California Sales and Use Tax Certificate Form 2009

What is the California Sales And Use Tax Certificate Form

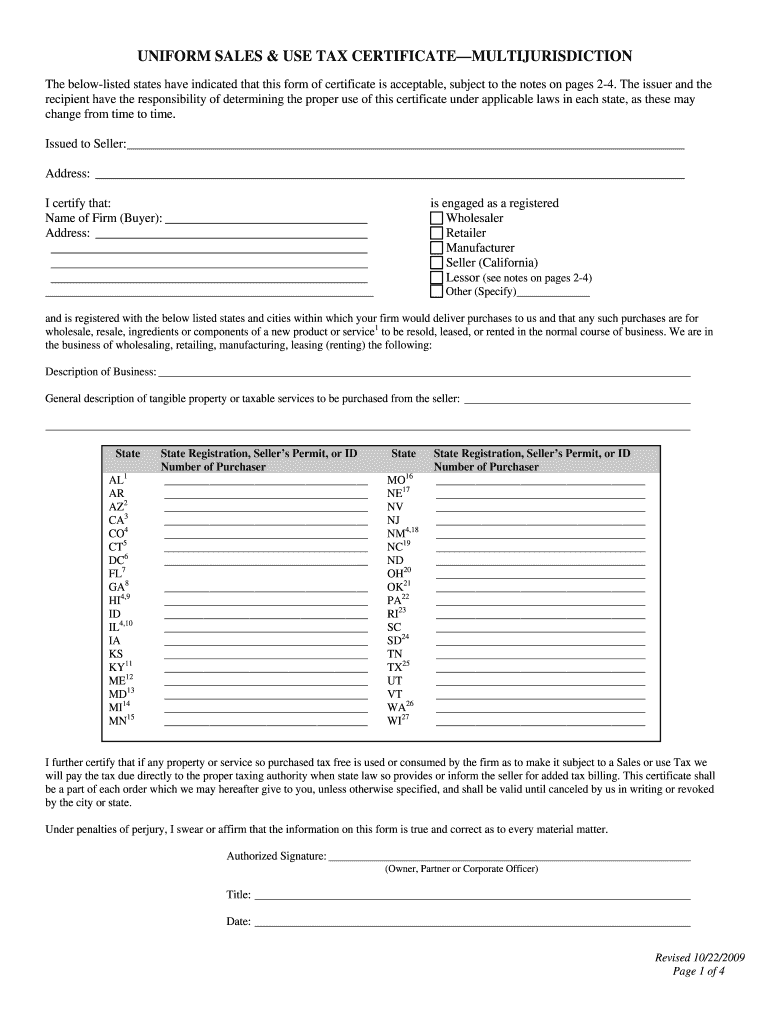

The California Sales And Use Tax Certificate Form is an essential document used by businesses to claim exemption from sales tax when purchasing goods for resale. This form allows sellers to provide a valid certificate to their suppliers, indicating that the items being purchased are intended for resale rather than personal use. By using this certificate, businesses can avoid paying sales tax on items they will later sell to customers.

How to use the California Sales And Use Tax Certificate Form

To effectively use the California Sales And Use Tax Certificate Form, businesses must fill it out accurately and present it to their suppliers. This involves providing essential information such as the purchaser's name, address, and seller's permit number. It is crucial to ensure that the form is signed and dated to validate the exemption. Suppliers should retain a copy of the certificate for their records, as it serves as proof that the sale was exempt from sales tax.

Steps to complete the California Sales And Use Tax Certificate Form

Completing the California Sales And Use Tax Certificate Form involves several straightforward steps:

- Obtain the form from a reliable source, such as the California Department of Tax and Fee Administration website.

- Fill in the purchaser's details, including the name and address of the business.

- Provide the seller's permit number, which is essential for validating the exemption.

- Indicate the reason for the exemption, typically for resale purposes.

- Sign and date the form to confirm its accuracy and authenticity.

Key elements of the California Sales And Use Tax Certificate Form

Several key elements must be included in the California Sales And Use Tax Certificate Form to ensure its validity:

- Purchaser Information: This includes the name, address, and seller's permit number of the business.

- Reason for Exemption: Clearly state that the purchase is for resale.

- Signature and Date: The form must be signed by an authorized representative of the business and dated to confirm its authenticity.

Legal use of the California Sales And Use Tax Certificate Form

The legal use of the California Sales And Use Tax Certificate Form is governed by state tax laws. Businesses must ensure that they are eligible to use the form and that it is completed accurately. Misuse of the certificate, such as using it for personal purchases or failing to provide accurate information, can lead to penalties. Therefore, it is essential to understand the legal implications and ensure compliance with applicable regulations.

Who Issues the Form

The California Sales And Use Tax Certificate Form is issued by the California Department of Tax and Fee Administration (CDTFA). This state agency oversees the administration of sales and use tax laws in California and provides resources and guidance for businesses on how to properly utilize the form. Businesses can access the form and additional information directly from the CDTFA's official website.

Quick guide on how to complete california sales and use tax certificate form

Discover how to effortlessly navigate the completion of the California Sales And Use Tax Certificate Form with this simple tutorial

Digital filing and electronic document completion are becoming more popular and are the preferred choice for many users. It provides numerous advantages over conventional printed documents, such as convenience, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can locate, modify, sign, and enhance and send your California Sales And Use Tax Certificate Form without the hassle of constant printing and scanning. Follow this brief guide to get started and complete your document.

Utilize these instructions to obtain and fill out California Sales And Use Tax Certificate Form

- Begin by clicking the Get Form button to launch your form in our editor.

- Pay attention to the green label on the left that highlights necessary fields to ensure you don’t miss them.

- Leverage our advanced features to annotate, modify, sign, protect, and enhance your form.

- Secure your document or convert it into a fillable form using the options in the right panel.

- Review the form and check for errors or inconsistencies.

- Select DONE to complete your edits.

- Rename your document or leave it as is.

- Pick your preferred storage service to save your form, mail it using USPS, or click the Download Now button to obtain your form.

If California Sales And Use Tax Certificate Form isn’t what you were looking for, you can explore our wide array of pre-uploaded templates that you can fill out with ease. Check out our solution today!

Create this form in 5 minutes or less

Find and fill out the correct california sales and use tax certificate form

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

How does sales and use tax work in California? Do I pay the state the tax charged for items?

Yes, pretty much. If you're located in California or have a signNow presence in the state (see below), you have to collect sales tax on taxable items and remit it to the state . Remember that sales tax rates vary by county and even city. You'll need to apply for a seller's permit as it is illegal to collect sales tax without a permit.This is a great blog post that describes what qualifies as signNow presence aka sales tax nexus and has all the other important details about sales tax in California: California Sales Tax Guide for BusinessesAlso make sure to check out the official information here: Sales and Use Tax & Sales & Use Tax - California State Board of Equalization

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Create this form in 5 minutes!

How to create an eSignature for the california sales and use tax certificate form

How to make an eSignature for the California Sales And Use Tax Certificate Form online

How to create an electronic signature for your California Sales And Use Tax Certificate Form in Google Chrome

How to create an eSignature for putting it on the California Sales And Use Tax Certificate Form in Gmail

How to generate an electronic signature for the California Sales And Use Tax Certificate Form straight from your smartphone

How to generate an electronic signature for the California Sales And Use Tax Certificate Form on iOS

How to make an eSignature for the California Sales And Use Tax Certificate Form on Android devices

People also ask

-

What is the California Sales And Use Tax Certificate Form?

The California Sales And Use Tax Certificate Form is a document that allows businesses in California to purchase goods or services without paying sales tax. By providing this form to suppliers, you can ensure compliance with California tax regulations while saving costs on taxable purchases.

-

How can I obtain the California Sales And Use Tax Certificate Form?

You can obtain the California Sales And Use Tax Certificate Form directly from the California Department of Tax and Fee Administration's website. Once you have filled out the required information, you can use airSlate SignNow to easily eSign and send the form to your suppliers.

-

What are the benefits of using airSlate SignNow for the California Sales And Use Tax Certificate Form?

Using airSlate SignNow for the California Sales And Use Tax Certificate Form streamlines the signing process, making it quick and efficient. Our platform offers secure storage, easy access, and the ability to send documents for eSignature without the hassle of printing and mailing.

-

Is there a cost associated with using airSlate SignNow to manage the California Sales And Use Tax Certificate Form?

airSlate SignNow offers competitive pricing plans that cater to different business needs, ensuring you can manage documents, including the California Sales And Use Tax Certificate Form, affordably. We provide various subscription options, and you can choose the one that fits your budget and usage requirements.

-

Can I integrate airSlate SignNow with other software for my California Sales And Use Tax Certificate Form needs?

Yes, airSlate SignNow offers integrations with popular business software, allowing you to streamline your workflow for managing the California Sales And Use Tax Certificate Form. Whether you use CRM, accounting software, or cloud storage solutions, our integrations help keep your processes efficient.

-

What features does airSlate SignNow offer for eSigning the California Sales And Use Tax Certificate Form?

airSlate SignNow provides a user-friendly interface for eSigning the California Sales And Use Tax Certificate Form, along with features like templates, customizable workflows, and real-time tracking of document status. This ensures you can sign and send documents quickly while maintaining full control over the process.

-

How secure is airSlate SignNow for handling the California Sales And Use Tax Certificate Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect your documents, including the California Sales And Use Tax Certificate Form, ensuring that all transactions and stored data are secure and compliant with industry standards.

Get more for California Sales And Use Tax Certificate Form

- Nj 2016 physician cds registration renewal requirements form

- Ncswclb certificationlicensure renewal information north carolina

- Verification of professional counseling experiencepdf ncblpc form

- Application for productlabel registration ohio department of com ohio form

- Printable spray application record form

- Application for osmb marine event permit oregongov oregon form

- Commercial operator insurance form oregongov oregon

- Blm annual report form

Find out other California Sales And Use Tax Certificate Form

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free