Oklahoma Resident Income Tax Return Form 511 2021-2026

What is the Oklahoma Resident Income Tax Return Form 511

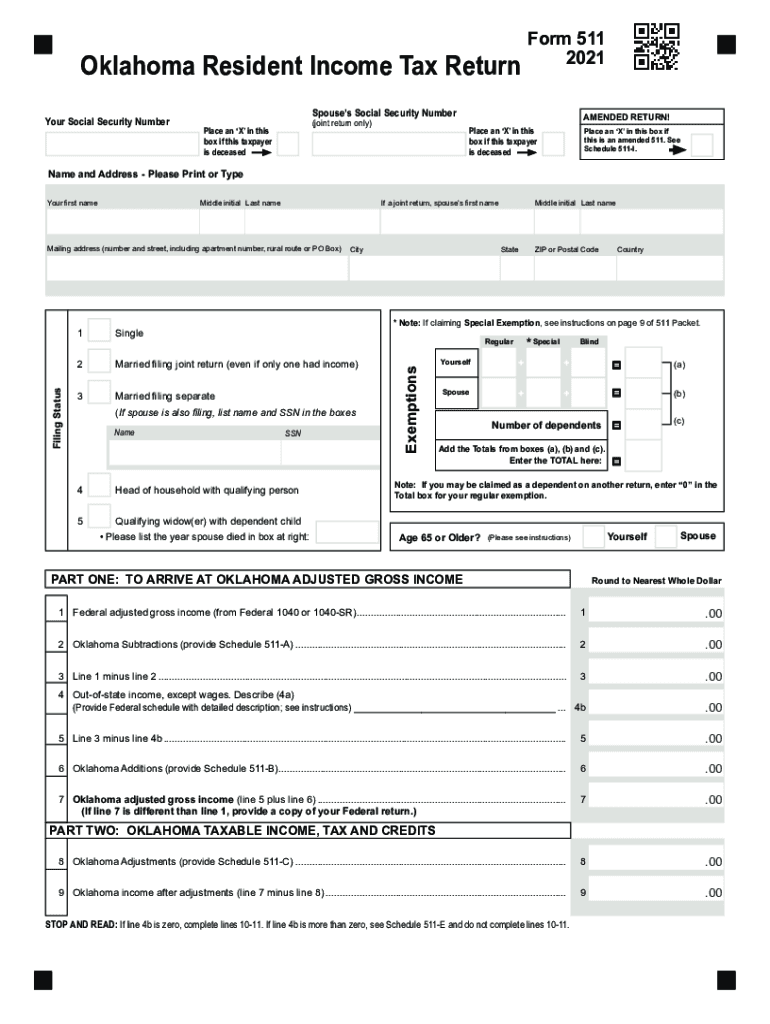

The Oklahoma Resident Income Tax Return Form 511 is a crucial document for individuals residing in Oklahoma who need to report their income and calculate their state tax liability. This form is specifically designed for residents and is used to determine the amount of tax owed to the state based on various income sources. The 2014 version of this form adheres to the tax regulations in effect for that year, ensuring compliance with state laws. It is essential for residents to accurately complete this form to avoid penalties and ensure proper tax processing.

Steps to Complete the Oklahoma Resident Income Tax Return Form 511

Completing the Oklahoma Resident Income Tax Return Form 511 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Accurately list all sources of income, including wages, interest, dividends, and any other taxable income.

- Calculate deductions: Identify and apply any applicable deductions that can reduce your taxable income, such as standard deductions or itemized deductions.

- Determine tax liability: Use the tax tables provided with the form to calculate the amount of tax owed based on your taxable income.

- Sign and date the form: Ensure that you sign and date the form to validate it before submission.

How to Obtain the Oklahoma Resident Income Tax Return Form 511

The Oklahoma Resident Income Tax Return Form 511 can be obtained through various methods. Residents can access the form directly from the Oklahoma Tax Commission's website, where it is available for download in PDF format. Additionally, physical copies of the form may be available at local tax offices and public libraries. It is advisable to ensure you are using the correct version for the tax year, such as the 2014 Oklahoma tax forms, to avoid any compliance issues.

