PDF Uniform Sales & Use Tax Resale Certificate Multijurisdiction 2020-2026

What is the PDF Uniform Sales & Use Tax Resale Certificate — Multijurisdiction

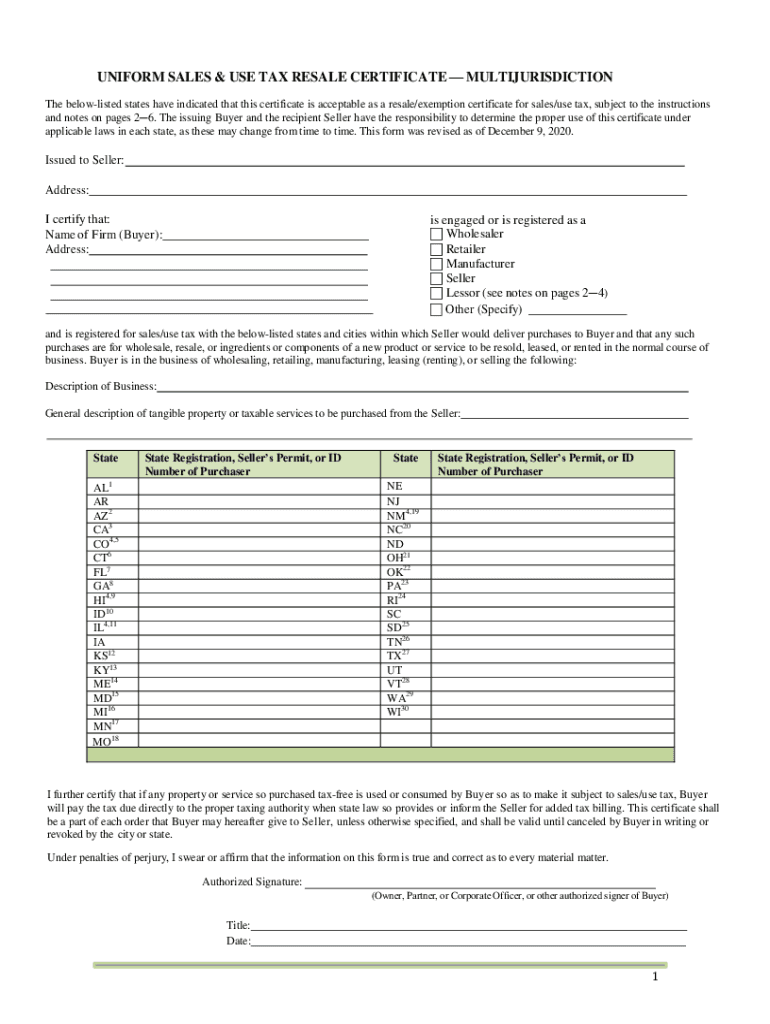

The PDF Uniform Sales & Use Tax Resale Certificate — Multijurisdiction is a standardized document used by businesses to claim exemption from sales tax on purchases intended for resale. This certificate is recognized across multiple states, simplifying the process for businesses operating in different jurisdictions. By presenting this certificate, a seller can avoid charging sales tax on items that will be resold, thus supporting cash flow and reducing administrative burdens.

Key elements of the PDF Uniform Sales & Use Tax Resale Certificate — Multijurisdiction

Understanding the essential components of the PDF Uniform Sales & Use Tax Resale Certificate is crucial for proper use. Key elements include:

- Purchaser Information: Name, address, and sales tax identification number of the purchaser.

- Seller Information: Name and address of the seller from whom the goods are being purchased.

- Description of Property: A clear description of the items being purchased for resale.

- Signature: The signature of the purchaser or an authorized representative, affirming the validity of the certificate.

- Date: The date on which the certificate is completed.

Steps to complete the PDF Uniform Sales & Use Tax Resale Certificate — Multijurisdiction

Completing the PDF Uniform Sales & Use Tax Resale Certificate involves several straightforward steps:

- Download the Certificate: Obtain the PDF Uniform Sales & Use Tax Resale Certificate from a reliable source.

- Fill in Purchaser Information: Enter the name, address, and sales tax ID number of your business.

- Provide Seller Information: Include the name and address of the seller from whom you are purchasing items.

- Describe the Property: Clearly list the items being purchased for resale.

- Sign and Date: Ensure the certificate is signed by you or an authorized representative and dated appropriately.

