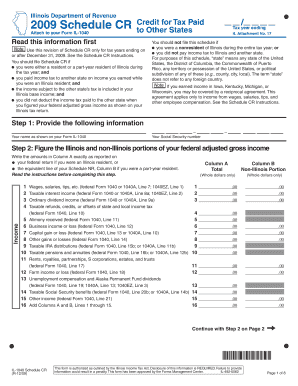

Illinois Department of Revenue Schedule CR Attach to Your Form IL 1040 Credit for Tax Paid to Other States Read This Information

Understanding the Illinois Department Of Revenue Schedule CR

The Illinois Department Of Revenue Schedule CR is a crucial form for taxpayers who have paid taxes to other states. This form allows you to claim a credit on your Illinois tax return, specifically when you are filing your Form IL-1040. The credit is designed to prevent double taxation on income earned in another state while you reside in Illinois. Understanding this form is essential to ensure you receive the appropriate tax relief and to comply with state regulations.

Steps to Complete the Schedule CR

Completing the Schedule CR requires careful attention to detail. Here are the steps you should follow:

- Gather all relevant information about taxes paid to other states, including the amount and the state in which the taxes were paid.

- Fill out the top section of the Schedule CR with your personal information, including your name, address, and Social Security number.

- In the main section, report the amount of credit you are claiming based on the taxes paid to other states. Ensure that you have documentation to support your claim.

- Attach the completed Schedule CR to your Form IL-1040 when filing your tax return.

- Review your completed forms for accuracy before submission.

Eligibility Criteria for Claiming the Credit

To be eligible for the credit on the Schedule CR, you must meet specific criteria:

- You must be a resident of Illinois for the tax year in which you are claiming the credit.

- You must have paid income tax to another state on income that is also subject to Illinois tax.

- The income for which you are claiming the credit must be reported on your Illinois tax return.

Required Documents for Filing

When filing the Schedule CR, you need to include certain documents to substantiate your claim:

- A copy of the tax return filed with the other state.

- Documentation showing the amount of tax paid to that state.

- Any additional forms or schedules required by the Illinois Department of Revenue.

Filing Deadlines for Schedule CR

It is important to be aware of the filing deadlines for the Schedule CR to avoid penalties:

- The Schedule CR must be submitted along with your Form IL-1040 by the standard tax filing deadline, typically April 15.

- If you are granted an extension for your Form IL-1040, the same extension applies to the Schedule CR.

Common Mistakes to Avoid

When completing the Schedule CR, taxpayers should be cautious of common pitfalls:

- Failing to include all required documentation can lead to delays or denial of the credit.

- Incorrectly calculating the amount of credit can result in underpayment or overpayment of taxes.

- Neglecting to attach the Schedule CR to your Form IL-1040 can lead to processing issues.

Quick guide on how to complete illinois department of revenue schedule cr attach to your form il 1040 credit for tax paid to other states read this information

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign [SKS] Stress-Free

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize signNow sections of your documents or redact sensitive information using features specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and hit the Done button to save your modifications.

- Choose your preferred method for sharing the form: via email, text message (SMS), invite link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate creating new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] while ensuring seamless communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule CR Attach To Your Form IL 1040 Credit For Tax Paid To Other States Read This Information

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule cr attach to your form il 1040 credit for tax paid to other states read this information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule CR?

The Illinois Department Of Revenue Schedule CR is a form that allows taxpayers to claim a credit for taxes paid to other states. It is essential for individuals who have income sourced from multiple states. To ensure you receive the correct credit, you must attach this form to your Form IL 1040. For detailed guidance, refer to the information provided.

-

How do I attach the Schedule CR to my Form IL 1040?

To attach the Illinois Department Of Revenue Schedule CR to your Form IL 1040, simply include it as a supporting document when filing your tax return. Ensure that all relevant information is filled out accurately to avoid delays. For more detailed instructions, please read this information carefully.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the Illinois Department Of Revenue Schedule CR, streamlines the eSigning process. It provides a user-friendly interface that simplifies document management and ensures compliance. This cost-effective solution helps you save time and reduces the risk of errors when filing your Form IL 1040.

-

Is there a cost associated with using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. The cost is competitive and reflects the value of the features provided, such as secure eSigning and document storage. For more details on pricing, please visit our website and read this information.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow efficiency. Whether you use CRM systems or accounting software, you can easily connect them to streamline the process of managing your Illinois Department Of Revenue Schedule CR and other tax documents. Read this information for a complete list of integrations.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your Illinois Department Of Revenue Schedule CR and other important documents are handled efficiently and securely. For more insights, read this information.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents, including the Illinois Department Of Revenue Schedule CR. You can trust that your sensitive information is safe while you manage your tax documents. For further details, read this information.

Get more for Illinois Department Of Revenue Schedule CR Attach To Your Form IL 1040 Credit For Tax Paid To Other States Read This Information

Find out other Illinois Department Of Revenue Schedule CR Attach To Your Form IL 1040 Credit For Tax Paid To Other States Read This Information

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form