Legal Use of the Oklahoma Resident Income Tax Return Form 511

The legal use of the Oklahoma Resident Income Tax Return Form 511 is governed by state tax laws. To be considered valid, the form must be filled out accurately and submitted by the designated deadline. Electronic signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Using a reliable eSignature platform can enhance the legal standing of your submission, ensuring it meets all regulatory requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Resident Income Tax Return Form 511 are crucial for compliance. For the 2014 tax year, the typical deadline for filing the return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to be aware of these dates to avoid late filing penalties and interest on any taxes owed.

Required Documents

When completing the Oklahoma Resident Income Tax Return Form 511, certain documents are required to ensure accurate reporting. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as interest or dividends

- Documentation for any deductions claimed, such as mortgage interest statements or medical expenses

Having these documents readily available will facilitate a smoother and more accurate filing process.

Quick guide on how to complete oklahoma resident income tax return form 511

Effortlessly Prepare Oklahoma Resident Income Tax Return Form 511 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, adjust, and electronically sign your documents quickly and without delays. Manage Oklahoma Resident Income Tax Return Form 511 on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign Oklahoma Resident Income Tax Return Form 511 with Ease

- Obtain Oklahoma Resident Income Tax Return Form 511 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Oklahoma Resident Income Tax Return Form 511 to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma resident income tax return form 511

Create this form in 5 minutes!

How to create an eSignature for the oklahoma resident income tax return form 511

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What are 2014 Oklahoma tax forms and why are they important?

2014 Oklahoma tax forms are official documents required for filing state taxes for that year. They are essential for ensuring compliance with state tax laws and correctly reporting your income. Completing these forms accurately can help you avoid penalties and secure any eligible refunds.

-

How can airSlate SignNow help with 2014 Oklahoma tax forms?

airSlate SignNow offers a streamlined process to fill out and eSign your 2014 Oklahoma tax forms efficiently. With its user-friendly interface, you can easily manage the signing process, ensuring that all documents are completed and submitted on time, simplifying your tax preparation.

-

What is the pricing structure for using airSlate SignNow for 2014 Oklahoma tax forms?

AirSlate SignNow offers competitive pricing plans that cater to different needs when working with 2014 Oklahoma tax forms. You can choose from various subscription options, which provide flexible access to features like unlimited signing and document storage, ensuring you get the best value for your tax preparation.

-

Can I integrate airSlate SignNow with accounting software for my 2014 Oklahoma tax forms?

Yes, airSlate SignNow can integrate seamlessly with various accounting software platforms. This allows you to import necessary data directly into your 2014 Oklahoma tax forms, streamlining your tax filing process and improving overall efficiency.

-

What features does airSlate SignNow offer to assist with 2014 Oklahoma tax forms?

AirSlate SignNow provides several key features that help with managing 2014 Oklahoma tax forms, including customizable templates, document sharing, and secure eSignature options. These features facilitate easy collaboration and ensure that all necessary parties can review and sign documents quickly.

-

Are there any benefits to using airSlate SignNow for my 2014 Oklahoma tax forms?

Using airSlate SignNow for your 2014 Oklahoma tax forms offers numerous benefits, such as time savings and reduced errors. The digital platform enables faster document turnaround and helps ensure all signatures are collected, providing you peace of mind during tax season.

-

How secure is airSlate SignNow for handling 2014 Oklahoma tax forms?

AirSlate SignNow takes security seriously and employs industry-standard encryption to protect your data, including your 2014 Oklahoma tax forms. With multiple layers of security, you can trust that your sensitive tax information is safe and secure when using our platform.

Get more for Oklahoma Resident Income Tax Return Form 511

- Complex will with credit shelter marital trust for large estates new jersey form

- New jersey corporation 497319384 form

- Nj workers compensation form

- New jersey workers compensation 497319386 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497319387 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497319388 form

- Nj settlement minor form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497319390 form

Find out other Oklahoma Resident Income Tax Return Form 511

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form