Legal use of the PDF Uniform Sales & Use Tax Resale Certificate — Multijurisdiction

The legal use of the PDF Uniform Sales & Use Tax Resale Certificate is governed by state laws. To ensure compliance, businesses must use the certificate only for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases or items not meant for resale, can lead to penalties. It is essential to maintain accurate records of transactions where the certificate is used, as these may be subject to audit by state tax authorities.

State-specific rules for the PDF Uniform Sales & Use Tax Resale Certificate — Multijurisdiction

While the PDF Uniform Sales & Use Tax Resale Certificate is designed for multijurisdictional use, specific rules may vary by state. Businesses should familiarize themselves with the regulations in each state where they operate. Some states may have additional requirements, such as including a specific state tax ID number or additional documentation. Always check local laws to ensure compliance and avoid potential issues.

Examples of using the PDF Uniform Sales & Use Tax Resale Certificate — Multijurisdiction

Practical examples can illustrate how to effectively use the PDF Uniform Sales & Use Tax Resale Certificate:

- A retailer purchasing clothing from a wholesaler for resale can present the certificate to avoid paying sales tax on the transaction.

- A restaurant buying bulk food supplies for resale to customers can use the certificate when ordering from suppliers.

- A contractor purchasing materials for a project can provide the certificate to suppliers to ensure they are not charged sales tax on items that will be incorporated into a final product.

Quick guide on how to complete pdf uniform sales use tax resale certificate multijurisdiction

Complete PDF Uniform Sales & Use Tax Resale Certificate Multijurisdiction effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage PDF Uniform Sales & Use Tax Resale Certificate Multijurisdiction on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to edit and eSign PDF Uniform Sales & Use Tax Resale Certificate Multijurisdiction with ease

- Locate PDF Uniform Sales & Use Tax Resale Certificate Multijurisdiction and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors requiring new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign PDF Uniform Sales & Use Tax Resale Certificate Multijurisdiction and ensure outstanding communication at every level of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf uniform sales use tax resale certificate multijurisdiction

Create this form in 5 minutes!

How to create an eSignature for the pdf uniform sales use tax resale certificate multijurisdiction

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the current rate of california sales tax 2024?

The california sales tax 2024 rate varies by county and city, typically ranging from 7.25% to 10.25%. It's essential for businesses to verify specific local rates to ensure compliance. This affects pricing strategies and sales reports.

-

How does airSlate SignNow help with california sales tax 2024 compliance?

airSlate SignNow provides tools to ensure all your documentation complies with the california sales tax 2024 regulations. By streamlining the signing process and maintaining accurate records, it helps businesses stay organized and compliant with local tax laws.

-

What features does airSlate SignNow offer for managing sales tax documents?

With airSlate SignNow, businesses can easily create, edit, and manage sales tax documents relevant to california sales tax 2024. Features include templates, automated reminders, and secure storage, which simplify workflows to save time and reduce errors.

-

Is airSlate SignNow affordable for small businesses dealing with california sales tax 2024?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses handling california sales tax 2024. With competitive rates and various subscription options, businesses can choose a plan that fits their budget while ensuring compliance.

-

Can airSlate SignNow integrate with accounting software to manage california sales tax 2024?

Absolutely, airSlate SignNow integrates seamlessly with popular accounting software to streamline the management of california sales tax 2024. This integration allows businesses to automatically sync their documents and financial data, enhancing accuracy and efficiency.

-

What are the benefits of using airSlate SignNow for california sales tax 2024?

Using airSlate SignNow for california sales tax 2024 brings numerous benefits including increased efficiency, improved accuracy, and enhanced compliance. The platform's ease of use helps businesses save time while ensuring all documents are professionally managed.

-

How can I ensure my documents are secure regarding california sales tax 2024?

airSlate SignNow prioritizes document security, employing advanced encryption and secure access controls for all files related to california sales tax 2024. This means your sensitive information is protected, ensuring compliance and peace of mind.

Get more for PDF Uniform Sales & Use Tax Resale Certificate Multijurisdiction

- Dorscgovforms siteforms1350 department of revenue c 268 certificate of tax

- Scllr1350 state of south carolina department of revenue south carolina income tax rebate 20221350 state of south carolina form

- 2020 r delaware individual resident income tax return form 200 01

- Ct form os 114 online filing

- Get the free all department heads and budget managers form

- Lee county tourist tax login form

- Wwwtaxformfinderorg forms 2021state of connecticut form ct1040x 2021 amended connecticut

- Portalctgov drs drs formsunrelated returns ct

Find out other PDF Uniform Sales & Use Tax Resale Certificate Multijurisdiction

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast