Schedule NLD Illinois Net Loss Deduction Illinois Department of Form

What is the Schedule NLD Illinois Net Loss Deduction?

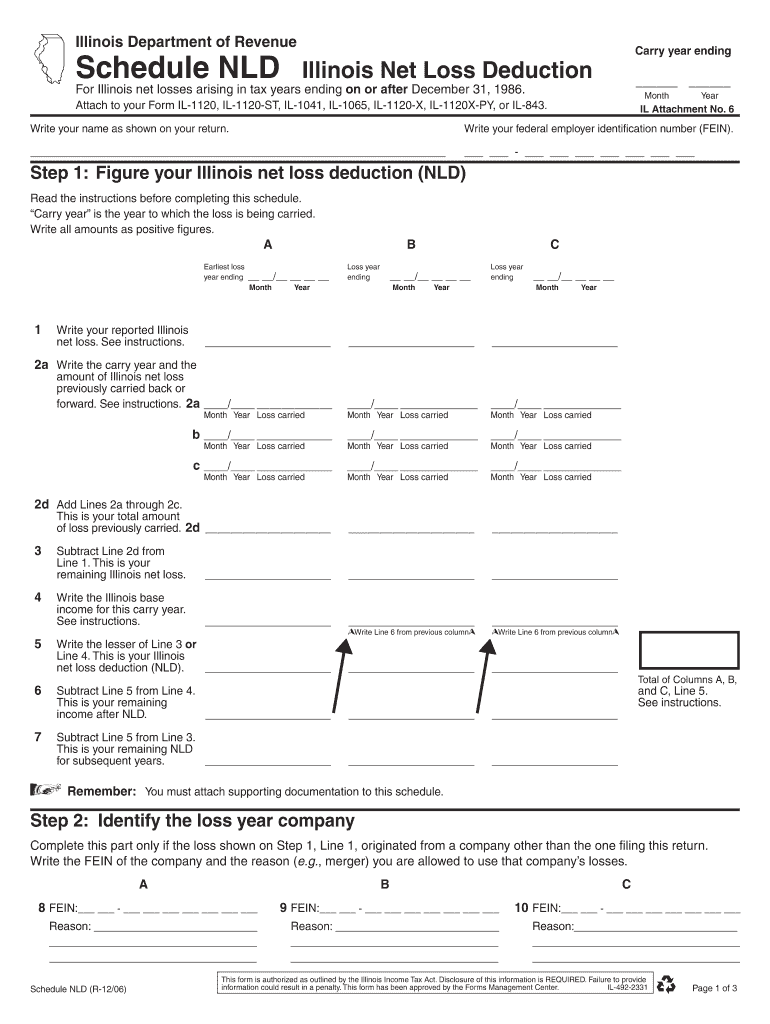

The Schedule NLD Illinois Net Loss Deduction is a tax form used by businesses and individuals in Illinois to report net operating losses. This form allows taxpayers to deduct losses incurred in prior years from their current taxable income, thereby reducing their overall tax liability. The Illinois Department of Revenue oversees the administration of this deduction, ensuring compliance with state tax laws.

How to use the Schedule NLD Illinois Net Loss Deduction

To effectively utilize the Schedule NLD, taxpayers must first determine their net operating loss for the applicable tax year. This involves calculating total income and subtracting allowable deductions to arrive at the net loss figure. Once the net loss is established, it can be reported on the Schedule NLD form, which should be submitted along with the state income tax return. Accurate completion of this form is essential to ensure that the deduction is applied correctly.

Steps to complete the Schedule NLD Illinois Net Loss Deduction

Completing the Schedule NLD involves several key steps:

- Gather financial documents, including income statements and expense reports.

- Calculate the net operating loss by subtracting total deductions from total income.

- Fill out the Schedule NLD form with the calculated net loss.

- Attach the completed Schedule NLD to your Illinois income tax return.

- Review the form for accuracy before submission to avoid delays or penalties.

Eligibility Criteria

To qualify for the Schedule NLD Illinois Net Loss Deduction, taxpayers must have incurred a net operating loss in a previous tax year. This loss can arise from various sources, including business operations, rental properties, or other income-generating activities. Additionally, taxpayers must adhere to specific state guidelines regarding the reporting and utilization of these losses, ensuring they meet all necessary eligibility requirements.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines when filing the Schedule NLD. Typically, the Illinois income tax return, including the Schedule NLD, must be filed by April fifteenth of the following year. Extensions may be available, but it is crucial to check with the Illinois Department of Revenue for specific dates and any changes that may occur annually.

Required Documents

When preparing to file the Schedule NLD, several documents are necessary to support the reported net loss. These may include:

- Prior year tax returns to establish loss amounts.

- Financial statements detailing income and expenses.

- Any documentation related to business operations or investments that contributed to the loss.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Quick guide on how to complete schedule nld illinois net loss deduction illinois department of

Complete [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, invite link, or by downloading it to your computer.

Set aside concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule NLD Illinois Net Loss Deduction Illinois Department Of

Create this form in 5 minutes!

How to create an eSignature for the schedule nld illinois net loss deduction illinois department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule NLD Illinois Net Loss Deduction?

The Schedule NLD Illinois Net Loss Deduction is a form used by businesses to claim a deduction for net losses incurred in Illinois. This deduction can help reduce taxable income, providing signNow tax relief. Understanding how to properly fill out this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow assist with the Schedule NLD Illinois Net Loss Deduction?

airSlate SignNow offers an easy-to-use platform for electronically signing and sending documents, including the Schedule NLD Illinois Net Loss Deduction. Our solution streamlines the process, ensuring that your forms are completed accurately and submitted on time. This efficiency can save you valuable time and reduce the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Schedule NLD Illinois Net Loss Deduction?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage your Schedule NLD Illinois Net Loss Deduction without breaking the bank. We provide transparent pricing with no hidden fees, allowing you to choose the plan that best fits your requirements.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing your Schedule NLD Illinois Net Loss Deduction. These features enhance collaboration and ensure that your documents are easily accessible and securely stored. Additionally, our platform supports multiple file formats for added convenience.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, making it easier to manage your Schedule NLD Illinois Net Loss Deduction. This integration allows for a more streamlined workflow, enabling you to sync data and documents across platforms effortlessly. Check our integration options to find the best fit for your business.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, including the Schedule NLD Illinois Net Loss Deduction, offers numerous benefits. Our platform enhances efficiency, reduces paperwork, and ensures compliance with legal standards. Additionally, the ability to track document status in real-time provides peace of mind during tax season.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your sensitive tax documents, including the Schedule NLD Illinois Net Loss Deduction. Our platform is designed to ensure that your information remains confidential and secure throughout the signing and submission process.

Get more for Schedule NLD Illinois Net Loss Deduction Illinois Department Of

- Ri 012 2015 2019 form

- Budget request form

- Lee county notice of hearing form 20th judicial circuit florida

- Surgery scheduling sheet form

- Iraq visa from form

- Miscellaneous statement in lieu of receipts marine corps base form

- Fit2work application st john of god health care form

- Application to proceed without prepayment of fees ohsd uscourts form

Find out other Schedule NLD Illinois Net Loss Deduction Illinois Department Of

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online