Illinois Department of Revenue Year Ending Schedule 8020 Related Party Expenses Month Attach to Your Form IL 1120, IL 1120 ST, I

Understanding the Illinois Department Of Revenue Year Ending Schedule 8020

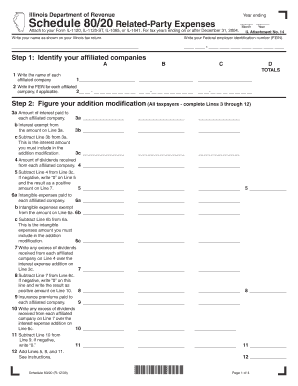

The Illinois Department Of Revenue Year Ending Schedule 8020 is a crucial document for businesses that need to report related party expenses. This schedule is attached to various tax forms, including IL 1120, IL 1120 ST, IL 1065, and IL 1041. It is designed to provide transparency regarding transactions between related entities, ensuring compliance with state tax regulations. Understanding the purpose and requirements of Schedule 8020 helps businesses accurately report their financial activities and maintain good standing with the Illinois Department of Revenue.

Steps to Complete the Schedule 8020

Completing the Illinois Department Of Revenue Year Ending Schedule 8020 involves several key steps:

- Gather financial records related to transactions with related parties.

- Identify all related party transactions that occurred during the tax year.

- Fill out the schedule by providing details such as the names of related parties, the nature of the transactions, and the amounts involved.

- Attach the completed Schedule 8020 to your primary tax form (IL 1120, IL 1120 ST, IL 1065, or IL 1041).

- Review the entire document for accuracy before submission.

Key Elements of Schedule 8020

When filling out the Schedule 8020, it is important to include specific information to ensure compliance:

- Identification of Related Parties: Clearly list all entities that are considered related parties.

- Transaction Details: Provide a description of each transaction, including the nature and purpose.

- Amounts: Accurately report the monetary values associated with each transaction.

- Supporting Documentation: Maintain records that substantiate the reported transactions, as these may be requested by the Illinois Department of Revenue.

Legal Use of Schedule 8020

The Illinois Department Of Revenue Year Ending Schedule 8020 is a legally required document for businesses engaged in transactions with related parties. Failure to accurately complete and submit this schedule can lead to penalties and potential audits. It is essential for taxpayers to understand their obligations under Illinois tax law and ensure that all related party transactions are reported in compliance with state regulations.

Filing Deadlines for Schedule 8020

Timely submission of the Schedule 8020 is critical. The filing deadlines align with the due dates of the associated tax forms. Generally, the IL 1120, IL 1120 ST, IL 1065, and IL 1041 are due on the 15th day of the fourth month following the end of the tax year. Businesses should mark their calendars to ensure they meet these deadlines to avoid late fees and penalties.

Obtaining Schedule 8020

The Illinois Department Of Revenue Year Ending Schedule 8020 can be obtained through the Illinois Department of Revenue's official website. It is available as a downloadable form that can be printed and filled out manually or completed digitally. Ensure that you are using the most current version of the form to comply with any recent updates to tax regulations.

Quick guide on how to complete illinois department of revenue year ending schedule 8020 related party expenses month attach to your form il 1120 il 1120 st il

Complete [SKS] effortlessly on any device

Online document management has gained signNow traction among organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow caters to your document management needs in a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue year ending schedule 8020 related party expenses month attach to your form il 1120 il 1120 st il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Year Ending Schedule 8020?

The Illinois Department Of Revenue Year Ending Schedule 8020 is a form used to report related party expenses for businesses. It is essential for ensuring compliance with state tax regulations when filing your Form IL 1120, IL 1120 ST, IL 1065, or IL 1041. Properly completing this schedule helps avoid potential penalties and ensures accurate tax reporting.

-

How do I attach the Schedule 8020 to my tax forms?

To attach the Illinois Department Of Revenue Year Ending Schedule 8020, simply include it with your Form IL 1120, IL 1120 ST, IL 1065, or IL 1041 when filing. Ensure that all related party expenses are accurately reported on the schedule to maintain compliance. This process can be streamlined using airSlate SignNow for efficient document management.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for managing your tax documents, including the Illinois Department Of Revenue Year Ending Schedule 8020, offers numerous benefits. It provides an easy-to-use platform for eSigning and sending documents securely. Additionally, it helps streamline your workflow, saving time and reducing the risk of errors in your tax filings.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With flexible pricing plans, it allows you to manage your documents efficiently without breaking the bank. This is particularly beneficial when handling forms like the Illinois Department Of Revenue Year Ending Schedule 8020.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your document management capabilities. This means you can easily incorporate the Illinois Department Of Revenue Year Ending Schedule 8020 into your existing workflows, making tax preparation and filing more efficient.

-

What features does airSlate SignNow offer for document security?

airSlate SignNow prioritizes document security with features such as encryption, secure cloud storage, and user authentication. These measures ensure that your sensitive information, including the Illinois Department Of Revenue Year Ending Schedule 8020, is protected throughout the signing and filing process. You can trust that your documents are safe and secure.

-

How can airSlate SignNow help with compliance for tax filings?

airSlate SignNow assists with compliance by providing templates and guidance for completing necessary forms, including the Illinois Department Of Revenue Year Ending Schedule 8020. By using our platform, you can ensure that all required information is accurately captured and submitted with your tax forms, reducing the risk of non-compliance.

Get more for Illinois Department Of Revenue Year Ending Schedule 8020 Related Party Expenses Month Attach To Your Form IL 1120, IL 1120 ST, I

Find out other Illinois Department Of Revenue Year Ending Schedule 8020 Related Party Expenses Month Attach To Your Form IL 1120, IL 1120 ST, I

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease