IL 1065 Tax Illinois Form

What is the IL 1065 Tax Illinois

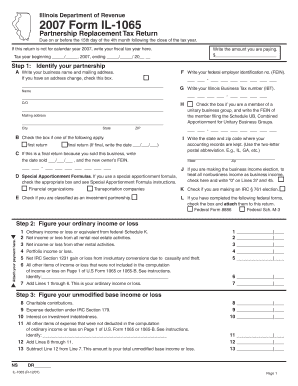

The IL 1065 Tax Illinois is a tax form specifically designed for partnerships operating within the state of Illinois. This form is used to report the income, deductions, and credits of the partnership, as well as to calculate the tax owed by the entity. Partnerships are unique in that they do not pay income tax at the entity level; instead, the income is passed through to individual partners, who then report it on their personal tax returns. Understanding the IL 1065 is essential for ensuring compliance with state tax laws and for accurate financial reporting.

Steps to complete the IL 1065 Tax Illinois

Completing the IL 1065 Tax Illinois involves several important steps. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form, ensuring that all income, deductions, and credits are reported correctly. It's important to pay attention to the specific instructions provided with the form, as they outline how to report various types of income and deductions. Once completed, review the form for accuracy before submitting it to the Illinois Department of Revenue.

Filing Deadlines / Important Dates

Filing the IL 1065 Tax Illinois is subject to specific deadlines. The form must typically be filed by the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is usually March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is crucial for partnerships to adhere to these deadlines to avoid penalties and interest on any taxes owed.

Required Documents

To successfully complete the IL 1065 Tax Illinois, several documents are required. These include:

- Financial statements, including profit and loss statements

- Records of all income received and expenses incurred

- Information on each partner's share of income, deductions, and credits

- Any relevant tax documents that support the amounts reported on the form

Having these documents organized and readily available can streamline the filing process and help ensure accuracy.

Who Issues the Form

The IL 1065 Tax Illinois is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Illinois. The department provides the necessary forms and instructions for filing, as well as resources for taxpayers seeking assistance with their tax obligations.

Penalties for Non-Compliance

Failing to file the IL 1065 Tax Illinois on time can result in significant penalties. Partnerships may face late filing penalties, which can accumulate over time. Additionally, if taxes owed are not paid, interest will accrue on the unpaid balance. It is essential for partnerships to be aware of these potential penalties and to take timely action to avoid them.

Quick guide on how to complete il 1065 tax illinois

Effortlessly Prepare [SKS] on Any Device

Digital document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right format and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS apps and streamline any document-related task today.

The Easiest Way to Modify and Electronically Sign [SKS] Effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 1065 Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the il 1065 tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1065 Tax Illinois form?

The IL 1065 Tax Illinois form is used by partnerships to report income, deductions, and credits to the state of Illinois. It is essential for compliance with state tax regulations and ensures that partnerships fulfill their tax obligations accurately.

-

How can airSlate SignNow help with IL 1065 Tax Illinois filings?

airSlate SignNow streamlines the process of preparing and signing the IL 1065 Tax Illinois form. With our easy-to-use platform, businesses can quickly send, eSign, and manage their tax documents, ensuring timely submissions and reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for IL 1065 Tax Illinois?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution allows you to choose a plan that fits your needs, ensuring you can efficiently manage your IL 1065 Tax Illinois filings without breaking the bank.

-

Are there any features specifically designed for IL 1065 Tax Illinois users?

Yes, airSlate SignNow includes features tailored for IL 1065 Tax Illinois users, such as customizable templates and automated reminders. These tools help ensure that your tax documents are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other accounting software for IL 1065 Tax Illinois?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your IL 1065 Tax Illinois filings. This integration allows for efficient data transfer and ensures that all your financial information is up-to-date.

-

What are the benefits of using airSlate SignNow for IL 1065 Tax Illinois?

Using airSlate SignNow for IL 1065 Tax Illinois offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our platform simplifies the eSigning process, allowing you to focus on your business while we handle your tax documentation.

-

Is airSlate SignNow secure for handling IL 1065 Tax Illinois documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your IL 1065 Tax Illinois documents are protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for IL 1065 Tax Illinois

- Cp40615 mandatory 116 form

- 01 page 1 of 4 state highway administration independent quality assurance erosion and sediment control field investigation form

- Ct iv contrast informed consent form

- Economic disclosure form

- Htx104 pe submittal data ebtron form

- Third party authorization rushmore loan management services dev rushmorelm forebrain form

- Tower transit application form

- Form 261

Find out other IL 1065 Tax Illinois

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast