, Schedule 1299 D Income Tax Credits Illinois Department of Tax Illinois Form

What is the Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois

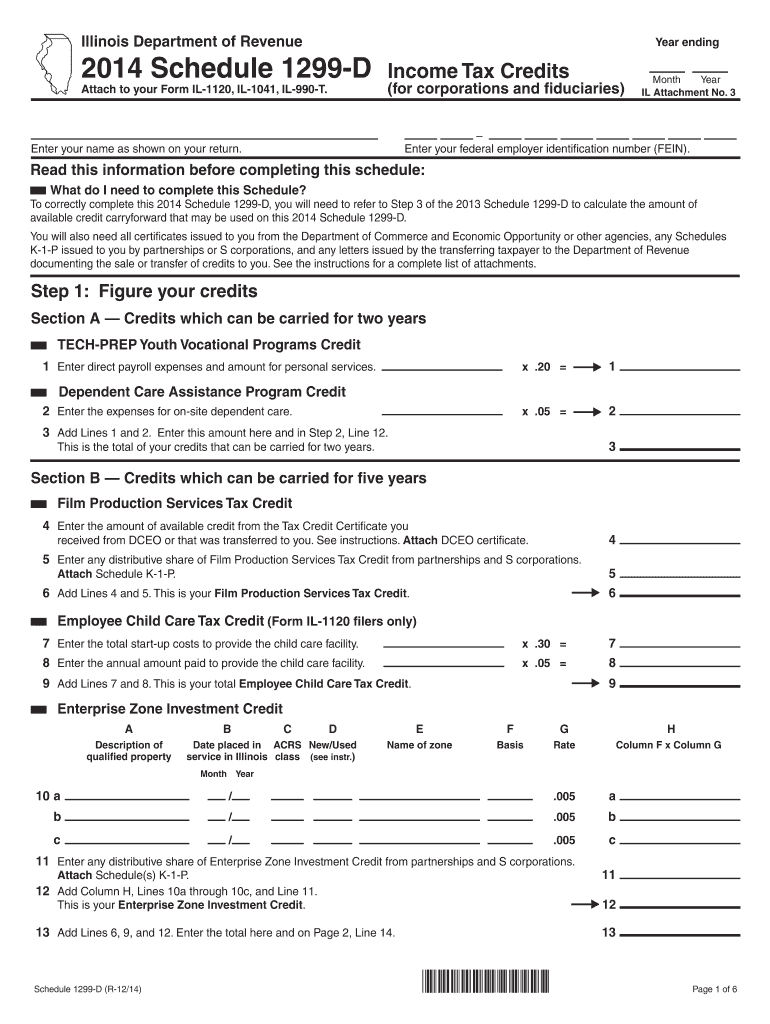

The Schedule 1299 D is a form used by taxpayers in Illinois to claim various income tax credits. This form is specifically designed for individuals and businesses to report eligible credits that can reduce their tax liability. The Illinois Department of Revenue administers this form, ensuring that taxpayers can take advantage of available credits to lower their overall tax burden. The Schedule 1299 D includes details about the types of credits available, eligibility requirements, and instructions for proper completion.

How to use the Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois

To effectively use the Schedule 1299 D, taxpayers should first review the list of available credits. Each credit has specific eligibility criteria that must be met. After determining which credits apply, individuals should accurately fill out the form, providing all required information. It is important to follow the instructions carefully to ensure that all necessary documentation is included. Once completed, the form should be submitted along with the taxpayer's Illinois income tax return.

Steps to complete the Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois

Completing the Schedule 1299 D involves several key steps:

- Gather all necessary documentation related to the credits you intend to claim.

- Review the eligibility requirements for each credit to ensure compliance.

- Fill out the form accurately, providing all requested information and calculations.

- Attach any required supporting documents to substantiate your claims.

- Submit the completed Schedule 1299 D along with your Illinois income tax return by the appropriate deadline.

Eligibility Criteria

Eligibility for the credits claimed on the Schedule 1299 D varies depending on the specific credit. Common criteria include factors such as income level, residency status, and the nature of the expenses incurred. Taxpayers must ensure they meet these criteria before attempting to claim the credits. It is advisable to consult the instructions provided with the form for detailed eligibility guidelines for each credit available.

Required Documents

When filling out the Schedule 1299 D, taxpayers should prepare to include specific documentation that supports their claims. This may include:

- Proof of residency in Illinois, such as a driver’s license or utility bill.

- Receipts or statements for expenses related to the credits being claimed.

- Any additional forms or schedules that may be required for specific credits.

Having these documents ready will facilitate a smoother filing process and help avoid delays or issues with the Illinois Department of Revenue.

Form Submission Methods

The Schedule 1299 D can be submitted to the Illinois Department of Revenue through various methods. Taxpayers may choose to file electronically, which is often the most efficient option. Alternatively, the form can be mailed in or submitted in person at designated locations. It is important to adhere to submission deadlines to ensure timely processing of tax returns and credits.

Quick guide on how to complete schedule 1299 d income tax credits illinois department of tax illinois

Complete , Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois effortlessly on any device

Online document management has gained increased traction among businesses and individuals alike. It offers an excellent environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to find the correct form and securely maintain it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage , Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign , Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois with ease

- Find , Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign , Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 1299 d income tax credits illinois department of tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Schedule 1299 D Income Tax Credits?

Schedule 1299 D Income Tax Credits are tax credits offered by the Illinois Department of Tax that help businesses reduce their tax liability. These credits are designed to incentivize economic development and support various business activities in Illinois.

-

How can airSlate SignNow assist with Schedule 1299 D Income Tax Credits?

airSlate SignNow provides a streamlined platform for businesses to manage and eSign documents related to Schedule 1299 D Income Tax Credits. By simplifying the documentation process, businesses can ensure they meet all requirements set by the Illinois Department of Tax efficiently.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documentation like Schedule 1299 D Income Tax Credits. These features help ensure compliance and enhance the overall efficiency of the tax filing process.

-

Is airSlate SignNow cost-effective for small businesses applying for tax credits?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to apply for Schedule 1299 D Income Tax Credits. With competitive pricing and a range of features, it allows businesses to save time and money while ensuring compliance with the Illinois Department of Tax.

-

Can airSlate SignNow integrate with other tax software?

Absolutely! airSlate SignNow can integrate seamlessly with various tax software solutions, making it easier for businesses to manage their Schedule 1299 D Income Tax Credits documentation. This integration helps streamline workflows and ensures that all necessary documents are readily accessible.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Schedule 1299 D Income Tax Credits, offers numerous benefits such as enhanced security, faster processing times, and improved collaboration. These advantages help businesses stay organized and compliant with the Illinois Department of Tax requirements.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect sensitive tax information, including data related to Schedule 1299 D Income Tax Credits. This ensures that all documents are safe and compliant with industry standards.

Get more for , Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois

- Swim at your own risk waiver form

- Install certification statement idi insulation form

- Presidential memorial certificate sample form

- Pr kaz na hradu payment order 15391 eur unicredit bank unicreditbank form

- American funds transfer registration change request form

- Uas ny community assessment form

- Forms pdf files ccdr n005

- Ps form 3602 nz fillable

Find out other , Schedule 1299 D Income Tax Credits Illinois Department Of Tax Illinois

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online