Loan Against Deposit Application Form 2023-2026

What is the Loan Against Deposit Application Form

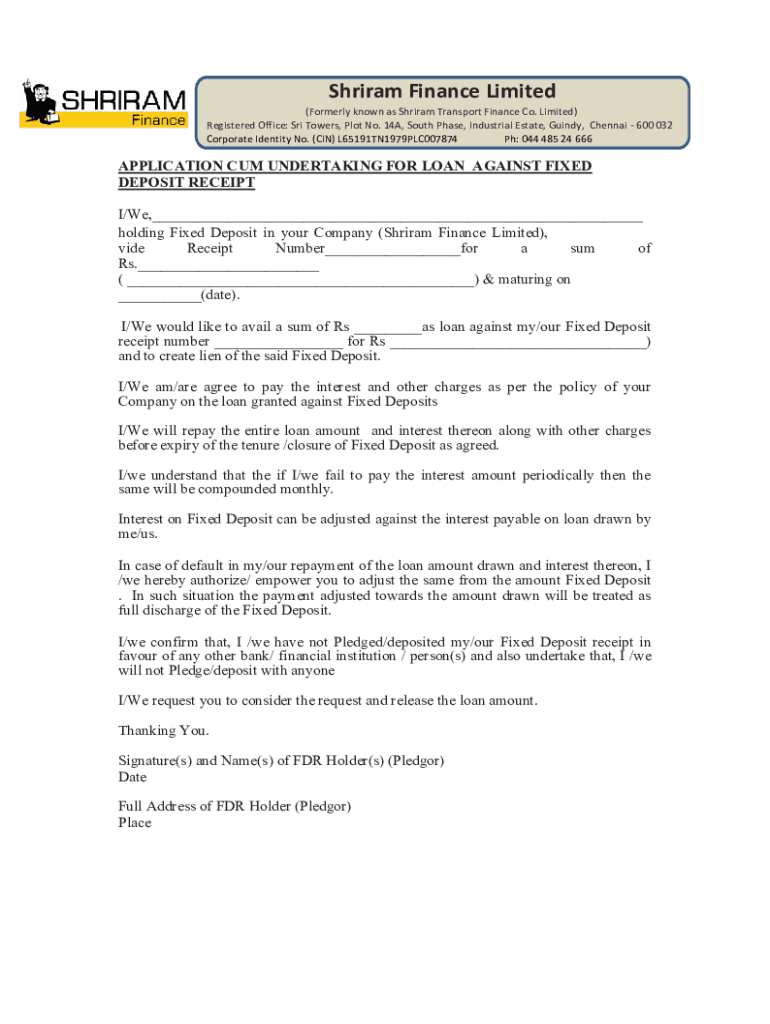

The Loan Against Deposit Application Form is a document used by individuals or businesses to request a loan secured by a fixed deposit. This form outlines the borrower's details, the amount requested, and the terms of the loan. It serves as a formal request to the financial institution, indicating the intention to use the fixed deposit as collateral. Understanding this form is crucial for anyone considering leveraging their fixed deposit for financial needs.

How to use the Loan Against Deposit Application Form

To effectively use the Loan Against Deposit Application Form, begin by gathering necessary information, including your fixed deposit details and personal identification. Fill out the form accurately, ensuring all required fields are completed. After submission, the financial institution will review your application, assess your eligibility, and determine the loan amount based on the value of your fixed deposit. Keep a copy of the submitted form for your records.

Steps to complete the Loan Against Deposit Application Form

Completing the Loan Against Deposit Application Form involves several key steps:

- Obtain the form from your bank or financial institution.

- Provide personal details, including your name, address, and contact information.

- Include information about the fixed deposit, such as the account number and maturity date.

- Specify the loan amount you wish to request.

- Sign and date the form to confirm your application.

Review the completed form for accuracy before submission to avoid any delays in processing.

Key elements of the Loan Against Deposit Application Form

The Loan Against Deposit Application Form contains several key elements that are essential for processing your request:

- Applicant Information: Personal details of the borrower.

- Deposit Information: Details of the fixed deposit being used as collateral.

- Loan Amount: The specific amount requested by the borrower.

- Terms and Conditions: Any relevant terms associated with the loan.

- Signature: The borrower's signature to authorize the application.

Required Documents

When submitting the Loan Against Deposit Application Form, certain documents are typically required to support your application. These may include:

- A copy of the fixed deposit receipt.

- Government-issued identification, such as a driver's license or passport.

- Proof of income or employment verification.

- Any additional documents specified by the financial institution.

Providing complete documentation helps expedite the approval process.

Form Submission Methods

The Loan Against Deposit Application Form can usually be submitted through various methods, depending on the policies of the financial institution:

- Online: Many banks offer online submission through their websites or mobile apps.

- Mail: You can send the completed form via postal service to the bank's designated address.

- In-Person: Submitting the form directly at a bank branch allows for immediate processing and assistance.

Choose the method that best suits your needs and ensure that you keep a copy of your submission.

Eligibility Criteria

Eligibility for a loan against a fixed deposit typically includes several criteria that applicants must meet:

- The applicant must be the account holder of the fixed deposit.

- The fixed deposit must be active and not nearing maturity.

- Creditworthiness may be assessed based on the applicant's financial history.

- The requested loan amount should generally not exceed a certain percentage of the fixed deposit value.

Understanding these criteria can help applicants prepare their applications more effectively.

Quick guide on how to complete loan against deposit application form

Effortlessly Prepare Loan Against Deposit Application Form on Any Device

Digital document management has gained signNow traction among organizations and individuals alike. It presents an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Loan Against Deposit Application Form on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Alter and eSign Loan Against Deposit Application Form with Little Effort

- Find Loan Against Deposit Application Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the document or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your adjustments.

- Select how you would prefer to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Loan Against Deposit Application Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct loan against deposit application form

Create this form in 5 minutes!

How to create an eSignature for the loan against deposit application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application for fixed deposit?

The application for fixed deposit is a formal request to open a fixed deposit account with a bank or financial institution. This application allows you to invest a lump sum amount for a specified tenure at a fixed interest rate. By submitting this application, you can secure your funds and earn interest over time.

-

How do I submit an application for fixed deposit?

To submit an application for fixed deposit, you can visit your bank's website or branch. Most banks offer an online application process where you can fill out the required details and upload necessary documents. Ensure that you have all the information ready to expedite the process.

-

What documents are required for the application for fixed deposit?

Typically, the documents required for the application for fixed deposit include proof of identity, proof of address, and PAN card for tax purposes. Some banks may also ask for additional documents depending on their policies. It's best to check with your bank for a complete list of requirements.

-

What are the benefits of using the application for fixed deposit?

The application for fixed deposit offers several benefits, including guaranteed returns, safety of principal amount, and fixed interest rates. It is an ideal investment option for risk-averse individuals looking to grow their savings over time. Additionally, many banks provide flexible tenure options to suit your financial goals.

-

Is there a minimum amount required for the application for fixed deposit?

Yes, most banks have a minimum deposit requirement for the application for fixed deposit, which can vary signNowly. This amount can range from a few thousand to several lakhs, depending on the bank's policies. It's advisable to check with your chosen bank for their specific minimum deposit criteria.

-

Can I withdraw my funds before the maturity of the application for fixed deposit?

While you can withdraw funds before the maturity of the application for fixed deposit, it may incur penalties or reduced interest rates. Early withdrawal policies vary by bank, so it's important to understand the terms before committing. Generally, it's best to keep your funds until maturity to maximize your returns.

-

How does the interest calculation work for the application for fixed deposit?

Interest for the application for fixed deposit is typically calculated on a quarterly or monthly basis, depending on the bank's terms. The interest rate is fixed at the time of deposit and remains unchanged throughout the tenure. This ensures that you know exactly how much you will earn by the end of the term.

Get more for Loan Against Deposit Application Form

- City state zip decedents social security number ssn form

- For calendar year or tax year beginning form

- Form ct 200 v payment voucher for e filed corporation tax

- Form mta 305 employers quarterly metropolitan commuter transportation mobility tax return revised 723

- Request and authority for leave arn39556 daform31 000 efile 1 pdf

- Corporate ampamp commercial financial services agreement form

- Form pcr political contribution refund application

- Get mn form mwr reciprocity exemptionaffidavit of

Find out other Loan Against Deposit Application Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online