Illinois Department of Revenue IL 1000 P What is the Purpose of Form IL 1000 P Tax Illinois

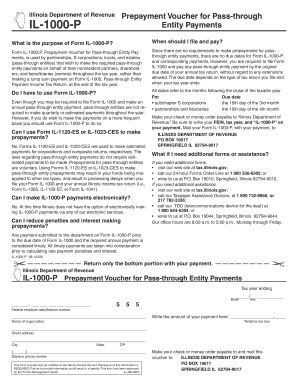

What is the Illinois Department Of Revenue IL 1000 P?

The Illinois Department of Revenue IL 1000 P is a specific tax form used for reporting various tax-related information in the state of Illinois. This form is primarily designed for individuals and businesses to disclose income, deductions, and other relevant financial data to the state revenue authorities. It plays a crucial role in ensuring compliance with state tax laws and regulations.

How to use the Illinois Department Of Revenue IL 1000 P

To effectively use the IL 1000 P form, taxpayers should first gather all necessary financial documents, including income statements, expense receipts, and any previous tax filings. After completing the form, it is essential to review all entries for accuracy. Once verified, the form can be submitted electronically or via mail to the Illinois Department of Revenue, depending on the taxpayer's preference and the submission method chosen.

Steps to complete the Illinois Department Of Revenue IL 1000 P

Completing the IL 1000 P involves several key steps:

- Gather all relevant financial documents and information.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check calculations and entries for any errors.

- Sign and date the form to verify its authenticity.

- Submit the completed form to the Illinois Department of Revenue through the chosen method.

Key elements of the Illinois Department Of Revenue IL 1000 P

The IL 1000 P includes several important sections that taxpayers must complete. Key elements typically include:

- Taxpayer identification information, such as name and address.

- Income details, including wages, business income, and other earnings.

- Deductions and credits applicable to the taxpayer's situation.

- Signature and date fields to validate the submission.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific filing deadlines for the IL 1000 P to avoid penalties. Generally, the form is due on the same date as the federal tax return, which is typically April 15. However, extensions may be available under certain circumstances, and it is important to check for any updates or changes to these dates each tax year.

Penalties for Non-Compliance

Failure to file the IL 1000 P by the deadline or inaccuracies in the submitted information can result in penalties. These penalties may include fines, interest on unpaid taxes, and potential legal actions. It is crucial for taxpayers to ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete illinois department of revenue il 1000 p what is the purpose of form il 1000 p tax illinois

Effortlessly Prepare [SKS] on Any Device

The digital management of documents has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest method to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue il 1000 p what is the purpose of form il 1000 p tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue IL 1000 P?

The Illinois Department Of Revenue IL 1000 P is a tax form used for reporting certain tax liabilities in Illinois. It is essential for businesses to understand its purpose to ensure compliance with state tax regulations. This form helps streamline the tax reporting process, making it easier for businesses to manage their tax obligations.

-

What is the purpose of Form IL 1000 P?

The purpose of Form IL 1000 P is to provide the Illinois Department Of Revenue with necessary information regarding tax payments and liabilities. This form is crucial for businesses to accurately report their tax obligations and avoid penalties. Understanding the purpose of Form IL 1000 P can help ensure that your business remains compliant with Illinois tax laws.

-

How can airSlate SignNow help with Form IL 1000 P?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing and submitting Form IL 1000 P. With our eSigning capabilities, businesses can easily fill out and sign the form electronically, saving time and reducing errors. This efficiency is particularly beneficial for those navigating the complexities of Illinois tax regulations.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Illinois Department Of Revenue IL 1000 P provides several benefits, including increased efficiency and reduced paperwork. Our platform allows for secure electronic signatures, ensuring that your documents are legally binding. Additionally, our solution is cost-effective, making it accessible for businesses of all sizes.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with Illinois tax regulations, including those related to the Illinois Department Of Revenue IL 1000 P. Our platform ensures that all electronic signatures and document submissions meet legal standards. This compliance helps businesses confidently manage their tax documentation.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow when dealing with forms like the Illinois Department Of Revenue IL 1000 P. Our integrations with popular tools allow for easy document management and sharing. This connectivity ensures that your tax processes are streamlined and efficient.

-

How much does airSlate SignNow cost?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, making it a cost-effective solution for managing forms like the Illinois Department Of Revenue IL 1000 P. Our pricing is designed to provide value while ensuring that businesses can access essential features without breaking the bank. You can choose a plan that best fits your requirements.

Get more for Illinois Department Of Revenue IL 1000 P What Is The Purpose Of Form IL 1000 P Tax Illinois

Find out other Illinois Department Of Revenue IL 1000 P What Is The Purpose Of Form IL 1000 P Tax Illinois

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online