software, or project management tools, our integrations help you manage your documents more efficiently and enhance collaboration across your team.

-

What are the benefits of using airSlate SignNow for my Use Tax Exemption Form needs?

Using airSlate SignNow for your Use Tax Exemption Form provides numerous benefits, including time savings and enhanced accuracy. With our digital solution, you can eliminate paperwork, reduce the risk of errors, and ensure compliance with tax regulations. Additionally, our intuitive platform makes it easy to manage documents from anywhere.

-

How secure is my Use Tax Exemption Form data with airSlate SignNow?

At airSlate SignNow, we prioritize your security and confidentiality. All data related to your Use Tax Exemption Form is protected with industry-leading encryption and complies with global security standards. Our platform ensures that your sensitive information remains safe and accessible only to authorized users.

Get more for Use Tax Exemption Form

- Patient summary form bconsciouschirobbcomb

- Mpac request for occupancy form

- Educatoramp39s statement ramsey county minnesota co ramsey mn form

- Lclb005a form bc

- Anlage kind zum antrag auf kindergeld englisch form

- Millionaire party qualification form educational organization

- Garden service contract template form

- Gardener contract template form

Find out other Use Tax Exemption Form

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online