Illinois Department of Revenue Schedule CR Credit for Tax Paid to Other States Tax Year Ending Attach to Your Form IL 1040 IL at

What is the Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States Tax Year Ending Attach To Your Form IL 1040 IL Attachment No

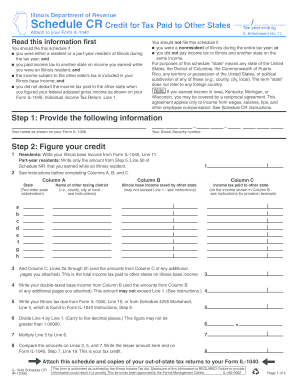

The Illinois Department Of Revenue Schedule CR is a form that allows taxpayers to claim a credit for taxes paid to other states. This credit helps to prevent double taxation on income earned in multiple states. When filing your Illinois state tax return using Form IL-1040, you must attach Schedule CR if you are eligible for this credit. The form is specifically designed for individuals who have paid income taxes to another state and wish to offset those amounts against their Illinois tax liability.

How to use the Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States Tax Year Ending Attach To Your Form IL 1040 IL Attachment No

To utilize the Schedule CR, begin by completing your Form IL-1040. After determining your taxable income, identify any taxes you have paid to other states. Complete Schedule CR by providing the necessary details regarding the taxes paid, including the state and the amount. Once filled, attach Schedule CR to your IL-1040 when submitting your tax return. Ensure that all information is accurate to avoid delays or issues with your tax filing.

Steps to complete the Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States Tax Year Ending Attach To Your Form IL 1040 IL Attachment No

Completing the Schedule CR involves several key steps:

- Gather documentation of taxes paid to other states, including W-2s and state tax returns.

- Fill out your Form IL-1040 to determine your Illinois tax liability.

- Complete Schedule CR by entering the state where taxes were paid and the corresponding amounts.

- Attach Schedule CR to your IL-1040 before submission.

- Review all entries for accuracy to ensure proper credit is applied.

Key elements of the Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States Tax Year Ending Attach To Your Form IL 1040 IL Attachment No

Important elements of Schedule CR include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- State Tax Information: Details about the other state(s) where taxes were paid.

- Credit Calculation: A section to calculate the credit based on the taxes paid and the Illinois tax liability.

- Signature: Required to validate the information provided on the form.

Eligibility Criteria

To qualify for the credit on Schedule CR, you must meet specific criteria:

- You must be a resident of Illinois.

- You must have paid income tax to another state on income that is also taxable in Illinois.

- The tax must be based on the same income that is reported on your Illinois tax return.

Form Submission Methods

Schedule CR can be submitted in conjunction with your Form IL-1040 through various methods:

- Online: Use the Illinois Department of Revenue's e-filing system to submit your tax return electronically.

- Mail: Print and mail your completed forms to the appropriate address provided by the Illinois Department of Revenue.

- In-Person: Visit a local revenue office to submit your forms directly.

Quick guide on how to complete illinois department of revenue schedule cr credit for tax paid to other states tax year ending attach to your form il 1040 il

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient way to modify and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the functionalities we provide to fill out your document.

- Emphasize important parts of the documents or obscure confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States Tax Year Ending Attach To Your Form IL 1040 IL At

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule cr credit for tax paid to other states tax year ending attach to your form il 1040 il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States Tax Year Ending?

The Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States Tax Year Ending is a form used by Illinois residents to claim a credit for taxes paid to other states. This credit helps to reduce the tax burden for individuals who earn income in multiple states. To utilize this credit, you must attach it to your Form IL 1040 IL Attachment No.

-

How do I complete the Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States?

To complete the Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States, gather your tax documents from the other states where you paid taxes. Fill out the schedule with the required information and ensure you attach it to your Form IL 1040 IL Attachment No. for accurate processing.

-

What are the benefits of using airSlate SignNow for submitting my Illinois Department Of Revenue Schedule CR?

Using airSlate SignNow simplifies the process of submitting your Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States. Our platform allows you to eSign documents securely and efficiently, ensuring that your forms are submitted on time. Additionally, our cost-effective solution helps you save both time and money.

-

Is there a cost associated with using airSlate SignNow for tax document submissions?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage your Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States efficiently. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow. This integration allows you to easily manage your Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States alongside your other tax documents, streamlining the entire process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including eSigning, document templates, and secure storage. These features are particularly useful when handling your Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States, ensuring that your documents are organized and easily accessible.

-

How can I ensure my Illinois Department Of Revenue Schedule CR is submitted correctly?

To ensure your Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States is submitted correctly, double-check all entries for accuracy and completeness. Using airSlate SignNow can help, as our platform provides prompts and guidance throughout the submission process. Additionally, always attach it to your Form IL 1040 IL Attachment No.

Get more for Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States Tax Year Ending Attach To Your Form IL 1040 IL At

Find out other Illinois Department Of Revenue Schedule CR Credit For Tax Paid To Other States Tax Year Ending Attach To Your Form IL 1040 IL At

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word