De88 Form 2004-2026

What is the DE 88 Form

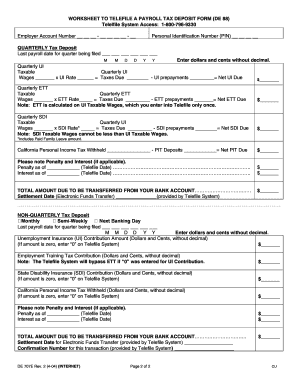

The DE 88 form, also known as the California Payroll Tax Deposit form, is a crucial document used by employers in California to report and deposit payroll taxes. This form is essential for ensuring compliance with state tax regulations. It captures various payroll tax liabilities, including state income tax withholding, unemployment insurance, and disability insurance. Employers must be familiar with this form to accurately fulfill their tax obligations and avoid penalties.

How to Use the DE 88 Form

Using the DE 88 form involves several steps to ensure accurate reporting and timely deposits. Employers must first determine their payroll tax liabilities for the reporting period. Once the liabilities are calculated, the form should be filled out with the appropriate amounts. After completing the form, employers can submit it electronically or via mail, depending on their preference and compliance requirements. It is essential to keep a copy of the submitted form for record-keeping purposes.

Steps to Complete the DE 88 Form

Completing the DE 88 form requires careful attention to detail. Here are the steps to follow:

- Gather payroll records for the reporting period.

- Calculate total payroll tax liabilities, including state income tax withholding and unemployment insurance.

- Fill out the DE 88 form with the calculated amounts, ensuring accuracy.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail, following state guidelines.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines when submitting the DE 88 form. Generally, payroll tax deposits are due on a semi-weekly or monthly basis, depending on the employer's total tax liability. It is crucial to stay informed about these deadlines to avoid late fees and penalties. Employers should consult the California Employment Development Department (EDD) for the most current deadlines and any changes to the filing schedule.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the DE 88 form can result in significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential legal action for persistent non-compliance. Employers are encouraged to familiarize themselves with the consequences of non-compliance to ensure they meet all obligations and avoid unnecessary costs.

Form Submission Methods

The DE 88 form can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission through the California EDD website.

- Mailing a paper copy of the completed form to the appropriate EDD address.

- In-person submission at designated EDD offices.

Employers should choose the method that best suits their operational needs while ensuring compliance with submission guidelines.

Quick guide on how to complete de88 form 397259999

Effortlessly prepare De88 Form on any device

Digital document management has become increasingly favored by organizations and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage De88 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Seamless editing and eSigning of De88 Form

- Find De88 Form and click Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and hit the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the frustration of tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign De88 Form, ensuring excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct de88 form 397259999

Create this form in 5 minutes!

How to create an eSignature for the de88 form 397259999

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a California payroll tax deposit?

A California payroll tax deposit is a payment made by employers to the state to cover employee payroll taxes. This includes contributions for unemployment insurance, disability insurance, and personal income tax withholding. Understanding how to manage these deposits is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with California payroll tax deposits?

airSlate SignNow streamlines the process of managing California payroll tax deposits by allowing businesses to easily send and eSign necessary documents. This ensures that all payroll tax forms are completed accurately and submitted on time. Our platform simplifies compliance, making it easier for businesses to focus on growth.

-

What features does airSlate SignNow offer for payroll management?

airSlate SignNow offers features such as document templates, automated workflows, and secure eSigning, which are essential for managing payroll documents, including those related to California payroll tax deposits. These features enhance efficiency and reduce the risk of errors in payroll processing. Additionally, our platform is user-friendly, making it accessible for all team members.

-

Is airSlate SignNow cost-effective for managing payroll tax deposits?

Yes, airSlate SignNow is a cost-effective solution for managing California payroll tax deposits. Our pricing plans are designed to fit various business sizes and budgets, ensuring that you get the best value for your investment. By reducing paperwork and streamlining processes, our solution can save you time and money.

-

Can airSlate SignNow integrate with other payroll systems?

Absolutely! airSlate SignNow integrates seamlessly with various payroll systems, allowing for efficient management of California payroll tax deposits. This integration ensures that all payroll data is synchronized, reducing the risk of discrepancies and enhancing overall workflow. You can easily connect your existing systems to our platform.

-

What are the benefits of using airSlate SignNow for payroll tax compliance?

Using airSlate SignNow for payroll tax compliance offers numerous benefits, including improved accuracy, faster processing times, and enhanced security for sensitive documents. Our platform helps ensure that your California payroll tax deposits are handled correctly, minimizing the risk of audits and penalties. This peace of mind allows you to focus on your core business activities.

-

How does airSlate SignNow ensure the security of payroll documents?

airSlate SignNow prioritizes the security of your payroll documents through advanced encryption and secure cloud storage. This ensures that all information related to California payroll tax deposits is protected from unauthorized access. Our compliance with industry standards further guarantees that your sensitive data remains safe.

Get more for De88 Form

Find out other De88 Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document