Oklahoma Resident Individual Income Tax Forms and Tax Ok 2021

Understanding the Oklahoma Resident Individual Income Tax Forms

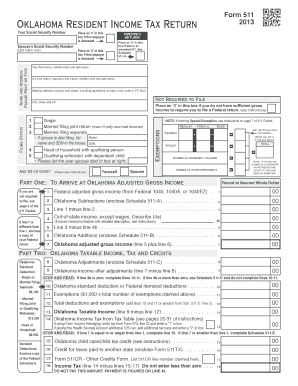

The Oklahoma Resident Individual Income Tax Forms are essential documents for residents of Oklahoma to report their income and calculate their state tax liability. These forms are used to gather information about an individual's income, deductions, and credits, which are necessary for determining the amount of tax owed or the refund due. The primary form used for this purpose is the Form 511, which is specifically designed for residents. Understanding these forms is crucial for accurate filing and compliance with state tax laws.

Steps to Complete the Oklahoma Resident Individual Income Tax Forms

Completing the Oklahoma Resident Individual Income Tax Forms involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out the form: Begin with the personal information section, followed by income details, deductions, and credits.

- Calculate your tax: Use the provided tax tables or software to determine your tax liability based on your income and deductions.

- Review your form: Double-check all entries for accuracy to avoid mistakes that could lead to penalties.

- Submit your form: Choose your submission method—online, by mail, or in person—and ensure it is sent by the deadline.

How to Obtain the Oklahoma Resident Individual Income Tax Forms

Obtaining the Oklahoma Resident Individual Income Tax Forms is straightforward. Residents can access these forms through the Oklahoma Tax Commission's official website, where they are available for download. Additionally, physical copies can often be found at local libraries, post offices, and tax preparation offices. It is important to ensure you are using the correct version of the forms for the tax year you are filing.

Filing Deadlines and Important Dates

Filing deadlines for the Oklahoma Resident Individual Income Tax Forms typically align with federal tax deadlines. Generally, the deadline for filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to be aware of these dates to avoid late fees and penalties.

Required Documents for Filing

To successfully complete the Oklahoma Resident Individual Income Tax Forms, certain documents are required:

- W-2 forms: These are issued by employers and report annual wages and taxes withheld.

- 1099 forms: These are used for reporting various types of income other than wages, such as freelance earnings.

- Proof of deductions: Documentation for any deductions claimed, such as mortgage interest statements or charitable contributions.

- Identification: A valid driver's license or state ID may be required for verification purposes.

Legal Use of the Oklahoma Resident Individual Income Tax Forms

The Oklahoma Resident Individual Income Tax Forms must be completed and submitted in accordance with state tax laws. Legal use of these forms includes accurately reporting income, claiming eligible deductions and credits, and submitting the forms by the established deadlines. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes.

Quick guide on how to complete oklahoma resident individual income tax forms and tax ok

Complete Oklahoma Resident Individual Income Tax Forms And Tax Ok effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without holdups. Manage Oklahoma Resident Individual Income Tax Forms And Tax Ok on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Oklahoma Resident Individual Income Tax Forms And Tax Ok with ease

- Find Oklahoma Resident Individual Income Tax Forms And Tax Ok and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Edit and eSign Oklahoma Resident Individual Income Tax Forms And Tax Ok and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma resident individual income tax forms and tax ok

Create this form in 5 minutes!

How to create an eSignature for the oklahoma resident individual income tax forms and tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Oklahoma Resident Individual Income Tax Forms And Tax Ok?

Oklahoma Resident Individual Income Tax Forms And Tax Ok are the official documents required for filing individual income taxes in Oklahoma. These forms help residents report their income, deductions, and credits to ensure compliance with state tax laws. Using airSlate SignNow, you can easily access and eSign these forms, streamlining your tax filing process.

-

How can airSlate SignNow help with Oklahoma Resident Individual Income Tax Forms And Tax Ok?

airSlate SignNow provides a user-friendly platform to manage your Oklahoma Resident Individual Income Tax Forms And Tax Ok. You can fill out, sign, and send these forms electronically, saving time and reducing the hassle of paper-based processes. Our solution ensures that your documents are secure and compliant with state regulations.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Oklahoma Resident Individual Income Tax Forms And Tax Ok. These tools enhance your efficiency by allowing you to manage your tax documents seamlessly. Additionally, our platform integrates with various applications to streamline your workflow.

-

Is airSlate SignNow cost-effective for managing tax forms?

Yes, airSlate SignNow is a cost-effective solution for managing Oklahoma Resident Individual Income Tax Forms And Tax Ok. Our pricing plans are designed to fit various budgets, ensuring that individuals and businesses can access essential tax document management tools without breaking the bank. You can choose a plan that best suits your needs.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates with popular tax preparation software, making it easier to manage your Oklahoma Resident Individual Income Tax Forms And Tax Ok. This integration allows for a seamless flow of information, reducing the risk of errors and saving you time during tax season. You can connect with tools you already use for a more efficient experience.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your Oklahoma Resident Individual Income Tax Forms And Tax Ok offers numerous benefits, including enhanced security, ease of use, and faster processing times. Our platform allows you to eSign documents from anywhere, ensuring you can meet deadlines without the stress of traditional paperwork. Additionally, our customer support is available to assist you with any questions.

-

How secure is airSlate SignNow for handling tax documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like Oklahoma Resident Individual Income Tax Forms And Tax Ok. We utilize advanced encryption and secure cloud storage to protect your information. Our compliance with industry standards ensures that your tax documents are safe and secure throughout the signing process.

Get more for Oklahoma Resident Individual Income Tax Forms And Tax Ok

Find out other Oklahoma Resident Individual Income Tax Forms And Tax Ok

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple