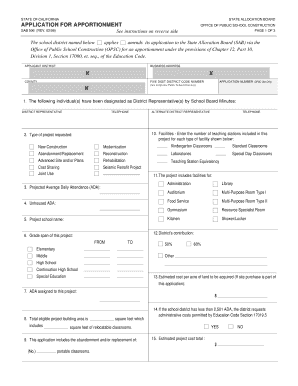

SAB 506, Rev 298 Application for Apportionment Form

Understanding the SAB 506, Rev 298 Application For Apportionment

The SAB 506, Rev 298 Application For Apportionment is a crucial document used in various financial and legal contexts. This application is primarily designed for individuals or entities seeking to apportion income or expenses across different jurisdictions. It is essential for ensuring compliance with state and federal regulations, particularly for businesses operating in multiple states. The form facilitates the accurate reporting of income, allowing taxpayers to allocate their earnings appropriately based on their operational footprint.

Steps to Complete the SAB 506, Rev 298 Application For Apportionment

Completing the SAB 506, Rev 298 Application For Apportionment involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the application form, providing detailed information about your business operations and income sources. Ensure that you accurately apportion income based on the jurisdictions where your business operates. After completing the form, review it for any errors or omissions before submission.

Required Documents for the SAB 506, Rev 298 Application For Apportionment

When preparing to submit the SAB 506, Rev 298 Application For Apportionment, certain documents are required to support your application. These may include:

- Income statements for the relevant tax year

- Expense reports detailing operational costs

- Records of any prior apportionment applications

- Documentation of business activities in each jurisdiction

Having these documents ready will streamline the application process and help ensure that all information is accurate and complete.

Filing Deadlines for the SAB 506, Rev 298 Application For Apportionment

It is important to be aware of the filing deadlines associated with the SAB 506, Rev 298 Application For Apportionment. Typically, applications must be submitted by a specific date to be considered for the current tax year. Missing the deadline can result in penalties or the inability to apportion income as desired. Check with your state’s tax authority for the exact dates and any potential extensions that may be available.

Legal Use of the SAB 506, Rev 298 Application For Apportionment

The SAB 506, Rev 298 Application For Apportionment serves a legal purpose in ensuring compliance with tax regulations. Properly completing and submitting this application allows taxpayers to legally apportion their income across jurisdictions, which can significantly affect tax liabilities. Failure to use this form correctly may lead to legal repercussions, including audits or penalties from tax authorities.

Application Process & Approval Time for the SAB 506, Rev 298 Application For Apportionment

The application process for the SAB 506, Rev 298 Application For Apportionment involves submitting the completed form along with the required documentation to the appropriate tax authority. Once submitted, the review and approval time can vary based on the jurisdiction and the complexity of the application. Typically, applicants can expect a response within a few weeks, but it is advisable to check with local tax offices for more specific timelines.

Quick guide on how to complete sab 506 rev 298 application for apportionment

Effortlessly prepare [SKS] on any gadget

Digital document management has become a trend among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign [SKS] and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sab 506 rev 298 application for apportionment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SAB 506, Rev 298 Application For Apportionment?

The SAB 506, Rev 298 Application For Apportionment is a document used by businesses to request the allocation of resources or benefits under specific regulations. This application ensures compliance with state guidelines and helps streamline the process of resource distribution.

-

How can airSlate SignNow assist with the SAB 506, Rev 298 Application For Apportionment?

airSlate SignNow provides a user-friendly platform for businesses to create, send, and eSign the SAB 506, Rev 298 Application For Apportionment. Our solution simplifies the document management process, ensuring that your application is completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for the SAB 506, Rev 298 Application For Apportionment?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small startup or a large enterprise, you can choose a plan that fits your budget while ensuring you have access to the tools needed for the SAB 506, Rev 298 Application For Apportionment.

-

What features does airSlate SignNow offer for the SAB 506, Rev 298 Application For Apportionment?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for the SAB 506, Rev 298 Application For Apportionment. These tools enhance efficiency and ensure that your documents are processed quickly and securely.

-

Are there any integrations available with airSlate SignNow for the SAB 506, Rev 298 Application For Apportionment?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, allowing you to manage the SAB 506, Rev 298 Application For Apportionment alongside your existing workflows. This integration capability enhances productivity and ensures a smooth document flow.

-

What are the benefits of using airSlate SignNow for the SAB 506, Rev 298 Application For Apportionment?

Using airSlate SignNow for the SAB 506, Rev 298 Application For Apportionment offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform helps businesses save time and resources while ensuring compliance with regulatory requirements.

-

Is airSlate SignNow secure for handling the SAB 506, Rev 298 Application For Apportionment?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your documents, including the SAB 506, Rev 298 Application For Apportionment. You can trust that your sensitive information is safe with us.

Get more for SAB 506, Rev 298 Application For Apportionment

- Planning pre application form south cambridgeshire district

- 4 h constructed accessory using fabric exhibit entry form igrow

- Final report guidelines atherton family foundation athertonfamilyfoundation form

- Exclusive right to sell listing contract colorado real estate commission approved form

- Real estate commission distribution form

- Musculoskeletal examination ppt form

- Ponder isd form

- The secret lives of sgt john wilson prairie spirit school division bb spiritsd form

Find out other SAB 506, Rev 298 Application For Apportionment

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document