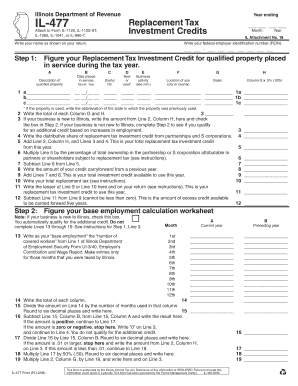

Illinois Department of Revenue Year Ending IL 477 Replacement Tax Investment Credits Attach to Form IL 1120, IL 1120 ST, IL 1065

Understanding the Illinois Department of Revenue Year Ending IL 477 Replacement Tax Investment Credits

The Illinois Department of Revenue Year Ending IL 477 Replacement Tax Investment Credits are credits available to businesses that invest in certain qualifying projects within the state. These credits can significantly reduce the tax liability for corporations, partnerships, and trusts that file forms IL 1120, IL 1120 ST, IL 1065, IL 1041, or IL 990 T. The investment credits are designed to encourage economic development and investment in Illinois, making them an essential consideration for eligible entities.

Steps to Complete the IL 477 Replacement Tax Investment Credits

Completing the IL 477 investment credits involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the investment. Next, carefully fill out the IL 477 form, ensuring that all required fields are completed. It is crucial to attach the completed form to the appropriate tax return, whether it is IL 1120, IL 1120 ST, IL 1065, IL 1041, or IL 990 T. Finally, review the entire submission for accuracy before filing it with the Illinois Department of Revenue.

Eligibility Criteria for the IL 477 Replacement Tax Investment Credits

To qualify for the IL 477 Replacement Tax Investment Credits, businesses must meet specific eligibility criteria. These criteria typically include making qualified investments in property used in Illinois, maintaining operations in the state, and filing the appropriate tax forms. Additionally, the investments must be made within the designated tax year to be eligible for credits. It is essential for businesses to assess their eligibility carefully to maximize potential tax benefits.

Legal Use of the IL 477 Replacement Tax Investment Credits

The legal use of the IL 477 Replacement Tax Investment Credits is governed by Illinois state tax law. Businesses are required to adhere to all regulations outlined by the Illinois Department of Revenue when claiming these credits. Misuse or fraudulent claims can result in penalties, including fines and interest on unpaid taxes. Therefore, it is vital for businesses to understand the legal framework surrounding these credits to ensure compliance and avoid potential legal issues.

Filing Deadlines for the IL 477 Replacement Tax Investment Credits

Filing deadlines for the IL 477 Replacement Tax Investment Credits align with the deadlines for the associated tax forms. Typically, these forms must be submitted by the 15th day of the fourth month following the close of the tax year. For example, if a business operates on a calendar year basis, the deadline would be April 15 of the following year. It is crucial for businesses to keep track of these deadlines to ensure timely submission and avoid penalties.

Common Scenarios for Using the IL 477 Replacement Tax Investment Credits

Businesses in various scenarios can benefit from the IL 477 Replacement Tax Investment Credits. For instance, a corporation expanding its facilities or a partnership investing in new equipment may both qualify for these credits. Additionally, trusts that make qualifying investments can also take advantage of the credits. Understanding how these credits apply to different business structures and situations can help entities make informed investment decisions.

Quick guide on how to complete il 477 instructions

Complete il 477 instructions effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents swiftly without delays. Manage il 477 instructions on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign il 477 without any hassle

- Find il 477 instructions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign il 477 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to il 477 instructions

Create this form in 5 minutes!

How to create an eSignature for the il 477

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask il 477

-

What are the il 477 instructions for using airSlate SignNow?

The il 477 instructions for airSlate SignNow guide users on how to effectively eSign and manage documents. These instructions provide step-by-step details on setting up your account, uploading documents, and sending them for signatures. Following these guidelines ensures a smooth and efficient signing process.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses of all sizes. The il 477 instructions can help you understand the different pricing tiers and what features are included in each. You can select a plan that best fits your needs and budget.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a variety of features including document templates, real-time tracking, and secure cloud storage. The il 477 instructions highlight how to utilize these features to streamline your document workflows. This makes it easier for businesses to manage their signing processes efficiently.

-

How can airSlate SignNow benefit my business?

Using airSlate SignNow can signNowly enhance your business's efficiency by reducing the time spent on document management. The il 477 instructions emphasize the benefits of quick eSigning and automated workflows, which can lead to faster transaction times and improved customer satisfaction. This ultimately helps in driving business growth.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality. The il 477 instructions provide details on how to connect with popular tools like CRM systems and cloud storage services. This allows for a seamless workflow across different platforms.

-

Is airSlate SignNow secure for document signing?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. The il 477 instructions explain the security measures in place to protect your documents and data. This ensures that your sensitive information remains confidential during the signing process.

-

Can I customize my documents with airSlate SignNow?

Yes, airSlate SignNow allows users to customize documents with various fields and templates. The il 477 instructions guide you on how to create personalized documents that meet your specific needs. This feature enhances the user experience and ensures that all necessary information is captured.

Get more for il 477 instructions

Find out other il 477

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online