Year IL Attachment No Form

What is the Year IL Attachment No

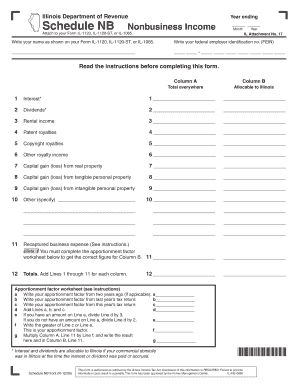

The Year IL Attachment No is a specific document required for certain tax filings in the state of Illinois. This attachment is typically used to report additional information related to income, deductions, or credits that cannot be captured on the standard tax forms. It is essential for taxpayers to understand the purpose of this attachment to ensure compliance with state tax regulations.

How to use the Year IL Attachment No

To use the Year IL Attachment No effectively, taxpayers should first determine if they need to include it with their tax return. This involves reviewing the instructions provided by the Illinois Department of Revenue. Once it is established that the attachment is necessary, taxpayers should fill it out with accurate information, ensuring that all required fields are completed. After completing the form, it should be attached to the main tax return when submitted, whether online or via mail.

Steps to complete the Year IL Attachment No

Completing the Year IL Attachment No involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Review the instructions specific to the Year IL Attachment No to understand the required information.

- Fill out the attachment, ensuring that all sections are accurately completed.

- Double-check the information for accuracy and completeness.

- Attach the completed form to your main tax return.

Key elements of the Year IL Attachment No

The Year IL Attachment No includes several critical elements that must be accurately reported. These elements typically consist of:

- Taxpayer identification information, such as name and Social Security number.

- Details of income sources that require additional reporting.

- Any deductions or credits that are not fully captured on the main tax form.

- Signature and date to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Year IL Attachment No align with the overall tax filing deadlines set by the Illinois Department of Revenue. Generally, individual tax returns are due on April fifteenth each year. It is crucial for taxpayers to be aware of any extensions or specific deadlines related to the Year IL Attachment No to avoid penalties or interest on late submissions.

Who Issues the Form

The Year IL Attachment No is issued by the Illinois Department of Revenue. This state agency is responsible for the administration of tax laws and the collection of taxes in Illinois. Taxpayers can find the attachment on the department's official website or through authorized tax preparation software that includes Illinois tax forms.

Quick guide on how to complete year il attachment no

Complete [SKS] effortlessly on any device

The management of online documents has become increasingly favored by both organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details using the specific tools that airSlate SignNow provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Year IL Attachment No

Create this form in 5 minutes!

How to create an eSignature for the year il attachment no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Year IL Attachment No. and how does it work?

The Year IL Attachment No. is a specific document format used in Illinois for attaching additional information to tax returns. With airSlate SignNow, you can easily create, send, and eSign this attachment, ensuring compliance and accuracy in your submissions. Our platform streamlines the process, making it simple to manage all your documentation needs.

-

How much does it cost to use airSlate SignNow for Year IL Attachment No.?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring the Year IL Attachment No. Our plans are designed to be cost-effective, ensuring you get the best value for your investment while simplifying your document management processes.

-

What features does airSlate SignNow provide for managing Year IL Attachment No.?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Year IL Attachment No. These tools enhance your workflow, allowing you to efficiently manage attachments and ensure that all necessary information is included and signed.

-

Can I integrate airSlate SignNow with other software for Year IL Attachment No. management?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the Year IL Attachment No. alongside your existing tools. Whether you use CRM systems, accounting software, or cloud storage solutions, our platform can enhance your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for Year IL Attachment No.?

Using airSlate SignNow for the Year IL Attachment No. provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform allows you to quickly prepare and send attachments, ensuring that your documents are signed and returned promptly, which can save you valuable time and resources.

-

Is airSlate SignNow secure for handling Year IL Attachment No.?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Year IL Attachment No. and other sensitive documents. You can trust that your information is safe while using our platform for eSigning and document management.

-

How can I get started with airSlate SignNow for Year IL Attachment No.?

Getting started with airSlate SignNow for the Year IL Attachment No. is easy. Simply sign up for an account, choose the plan that fits your needs, and start creating and sending your attachments. Our user-friendly interface and helpful resources will guide you through the process.

Get more for Year IL Attachment No

Find out other Year IL Attachment No

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation