Form A3 2017-2026

What is the Form A3

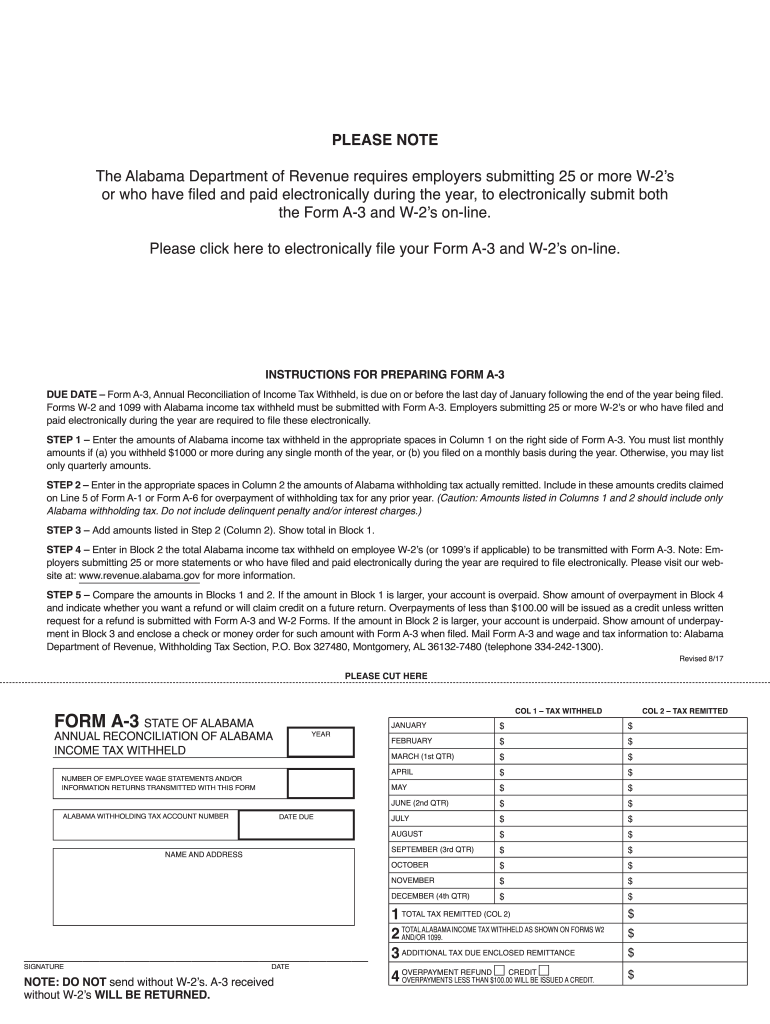

The 2001 A3 form, often referred to as the Alabama Form A3, is a reconciliation form used by taxpayers in Alabama to report income tax withholding. This form is essential for employers who need to reconcile the amounts withheld from employees' wages against what has been reported to the Alabama Department of Revenue. The A3 form ensures that the state receives accurate information regarding tax withholdings, which is crucial for both compliance and record-keeping purposes.

How to use the Form A3

To effectively use the 2001 A3 form, employers must gather all relevant payroll records for the tax year. This includes total wages paid, the amount of state income tax withheld, and any adjustments that may need to be made. The form allows employers to report these figures and ensure that the correct amounts are submitted to the state. It is important to follow the instructions provided with the form to avoid errors that could lead to penalties.

Steps to complete the Form A3

Completing the 2001 A3 form involves several key steps:

- Gather all payroll records, including wages and tax withholdings.

- Fill in the employer's information, including name, address, and tax identification number.

- Report the total amount of wages paid and the total state tax withheld for the year.

- Include any necessary adjustments or corrections.

- Sign and date the form to certify its accuracy.

Once completed, the form can be submitted to the Alabama Department of Revenue.

Legal use of the Form A3

The 2001 A3 form is legally required for employers in Alabama to report and reconcile state income tax withholdings. Failure to submit this form accurately and on time can result in penalties and interest. The form must be completed in accordance with the guidelines set forth by the Alabama Department of Revenue to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

It is crucial for employers to be aware of the filing deadlines associated with the 2001 A3 form. Typically, the form must be submitted by January 31 of the following year after the tax year ends. Employers should also keep in mind that any corrections or adjustments may have specific deadlines to avoid penalties.

Form Submission Methods

The 2001 A3 form can be submitted through various methods:

- Online: Employers can file electronically through the Alabama Department of Revenue's e-filing system.

- Mail: The form can be printed and mailed to the appropriate address provided by the Alabama Department of Revenue.

- In-Person: Employers may also choose to submit the form in person at their local tax office.

Each submission method has its own processing times, so employers should plan accordingly.

Quick guide on how to complete al form 2017 2018

Your assistance manual on how to prepare your Form A3

If you’re interested in learning how to complete and submit your Form A3, here are a few brief instructions to simplify your tax filing process.

To begin, you merely need to create your airSlate SignNow profile to transform the way you manage documentation online. airSlate SignNow is an extremely user-friendly and efficient document management solution that enables you to edit, create, and finalize your tax documents effortlessly. Utilizing its editor, you can alternate between text, check boxes, and digital signatures, and return to modify details as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and intuitive sharing options.

Follow the steps below to complete your Form A3 in minutes:

- Create your account and start working on PDFs quickly.

- Utilize our library to obtain any IRS tax form; browse through variants and schedules.

- Click Get form to access your Form A3 in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing can lead to return errors and delays in reimbursements. Certainly, before e-filing your taxes, verify the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct al form 2017 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

If I was unable to fill SSC Cgl 2017, can I fill SSC Cgl 2018 form?

Don’t wait till the last date, apply your form well in advance. If still you are unable to fill your form, you may fill in 2018.

Create this form in 5 minutes!

How to create an eSignature for the al form 2017 2018

How to make an electronic signature for the Al Form 2017 2018 in the online mode

How to make an electronic signature for your Al Form 2017 2018 in Chrome

How to generate an eSignature for signing the Al Form 2017 2018 in Gmail

How to create an eSignature for the Al Form 2017 2018 right from your smart phone

How to make an eSignature for the Al Form 2017 2018 on iOS

How to create an eSignature for the Al Form 2017 2018 on Android

People also ask

-

What is the Form A3 and how does it work with airSlate SignNow?

The Form A3 is a customizable document template designed for easy electronic signing. With airSlate SignNow, users can create, send, and eSign Form A3 quickly and securely, streamlining the document workflow and reducing the time spent on paperwork.

-

How much does it cost to use the Form A3 template in airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the Form A3 template. Depending on your business needs, you can choose from various subscription options, ensuring you get the best value for the features you require.

-

What features are included with the Form A3 in airSlate SignNow?

The Form A3 in airSlate SignNow comes equipped with a range of features including drag-and-drop document creation, customizable fields, and secure electronic signatures. These capabilities enhance the efficiency of your document management process, making it easier to handle Form A3.

-

Can I integrate the Form A3 with other software tools?

Yes, airSlate SignNow allows seamless integration of the Form A3 with various third-party applications such as CRM systems, cloud storage, and productivity tools. This integration helps you automate workflows and enhance collaboration across your business.

-

What are the benefits of using the Form A3 in airSlate SignNow?

Using the Form A3 in airSlate SignNow offers numerous benefits, including faster turnaround times for document approvals and enhanced security for your sensitive information. It also helps improve overall efficiency by reducing the need for paper and manual processes.

-

Is the Form A3 template mobile-friendly?

Absolutely! The Form A3 template in airSlate SignNow is fully optimized for mobile use. This means you can easily access, fill out, and eSign documents on the go, ensuring convenience and flexibility for busy professionals.

-

How do I start using the Form A3 in airSlate SignNow?

To start using the Form A3 in airSlate SignNow, simply sign up for an account and access the template library. From there, you can customize the Form A3 to fit your specific needs and begin sending it for eSignature.

Get more for Form A3

- Stna and cna skills checklist sssolutions4ucom form

- Extension and amendment of management agreement ihdaorg form

- Bond estimate declaration los angeles county assessors office assessor lacounty form

- Blank car title template form 254731257

- Counseling record lhibenefitsportalinfo lhi benefitsportal form

- Prey worksheet form

- Part a part a part a af form 1492 oct 91 af form 1492 carpooleielson

- Nrca lti 03 e pdf california energy commission drecp orgwww drecp form

Find out other Form A3

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later